Discover more about S&P Global’s offerings

S&P Global’s roots stretch back to 1860 with a vision for how Essential Intelligence could Accelerate Progress in the industrial revolution. Integrity, discovery and partnership are embedded into our identity.

Explore More

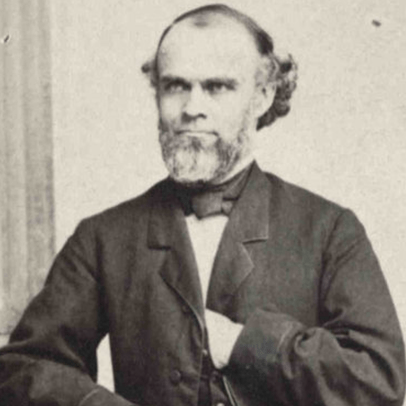

Henry Varnum Poor publishes “History of the Railroads and Canals of the United States,” the first attempt to arm investors with data on the growing U.S. railroad industry. It sparks an intelligence groundswell that continues today.

The U.S. government appoints Poor as a commissioner for the Union Pacific Railroad. Poor gains valuable insights, laying the groundwork for S&P Global’s industry-leading government and infrastructure solutions.

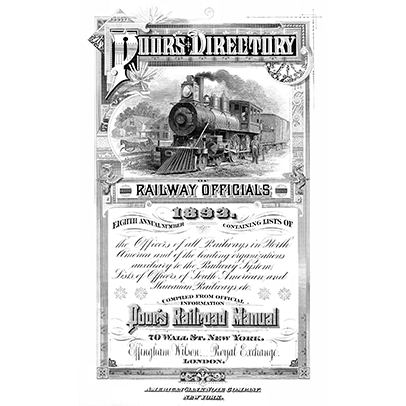

Poor’s Publishing prints the “Manual of the Railroads of the United States,” giving investors current information on U.S. railroads. The guide helps readers make decisions by allowing them to monitor a railroad’s performance.

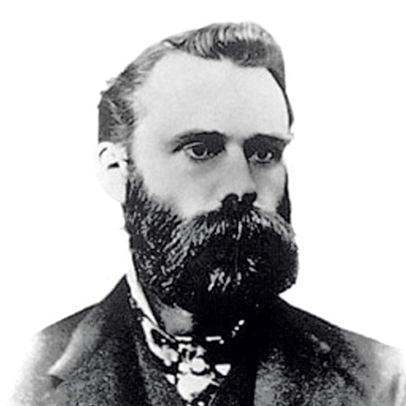

Charles Dow invents the first stock index. The 11-stock index appears in a newsletter, carried by runners to subscribers on Wall Street.

Charles Dow creates the Dow Jones Industrial Average, providing financial information with unprecedented speed. S&P Dow Jones Indices carries on Dow’s legacy in the global economy.

Luther Lee Blake founds the Standard Statistics Bureau to provide current information on non-railroad industrials. Standard Statistics delivers index cards, each containing current news items, to investors to complement the publication.

S&P Global works constantly to expand our data and insight capabilities. In an ever-changing world, our transparent, trusted solutions provide confidence for critical decisions.

Explore More

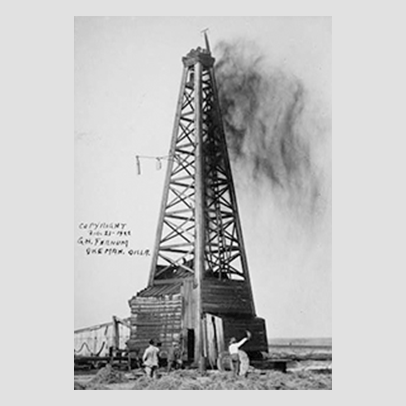

Reporter Warren C. Platt publishes the National Petroleum News, introducing competition to the markets and helps establish Platts as a leader in global energy, chemical and commodities information.

Standard Statistics expands the scale and scope of its index card capabilities by purchasing Babson’s Stock and Bond Card System. Standard Statistics index cards begin providing even more financial information in a portable format.

Poor’s Publishing issues its first credit rating, providing subscribers forward-looking, standardized data on issuers’ creditworthiness. Standard Statistics follows suit in 1922.

Platts Oilgram Price Service offers data daily. Standard Statistics creates its first stock market index. Weekly, it covers 233 U.S. companies, and weights capitalization.

Platts Oilgram Price Service’s U.S. Gulf Coast oil prices become the basis for the first major international oil transaction between the largest companies in the U.S., Europe and the Middle East.

Poor’s Publishing and Standard Statistics protect subscribers with insights that lead customers to liquidate their assets before the October stock market crash. S&P Global works with customers to build understanding during uncertainty.

Forming connections for impact is part of S&P Global’s DNA. It’s how we get our insights into the hands of subscribers with newfound ease and scale.

