As one of the world’s largest emerging market economies, India’s influence is steadily increasing. Access our latest research, analyses, and insights on India's markets and economy.

Access the Topic PageEconomic Implications

Indian Central Bank Takes Steps to Dampen NPL Formation Amid COVID-19 Resurgence

Surging COVID-19 cases in India may push bad loans in the banking sector higher but latest measures from the country's central bank may soften the impact of the new wave that threatens to disrupt business activity in the country.

With reported new daily cases climbing past 400,000, government data show that more than 3.7 million Indians are currently infected with the virus. However, actual numbers could be much higher. The nation's medical infrastructure is stretched and many state governments have announced restrictions on movement. Analysts and economists expect the virus resurgence to hit the economic recovery that was underway after the South Asian nation witnessed its first recession in 2020. That, in turn, is expected to hurt banks' asset quality.

Second COVID Wave May Derail India's Budding Recovery

India's second COVID wave could knock off as much as 2.8 percentage points from GDP growth in fiscal 2022, derailing what has been a promising recovery in the economy, profits, and credit metrics in the year to date.

Read the Full ArticleIndia's Second COVID Wave Heightens Downside Risks to GDP and Credit

India’s escalating second wave of COVID-19 infections is serious.

In addition to the substantial loss of life and significant humanitarian concerns, S&P Global Ratings believes the outbreak poses downside risks to GDP and heightens the possibility of business disruptions.

Read the Full Article

Commodities Outlook

India's COVID-19 Resurgence Clouds Energy, Metals and Agriculture Outlook

With India reporting about 300,000 cases daily for many consecutive days, analysts have revised down consumption numbers of some commodities.

Key Takeaways

- With India reporting about 300,000 cases daily for many consecutive days, analysts have revised down consumption numbers of some commodities.

