Lessons Learned

Five Lessons from the February Freeze in Texas's Power Market

Exceptionally cold weather conditions in mid-February throughout Texas triggered a large number of outages across the thermal and wind fleets, forcing ERCOT, the operator of the electrical grid, to resort to rolling blackouts throughout the state. Data that has emerged since then points to few measures that, in hindsight, could have reduced the severity of the consequences. Here are some of the main learnings from the extreme weather event

Key Takeaways

- Wind availability was not adequately accounted for in scenarios or real-time view.

- Gas generation resource was overestimated even under normal condition.

- Some gas supply issues were avoidable with existing safeguards.

- Future winterization measures will be driven by regulation and economics.

- Climate change impact is likely but wind still well placed to provide winter generation.

Future Energy Makeup

Texas Storm Showed Long-Term Need for Gas in Energy Transition – IHS Markit

The prolonged power outages that left millions of Texas customers in the dark during a February winter storm point to natural gas's long-haul role in the energy transition, one market expert said.

"To me, having wind [account for] north of 40% [of power generation] one week and then less than 3% the next week and expecting gas that's really spot market-based to have to ramp from 35% of generation to over 80% … it may be both a flawed design and a flawed expectation, but clearly there is some rationale," Sam Andrus, executive director for North American Gas at IHS Markit, said during an April 15 LDC Gas Forums webinar, referring to gas's function as a bridge fuel.

"Natural gas will be the marathon runner in the energy transition," Andrus added. "There may be some ways to go before that gets generally accepted.

As Texas Digs Out, Plans Proceed to Add 35 GW of Solar, Wind Capacity to Grid

As Texas power plant operators and grid managers revive the state's storm-battered electric system and prepare for an uncertain future, one thing appears unlikely to change: the rapid proliferation of renewable energy resources in the nation's largest power market

Read the Full ArticleTexas Gas, Power Players Need to Winterize, but Witnesses Differ over Renewables

Witnesses testifying to a U.S. House of Representatives subcommittee agreed March 24 that the Texas grid needs to winterize its generation fleet and infrastructure, but disagreed about how much renewable power contributed to the massive blackouts during the Feb. 14 winter storm.

Read the Full ArticleOutlooks

Global Gas Demand to Rise by 3.2% in 2021, Offsetting 2020 Losses: IEA

Global gas demand is expected to increase by 3.2% year on year in 2021, enough to more than offset the lost consumption in 2020, the International Energy Agency said in its latest quarterly market report published April 15.

Gas demand fell by 1.9% -- or some 75 Bcm -- in 2020, but recovery is expected this year, driven by demand in the industrial sector.

"We expect globally to see a rebound, sufficient in our view not only to offset last year but also show some growth compared with 2019," IEA senior analyst Jean-Baptiste Dubreuil said during a webinar presenting the report. However, he said, the forecast demand growth was "highly fragile" and dependent on the path of global economic recovery. Consumption in the industrial sector, which remained resilient in 2020 with an estimated 1.2% annual decline, is expected to take the lead in 2021 with 5.4% year-on-year growth -- close to 55 Bcm.

Warren Buffett's $8.3B Plan to Avert Texas Blackouts Raises Eyebrows

Billionaire Warren Buffett's Berkshire Hathaway Energy is pitching Texas lawmakers on an $8.3 billion proposal to build 10 new gas-fired power plants across the state to help avert another energy crisis like the one last month that left millions of customers without electricity.

Read the Full ArticleTexas Politicians Vow Fix for Loophole that Kept Natural Gas Facilities Offline

Texas politicians vowed March 24 to fix loopholes that allowed paperwork failures to keep natural gas facilities from being deemed "critical infrastructure" during the historic February freeze that left much of the state without power for days at a time.

Read the Full Article

Credit Implications

The ESG Pulse: Texas Storm Highlights Need for Preparedness

2020 was very much a litmus test for governance and preparedness by management and boards. The pandemic laid bare companies' resilience (or lack thereof) in dealing with a crisis and being responsive and adaptable. There will be a lot to draw from the experience in the coming years, particularly when assessing how ready companies are to prepare for another systemic challenge: climate change.

The recent events caused by February's winter storm, which left millions of homes in Texas without power have shown the need to prepare for the unexpected.

Companies Turn to Debt Markets, Courts to Address Texas Freeze Costs

As energy companies continue to disclose financial impacts from the historic mid-February freeze in Texas, some have begun taking more decisive steps to address the fallout.

