Emissions Risk

Coal Rebound to Largely Wipe Out Pandemic-Related CO2 Emissions Drop – IEA

Growing demand for coal in 2021 is set to wipe out most of the drop in carbon emissions that was caused when the world ground to a halt as a result of the coronavirus pandemic, the International Energy Agency predicts.

The organization expects global energy-related CO2 emissions to rise by 1.5 billion tonnes to 33 billion tonnes this year, an increase of almost 5% over 2020, as vaccinations and widespread fiscal stimulus packages are boosting economic growth and causing energy demand to rebound.

Global Energy CO2 Emissions Forecast to Rise 5% In 2021 on Revived Coal Burn: IEA

Global energy-related CO2 emissions are on course to surge by almost 5% in 2021 to 33 billion tonnes, the second-largest increase in history, the International Energy Agency said April 20 in its Global Energy Review 2021.

Read the Full Article

Outlook

U.S. Coal Default Risk Down in 2021, But Access to Capital Still a Challenge

After a challenging 2020, U.S. coal companies now generally face a lower probability of default but are still grappling with substantial obstacles to accessing capital.

EIA U.S. Coal Production, Export, Consumption Forecasts Rise for 2021

The U.S. Energy Information Administration forecast coal production of 585 million st in 2021, up 8.6% from 2020 output of almost 540 million st, the EIA said April 6.

In 2022, the EIA projected output of about 602 million st.

Read the Full ArticleCoal Stumbled Globally in 2020, but 'No Sign it Will Fade Away Quickly' – IEA

After an unprecedented decline in global coal demand, the International Energy Agency expects the fuel to rebound in 2021 before flattening out by 2025.

Read the Full Article

Energy Transition

China to Curb Coal Demand Growth In Economic Plans as Part of Climate Targets

China will curb coal consumption in its economic plans spanning the next 10 years, President Xi Jinping said April 22 at U.S. President Joe Biden's global climate summit. Xi also affirmed China's existing targets on peak carbon dioxide emissions before 2030 and carbon neutrality before 2060.

The precise language around limiting coal consumption could dim the prospects for unfettered growth in coal-fired power generation, which dominates China's energy mix, and pave the way for a more aggressive push for fuels like natural gas/LNG, nuclear and renewables.

"China has committed to move from carbon peak to carbon neutrality in a much shorter time span than what might take many developed countries, and that requires extraordinarily hard efforts from China," a transcript of Xi's speech at the summit said.

Fossil Fuel Financing Falls in 2020 Amid COVID-19, Environmental Groups Find

Fossil fuel financing fell by 9% in 2020 as the COVID-19 pandemic halted demand and production, but overall bank funding of the fossil fuel industry in 2020 remained higher than in 2016, the year after the 2015 Paris agreement on climate change was signed

Read the Full ArticleXcel Energy Accelerates Clean Energy Transition, Coal Exit in Colorado

Aiming to slash carbon-dioxide emissions 85% by 2030 from 2005 levels, Xcel Energy Inc. on March 31 pitched Colorado energy regulators a sweeping clean energy transition that would accelerate subsidiary Public Service Co. of Colorado's move away from coal-fired generation by leaning more heavily on new wind, solar and energy storage resources.

Read the Full Article

Closures

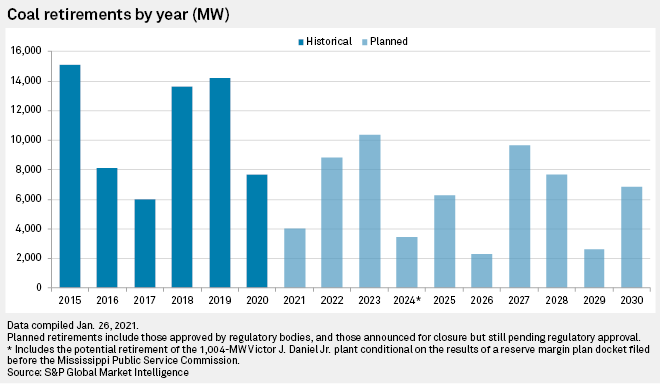

U.S. Coal's 'Road to Extinction' May Take Well Over a Decade Without Policy Push

Market forces, investor sentiment and existing policies have driven the decline of the U.S. coal fleet in recent years and will likely continue to prompt closures, but the last of the power plants may remain online well past the next decade without policy interventions.