Explore More

The merger of Standard Statistics and Poor’s Publishing brings Standard and Poor’s to life. The new organization leverages increased capabilities in credit ratings, business information and indices to serve customers across the globe.

Standard and Poor’s creates the S&P 500, the world’s most tracked index. The first to be computer-generated, it uses new electronic punch card systems. We use new technology to turn complexity into clarity more efficiently than ever.

Richard O’Brien forms the Technical Services Division, delivering printed data on microfilm. Two years later, a division is created now known as Information Handling Services.

Platts’ Channel Port Index opens the European markets to transparency in oil price information. The new index further cements Platts’ status as a trusted global provider of commodities information.

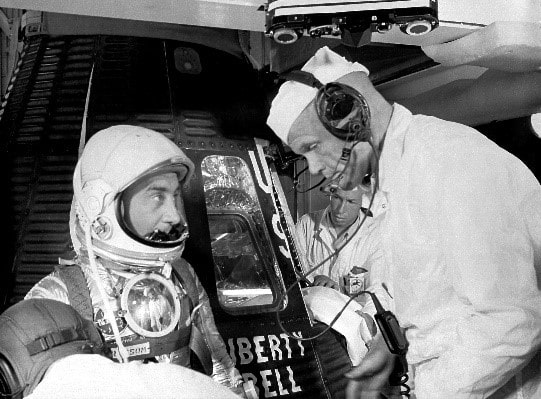

IHS flagship product, the Vendor Specs Microfilm File, gives insights to the aviation industry. Engineers use the data to support the military and in the space race. Source: NASA

Standard & Poor’s introduces Compustat, a database of thousands of companies with stock prices and dividends data stretching back decades. Compustat gives investors the ability to compare standardized data across companies and industries.

Customers worldwide depend on S&P Global’s data and insights. We’ve become the global standard in providing critical financial information to our customers.

Explore More

Standard and Poor’s joins McGraw-Hill, growing S&P’s scale and capabilities as a global purveyor of financial information. In decades to come, the ratings offering is nationally recognized by the SEC as a statistical rating organization.

Standard and Poor’s creates the CUSIP numbering system, its nine-character identifiers quickly becoming the standard for all securities.

IHS gains an international presence when it acquires Technical Indexes Ltd. in the United Kingdom. This positions IHS Group as the world’s largest producer of engineering information databases.

Narayanan Vaghul and Pradip Shah establish CRISIL, India’s first and largest rating agency. Through CRISIL’s ratings and enterprise assessments, S&P Global creates clarity in one of the world’s largest economies.

McGraw-Hill and RobecoSAM launch the Dow Jones Sustainability World Index, the first global benchmark for corporate responsibility. The DJSI collates criteria to provide best-in-class benchmarks for sustainable investing.

IHS launches Connect, empowering users to gain insights, seize opportunities and manage risk world-wide.

We return to our roots as S&P Global, embracing the treasured heritage and values that have differentiated us in the global marketplace.

Explore More

S&P Global, embodying Standard & Poor’s history and marketplace reputation, uses advancements in artificial intelligence, alternate data, data science and cloud computing, to help customers gain insights and avoid risk.

S&P Global acquires Kensho. Its leading AI and machine learning capabilities drive actionable insight from complex data. Kensho Link allows users to organize company data with S&P Global’s Company IDs.

S&P Global acquires Panjiva’s data analytics platform, helping clients grow their market share and increase global supply chain efficiency.

S&P Ratings Ltd. is born and approved as the first international credit ratings agency to enter the domestic China bond market.

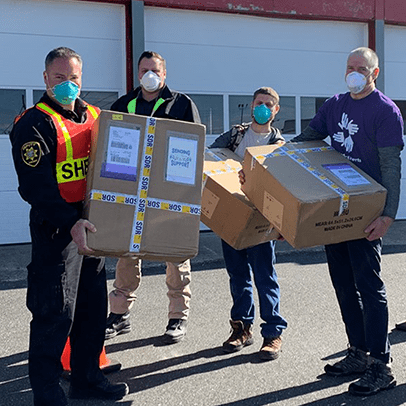

We provide uninterrupted service to our customers even as the COVID-19 pandemic, renewed calls for social justice, and a heightened focus on sustainability create uncertainty.

Learn More

New challenges to solve. New markets to navigate. New opportunities to capture. In a world that gets more complex by the hour, we will continue to provide the data, insights, technology, and innovation to help get our customers ahead.

Explore MoreS&P Global has been accelerating progress in the world since 1860, guiding our customers through uncertainty. Our values continue to underpin who we are and how we show up for our people, customers and communities. Follow the link to find out how we’re accelerating progress for the next generation.

Discover Our Capabilities