Read the Full ArticleWinter Storm In Texas Will Continue to be Felt In Utilities' Credit Profiles

The February winter storm unofficially known as "Uri" and its power market disruptions were the catalysts for recent negative rating actions affecting many electric and gas market participants in Texas and the Southwest.

Read the Full Report

Financial Losses

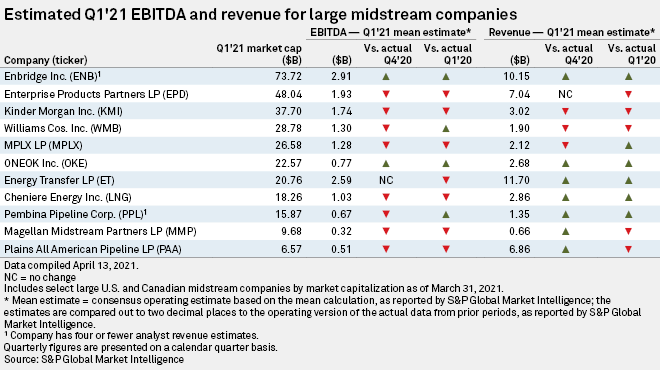

Midstream to Feel Texas Freeze in Q1 Results but Benefit from COVID-19 Rebound

Financial losses due to a severe winter storm in February should not materially overshadow the outlook for demand recovery in the natural gas midstream sector as companies release first-quarter earnings results, industry experts said.

The extreme winter weather in Texas and nearby states in February disrupted gas transportation and distribution operations and seasonal maintenance at LNG export facilities, and it is expected to be a factor heading into the summer.

Winter Storm Losses, Pricing Market Likely Talking Points on P&C Q1 Calls

Catastrophe losses from winter storms that swept through the southern U.S., along with pricing and margin expansion, should top the agendas of property and casualty insurance companies as they report first-quarter earnings.

Read the Full ArticleLosses from Winter Storm in Southern U.S. Expected to Reach Historic Levels

Insurers in Texas and surrounding states in the U.S. south are facing losses comparable to hurricane totals in the aftermath of unprecedented winter weather that recently swept across the region

Read the Full ArticleERCOT

ERCOT to Hit Record Peak In Summer 2021; Solar, Battery Growth May Help

The Electric Reliability Council of Texas expects to hit a record peakload amid worsening drought conditions in the summer of 2021, but growing solar and battery storage capacity may mitigate scarcity pricing conditions, stakeholders learned May 3.

However, Texas lawmakers and regulators have so far made no significant revisions in weatherization rules since the mid-February winter blast cut power for about 4 millions customers for as long as four days, during which scarcity conditions prompted ERCOT and regulators to set real-time systemwide prices at the $9,000/MWh estimated value of lost load.

Therefore, generators are required to make weatherization plans, and ERCOT can only report on whether generators have implemented those plans, according to a written presentation by Woody Rickerson, ERCOT vice president of grid planning and operations, posted online for the May 3 Summer Preparedness Workshop of ERCOT's Technical Advisory Committee.

Lawmakers 'Tweaking' ERCOT Market After Storm, but Big Changes Unlikely: Experts

Billions of dollars will be spent to ensure the Electric Reliability Council of Texas mid-February winter storm grid failure does not recur, but major market structure changes are unlikely.

Read the Full ArticleERCOT Spot Power Prices Soar on Severe Weather, Rising Natural Gas

ERCOT power day-ahead contracts trended sharply higher April 13 on the Intercontinental Exchange, as below-average temperatures put upward pressure on power demand.

Read the Full Article

FERC

FERC to Probe Cold-Related Market Manipulation, Launch New Resilience Proceeding

As policymakers continue to assess the damage wrought by devastating blackouts in Texas and neighboring states, the Federal Energy Regulatory Commission on Feb. 22 announced it will look into potential market manipulation as natural gas and electricity prices soared during the days-long event.

FERC to Gather Input on Scope, Function of New Public Participation Office

The Federal Energy Regulatory Commission will seek feedback on the scope and function of an Office of Public Participation it is creating that could play an important future role in the commission's natural gas project siting and its power sector oversight.

The commission plans a workshop on April 16 to help gather public views on the office, and in a Feb. 22 notice asked stakeholders to provide input on a handful of topics.