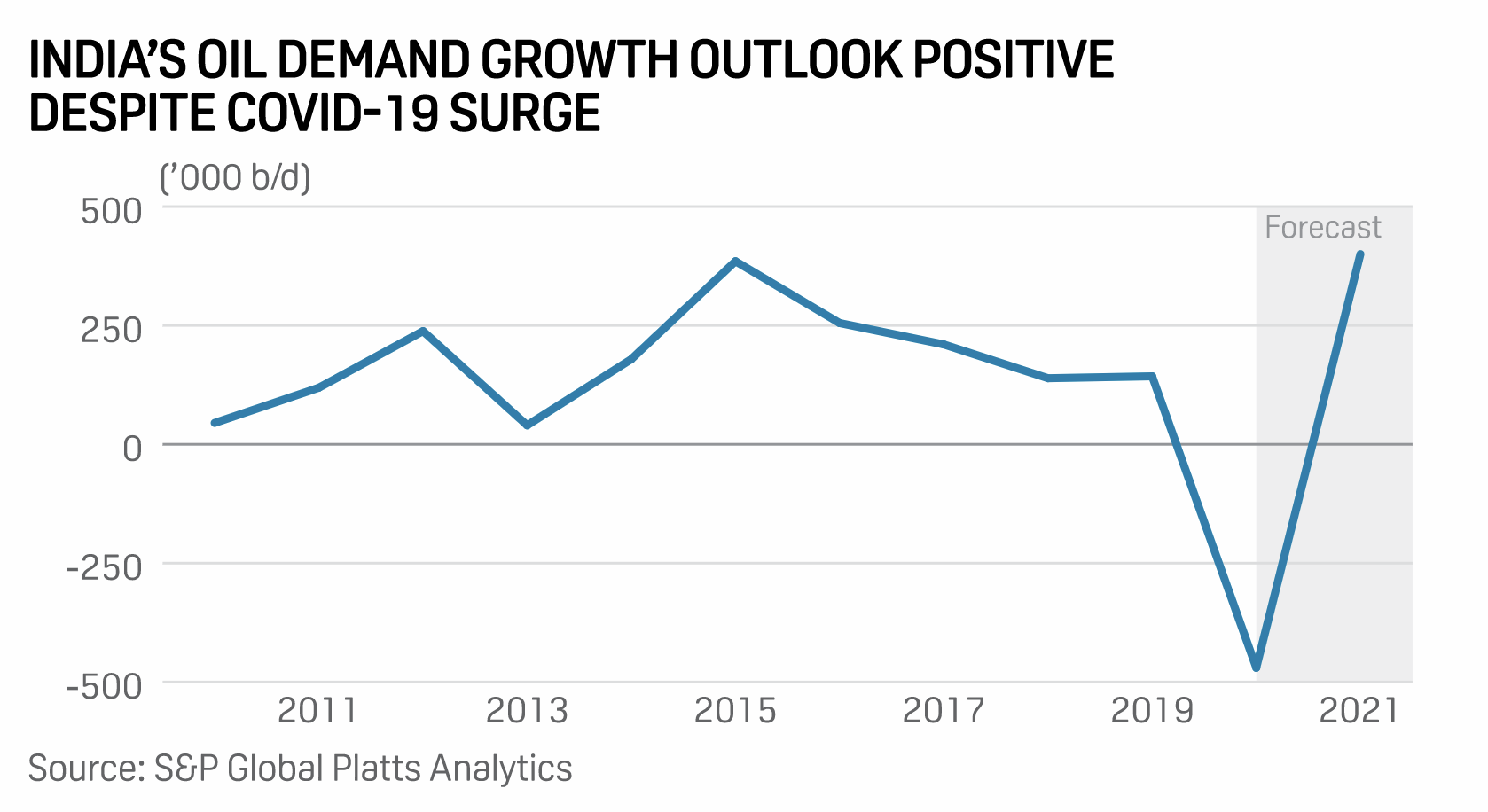

- S&P Global Platts Analytics has said India would witness a year-on-year oil demand growth of 400,000 b/d in 2021, lower than an earlier estimate of 440,000 b/d.

- Analysts fear India's city gas demand could drop by 25%-30% in the coming months.

- While steel production has not been affected, localized lockdowns have stagnated market demand for agricultural commodities in some pockets. Although agriculture and allied activities have been exempted from government restrictions so far, several markets remain closed.

Oil Markets

India CEO Series: India Aims to Cushion Oil Shock by Doubling Strategic Petroleum Reserves

India will push ahead with its plans to more than double its strategic petroleum reserves despite the unprecedented COVID-19 crisis creating some delays, and the country will soon invite interest from potential investors for its ambitious second-phase expansion, the chief of India's SPRs told S&P Global Platts.

H.P.S. Ahuja, CEO and Managing Director of Indian Strategic Petroleum Reserves Ltd. (ISPRL), said he was hoping to get the final clearance from the petroleum ministry soon, following which ISPRL would be able to float the request for participation for building SPR sites at two more locations in India.

"The pandemic has created some delays and hurdles but we should be able to progress very soon. We have the entire plan in place and can start work on the projects the moment our proposal gets the final green signal from the government," Ahuja said in an exclusive interview.

In the first phase, India set up SPRs at three locations with a combined capacity of 5.33 million mt -- 1.33 million mt at Visakhapatnam, 1.5 million mt at Mangalore and 2.5 million mt at Padur in Karnataka. All three facilities have been commissioned.

For the second phase, the federal cabinet has given its approval to build a further 6.5 million mt of SPRs at two locations -- 4 million mt at Chandikhol in Odisha and another 2.5 million mt at Padur.

Crude Runs, Oil Demand Feel Pain as India's COVID-19 Crisis Hits Like Never Before

Indian refiners have so far stayed away from slashing crude run rates sharply despite the surge in COVID-19 cases to record highs, but with a rise in regional lockdowns and its subsequent impact on mobility and industrial activity, analysts said they will be forced to scale back crude runs in anticipation of a slowdown in oil demand.

READ THE FULL ARTICLEIndia's Faltering Driving Activity, Dismal Vehicle Sales Cast Shadow Over Gasoline Demand Outlook

India's driving activity has nosedived to the lowest level in a year in early May, while commercial and passenger vehicle sales tumbled in April.

Read the Full ArticleCrude Oil Futures Tad Lower as Market Monitors Pandemic Situation in India

Crude oil futures were tad lower during the mid-morning trade in Asia May 3, as the market weighed the progress of the pandemic in India against the oil demand recovery in the U.S. and Europe.

Read the Full ArticleOPEC+ on Tap to Hike Oil Output Despite Indian COVID-19 Crisis Weighing on Market

OPEC and its allies appear set to press on with raising crude production despite the coronavirus crisis enveloping key oil consumer India.

Read the Full ArticleNatural Gas

India Pandemic Weighs on Natural Gas Demand Amid Souring GDP Outlook

India's deadly COVID-19 outbreak and widening localized lockdowns have soured the country's economic growth outlook, stifled its natural gas demand and resulted in more LNG carriers being diverted by gas companies, an analysis by S&P Global Platts showed.

On May 8, the southern Indian state of Tamil Nadu -- one of the country's most industrialized and among its largest by GDP -- imposed a two-week lockdown amid growing infections, joining several other states that have taken similar measures.

