Market Volatility

The U.S. Retail Trading Surge: Who's Coming Up Short?

Retail trading has surged in the U.S. since November 2019, when Charles Schwab slashed commissions on U.S-listed stocks and equity options to zero. With millions of individuals confined at home, the pandemic has amplified this trend.

More recently, thousands of individual investors banded together through social media to counter hedge funds, causing elevating volatility and leading to some significant losses for players that had shorted certain stocks or silver futures.

U.S. central counterparty clearinghouses (CCPs) raised margin requirements to protect against heightened clearing risks. This increased liquidity needs for retail brokers and prompted some to impose trading restrictions for individual investors.

Efficient Markets and Irrational Exuberance

Recent headlines have reflected the extraordinary behavior of GameStop Corp. The company’s stock rose from $18.84 at year-end 2020 to $325 at the close on Jan. 29, 2021, then declined to $90 in the first two trading days of February. At year-end, GameStop was the 314th largest stock in the S&P SmallCap 600®.

Read the Full ReportA Different Kind of Bubble

Information Technology was the top-performing sector in 2020, up 44%, while Momentum (up 28%) was the second best-performing factor. These two results are reminiscent of the bubble we experienced two decades ago. But the Tech sector of today is not your father’s Tech sector. Similarly, we can analyze the market from a factor perspective and look at the characteristics of Momentum today versus in the late 1990s. In several respects, the differences outweigh the similarities.

Read the Full Article

Long-term Implications

Short Interest in U.S. Stocks Declines in Aftermath of GameStop Saga, Data Shows

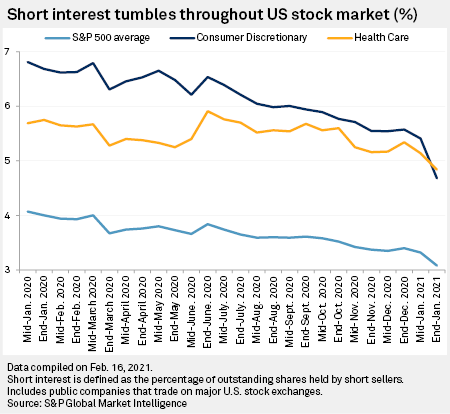

The retail trader-fueled short squeeze of GameStop Corp. and other so-called meme stocks has caused a sharp decline in short positions in U.S. equities, S&P Global Market Intelligence data shows. The trend is likely to linger as some hedge funds now view short-selling as increasingly risky.

"I think a lot of hedge funds are stepping back until the retail euphoria calms down," said Pauline Bell, an equity analyst at CFRA Research, in an interview. "Hedge funds are on the lookout. They don't want to get burned."

As of the end of January, the percentage of outstanding shares of S&P 500 constituent companies held by short sellers averaged 3.08%, down from 4.07% a year earlier, according to the latest S&P Global Market Intelligence data. Short sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If their plays are successful, short sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

Regulators Zero in on Payment for Order Flow in GameStop Aftermath

Wall Street is facing renewed skepticism from Washington, D.C., in the wake of the GameStop Corp. saga over the practice of payment for order flow, which has become a key revenue source for some retail brokerages.

Read the Full ArticleGameStop Mania Mimickers Quickly Lose Steam in LatAm

Retail investors' attempts to engineer a short squeeze like the one seen in the U.S. last week have so far not been successful in Latin America. And it is unlikely that they will be any time soon — at least in similar scale and magnitude, — analysts told S&P Global Market Intelligence

Read the Full ArticleGameStop Frenzy Could 'Forever Change' Shorting as Traders Disrupt Risk Calculus

An ongoing retail trader revolution in equity markets, which blossomed from an epic short squeeze on institutional investors who bet heavily against beleaguered video game retailer GameStop Corp., may have upended Wall Street speculative strategies.

Read the Full Article

GameStop

How Lawmakers Could Unpack GameStop's Wild Ride at 1st Congressional Hearing

Washington is working to understand what it can and should do in the wake of the sudden and unexpected boom-and-bust of GameStop Corp. shares. The reality may be that there is no easy answer.

From payment for order flow to real-time settlement to the gamification of trading, the facets of the U.S. stock market's inner workings that have come under scrutiny amid the meme stock craze have long been debated and discussed across the nation's capital and Wall Street.