Congress in December, as part of an omnibus spending bill, reaffirmed the direction first given to FERC in the Public Utility Regulatory Policies Act of 1978 to establish such an office.

Read the Full Article

Restarting Capacity

After the Thaw: U.S. Shale Production Quickly Recovers, Refinery Outages to Take Longer

Temperatures dipped far below normal levels in the mid-region of the US during the week ending Feb. 19, causing substantial production freeze offs and power outages at refineries, terminals, and processing plants. Oklahoma and Texas were particularly impacted by the extreme cold weather, with portions of those regions dipping to 40 degrees below normal temperatures for this time of year.

On the supply side, the impact from freeze offs peaked on Feb. 17 with 4 million b/d of crude being offline, resulting in production being down 2.5 million b/d on average during the week. Approximately 90% of the losses were estimated to be back online early the following week. The freeze offs also caused 20+ Bcf/d of natural gas to be offline at the storm's peak.

Dallas Fed Factory Outlook Survey Shows Strongest Production Activity on Record

Texas manufacturing activity in March reached the highest level in the 17-year history of the Federal Reserve Bank of Dallas' monthly survey, results released March 29 show, but wholesale power prices so far have been weaker than in March 2020, when pandemic-induced lockdowns began.

Read the Full ArticlePetrochemical Restart Efforts Continue Post-Freeze

U.S. Gulf Coast petrochemical producers were working to restart facilities that shut when a deep freeze hit the region the week of Feb. 15, but those efforts faced ups and downs amid detailed damage assessments.

Read the Full ArticlePost-Freeze U.S. Petrochemical Restarts Progressing

Most U.S. Gulf Coast petrochemical plants that were shut when sustained sub-freezing temperatures hit the region in mid-February have resumed operations or expect to restart by the end of March.

Read the Full ArticleGas Exports

U.S. Gasoline Markets Continue to Feel Effects of Texas Freeze

Soybean futures continue to support RVO prices as the US market awaits a Supreme Court decision to determine the future of small refinery exemptions.

European exports continue to head toward the East Coast on improved gasoline cracks and market optimism, pressuring New York Harbor prices lower.

Gulf Coast prices have spiked to three-year highs as refineries restabilize operations.

U.S. Gas Storage Draw Measures Well Below Normal for Second Straight Week

U.S. natural gas storage volumes declined less than the market expected for the second consecutive week

Read the Full ArticleAnalysts Expect Below-Average Natural Gas Storage Draw as Heating Season Enters Final Month

Waning U.S. demand likely prompted a below-average draw from storage last week as the withdrawal season winds down rapidly following February's brutal winter storm as Henry Hub futures continue to decline.

Read the Full Article

Gas Prices

East Texas Forward Gas Prices Strengthen As Tighter Summer Balances Loom

Forward gas traders in East Texas are pricing in tighter market balances than previously expected for 2021, as the lingering supply impact of this winter's historic freeze meets with stronger export demand.

Month to date, cash prices in East Texas have remained steeply discounted to Henry Hub gas. At Houston Ship Channel, prices have averaged 17 cents below the U.S. benchmark.

At the nearby Katy Hub, prices have traded at an average 13 cent discount, S&P Global Platts data shows. By later this year, forward traders are anticipating a major turnaround, pricing both locations at near-parity to Henry Hub during the upcoming summer months.

Historically, the East Texas price discount to Henry Hub often narrows during peak-demand months. The outlook for this summer, though, has strengthened over the past five weeks following this winter's historic freeze-off and its impact on Texas gas production and storage.

U.S. Gasoline, Distillate Stocks Plunge as Winter Storm Drives USGC Runs to All-Time Lows

U.S. refined product inventories moved sharply lower in the week ended Feb. 26 as U.S. Gulf Coast refinery runs remained stunted in the wake of severe winter weather earlier in the month, US Energy Information Administration showed March 3.

Read the Full ArticleU.S. Export Polymer Prices Showing Spikes Post-Freeze

U.S. polymer prices showed significant jumps March 2 as market activity inched back up in the aftermath of sustained sub-freezing temperatures along the U.S. Gulf Coast in mid-February that forced widespread production shutdowns.

Read the Full ArticleFebruary Spot Gas Values in Parts of U.S. Grew by 900% Month Over Month

The average price of natural gas for day-ahead delivery in February grew many hundredfold from the prior month in most regions of the U.S.

Read the Full Article