India's City Gas Demand May Drop by 25%-30% as COVID-19 Cripples Key States

India's city gas demand is expected to drop by around 25%-30% in the coming months as the COVID-19 pandemic spreads across large cities and states that are also the main consumers of natural gas with the highest penetration of gas pipeline networks, according to government officials and gas company executives.

Read the Full Article

Shipping & Trade

India's COVID-19 Surge to Unleash Drastic Disruptions in Maritime Industry: Sources

The ongoing second wave of the deadly coronavirus pandemic in India is expected to snowball into a major disruptor for the shipping and logistics industry as several ports globally are shunning ships which have called at any location along the South Asian coastline.

Bunkering operations could also come in the ambit of this catastrophic wave that has engulfed India, although no major disruptions have been noted yet as demand has been lackluster, bunker industry sources said.

The impact on global shipping logistics from India's isolation could become a very significant market disruptor by causing delay in supply of ships, said Ole-Rikard Hammer, oil and shipping analyst with Oslo-based Arctic Securities. This will obviously tighten the tankers' supply, Hammer told S&P Global Platts.

Virus Hit to Indian Economy Weighs on Australia's Export Diversification Hopes

The COVID-19 pandemic's huge blow to the middle class of India — a key target for Australian efforts to diversify its commodity export dependence from China — makes the Commonwealth Bank of Australia skeptical that the world is on the cusp of a new supercycle.

Read the Full ArticleFujairah Stands to Lose Out if India's COVID-19 Crisis Slows Economic Growth

The UAE's Port of Fujairah stands to lose out on crude oil and refined product exports and bunker sales if the spiraling COVID-19 crisis in India translates into slowing economic growth for Asia's third-largest economy.

Read the Full ArticleTankers Demand to Take a Hit as India Grapples with Massive COVID-19 Wave

The ongoing massive wave of the coronavirus in India is likely to reduce demand for ships amid a slowdown in the South Asian nation's crude imports, and potentially refined products exports, creating an artificial surplus of such oil tankers.

Read the Full ArticleAs the rest of world tightens restrictions to fight COVID-19, Asia flattened its curve of infections & has begun reopening its economies—but now faces new waves of coronavirus cases. Other countries in APAC face threats to energy sectors & economies.

Access the Topic PageAgriculture

India's Wheat Exports Face Disruptions on Localized Shutdowns, Port Delays: Sources

India's wheat exports have hit a roadblock over the past few weeks as the coronavirus pandemic has forced shutdowns and impacted key operations across the country, sources told S&P Global Platts May 21.

Apart from emerging bottlenecks at several key ports of India, like Kandla, Mumbai's Jawaharlal Nehru Port, and Visakhapatnam, the industry is witnessing disruptions on the supply side as most major grains markets are shut.

Key trade centers in Madhya Pradesh and Rajasthan, major growers of the staple food grain, have been shut for weeks, traders said.

"With major markets shut, supply has tightened in open markets and prices are rising," a trader based in Indore, Madhya Pradesh, said.

As supply turns scarce across markets, exporters are also facing difficulties in sourcing the grain for outbound shipments as logistical bottlenecks are creating hurdles, an official with a global food firm said.

Resurgence of COVID-19 Infections in India Raises Concerns Over Sugar Exports

The resurgence of COVID-19 cases in India highlights the ongoing concerns about the logistical challenges dampening the demand for sugar of Indian origin.

READ THE FULL ARTICLEIndia 2021-22 Wheat Procurement Spikes, May Limit Exports

The Food Corporation of India has purchased 20.0 million mt of wheat from farmers so far in the 2021-22 marketing season that began April 1, a more than fourfold increase from the same period last year and a figure likely to limit India's exportable supplies, according to sources.

Read the Full Article

Need for Oxygen

India's Government Asks Steelmakers to Boost Oxygen Output in Fight Against COVID-19

India has asked state-owned steelmakers to look into increasing their production of liquid medical oxygen to meet a shortfall caused by a surge in COVID-19 infections, the Ministry of Steel said on April 26.

Due to the request, at least one plant — the Bhilai steel plant operated by The Steel Authority of India Limited, or SAIL, has been temporarily shut to boost its LMO production. The plant has a production capacity of about 3.15 million mt/year.

Key Takeaways:

- SAIL has raised its average delivery of LMO to more than 800 mt/day, the ministry said, adding that the state-run steelmaker delivered 960 mt of LMO on April 24.

- Total LMO supplied from SAIL's integrated steel plants at Bhilai, Bokaro, Rourkela, Durgapur and Burnpur from August 2020 until April 24 has been 39,647 mt.

- Overall, steelmakers have increased their supply of liquid medical oxygen to more than 3,000 mt/day this week from an average of between 1,500 mt/day and 1,700 mt/day last week, the ministry said.