"People have been raising these issues for years, and none of them have been particularly solved because they're complex," said Graham Steele, who was the chief counsel to Democrats on the Senate Banking Committee from 2015 to 2017 and now works as the director of the Corporations and Society Initiative at Stanford University's Graduate School of Business.

GameStop Traders at a Crossroads: 'To The Moon' or 'Along for the Ride'

Emboldened by zero-commission trading, looser margin requirements and technology that puts the stock market at their fingertips, an army of small investors that runs the gamut from college students and dentists to lawyers and nurses is piling into some of the hottest trades Wall Street has seen in years.

Read the Full ArticleMelvin Capital Recorded 53% Loss in January Amid GameStop Tumult

Melvin Capital Management LP saw its holdings plunge 53% in January according to a report in The Wall Street Journal citing people familiar with the firm.

The hedge fund had taken on a series of large short positions, most notably in GameStop Corp. stock, which has soared in recent weeks driven by activity touting the stock on Reddit's WallStreetBets forum.

Metals

Silver Gets Boost on r/WallStreetBets Hype but Scope Will Hang on Attention Span Uranium Stocks Show Strength atop Reddit-Fueled Metals Market Volatility

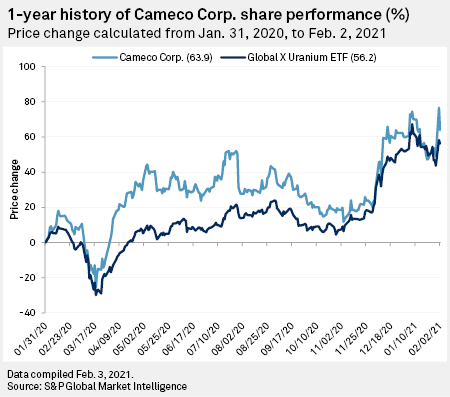

Uranium equities have had a banner start to the year as positive business fundamentals seemed to collide with the chaos of Reddit-fueled market chaos.

Shares in Cameco Corp. jumped above $14 for the second time in 2021 during the week of Feb. 1, increasing year on year from a share price of about $8.30. The company operates the largest uranium-producing mine in the world, Cigar Lake in Saskatchewan, Canada, and has suffered significant losses due to production stuttering related to the effects of the coronavirus pandemic. The Global X Funds - Global X Uranium ETF, an exchange-traded fund that provides investors with broader exposure to uranium mining, booked similar gains.

Silver Gets Boost on r/WallStreetBets Hype but Scope Will Hang on Attention Span

Silver could be the next high-profile target for retail investors after the GameStop Corp. stock spike, but analysts are skeptical that social media's meme economy will translate to another legendary result in the market any time soon.

Read the Full ArticleRecent Retail-Driven Silver Run Was 'Significant Event,' HSBC Analyst Says

As February kicked off, excitement surrounding a rally in GameStop Corp. stock and the r/WallStreetBets subreddit grew to such an extent that when silver prices and equities subsequently jumped, analysts, observers and media attributed the gains to the same phenomenon.

Read the Full Article

AMC

AMC Paying the Price of Survival with Expensive Debt, Stock Dilution

AMC Entertainment Holdings Inc. faced the long barrel of bankruptcy throughout 2020, and if it survives through the pandemic period, it will carry a balance sheet full of bullet holes.

In order to keep its iconic three letters glowing above its empty theaters, the company has had to pull a range of financial levers to attract lenders and investors, often having to offer stock and accept daunting debt terms to stay afloat. The pandemic-era commitments could leave AMC scrapping for many years to come, especially if the evolving theatrical model bends against theater operators and cuts into future earnings

AMC Theater Group: From Default Risk to 'Meme Stock' and Back Again

Amid a recent peak in coronavirus deaths, a fresh wave of film delays and troubling U.S. macroeconomic indicators, AMC Entertainment Holdings Inc. stock is going gangbusters.

AMC closed Jan. 28 at $8.63 per share, trading up 145.87% for the week-to-date. The growth, fueled by a retail-trader buying bonanza, seemed wholly unrelated to the company's fundamentals, as AMC has had a mixed bag of news lately. On one hand, the company provided a liquidity update, saying it had raised $917 million in capital commitments since mid-December 2020. It assured investors that talk of imminent bankruptcy is "completely off the table."

On the other hand, however, "imminent" seems to be an operative word in that phrasing.