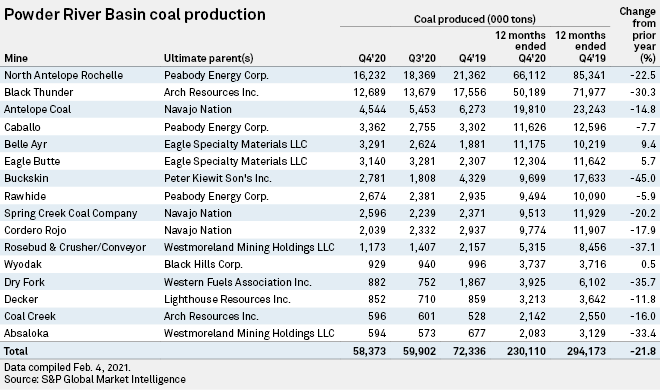

Closures, More Volume Declines Hitting Powder River Basin Coal Region in U.S.

A sharp decline in coal demand from the U.S. power sector is wreaking havoc on the Powder River Basin as mine operators in the region scaled back production during 2020 with few indications of improved prospects for volumes.

Production in the country's largest coal-producing basin fell 21.8% year over year in 2020, and two of the largest producers in the region have indicated that 2021 may not be much better.

Read the Full Article

Trade

Trade Review: Asia's Met Coal Trapped In A Season of Low Prices

Asia's seaborne metallurgical coal market may face a tumultuous second quarter as the low-priced environment looks set to stay given China's continued absence from Australian coals, which has had a profound impact in the physical market. Norms have been disrupted amid the onslaught of cargoes changing hands as non-Chinese steelmakers swap existing term cargoes for cheaper counterparts in the spot market.

The price volatility in the first quarter of 2021 may feature in Q2 given weather concerns in Australia, China's ongoing steel production cuts and environmental measures. Platts PLV FOB Australia benchmark moved in an inverted V-shape in Q1, jumping from near $100/mt at the start of the year to over $160/mt on Feb. 1, before sliding to $112.50/mt towards the end of Q1.

Powder River Basin Coal Production Down 15% in Recent 12 Months

U.S. coal production and employment nosedived in the second quarter, and much of the lost tonnage would have come from the Powder River Basin that spans southeastern Montana and northeastern Wyoming.

Read the Full ArticleU.S. Thermal Coal Exports May Tighten Despite Recent Price Rises

Downside potential for U.S. thermal coal exports remains for 2021 despite recent rises in prices.

Read the Full Article

2020 Activity

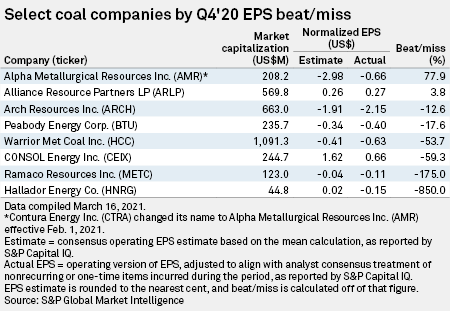

Most U.S. Coal Companies Miss Analyst Expectations in Q4'20 Amid Losses

Most publicly traded U.S. coal companies fell short of analysts' earnings projections in the fourth quarter of 2020, with a majority recording losses during the period.

Expectations were low going into the fourth quarter, with analysts projecting that most U.S. coal producers would report a loss in earnings and that only three would record positive EPS.

Coal Production From Top Northern Appalachia Mines Drops 25% in FY'20

Production at the top coal mines in the Northern Appalachian basin of the U.S. during the last quarter of 2020 fell short of the full-year 2019 totals but increased quarter over quarter, according to an analysis by S&P Global Market Intelligence.

Read the Full ArticleCoal Output Declined 14.3% at Top 25 Central Appalachian Mines in 2020

Coal production at the top 25 mines in the Central Appalachian basin of the U.S. held steady during the fourth quarter of 2020 while output slumped for the full year, according to an analysis by S&P Global Market Intelligence.

Read the Full Article