Hotels

As European Hotels Grapple with Prolonged Restrictions, Are Operators and Landlords Sharing the Pain?

In S&P Global Ratings' view, the lodging and travel sector will be among the last to recover once the pandemic has subsided–as the need for social distancing, quarantine, and travel restrictions extends into 2021–and could be several years before a full recovery.

With continued volatility in earnings expected, the ratings trend for hotel operators will be decisively negative this year. The lodging sector globally has a high number of investment-grade companies, and six issuers rated 'BBB-' have negative outlooks, therefore at risk of becoming fallen angels.

For the broader industry, S&P Global Ratings expects that revenue could decline by 50% in 2021, with EBITDA falling by more than 50% and dismal cash generation. Even so, the pandemic's impact on hotel operators across Europe has varied, and S&P Global Ratings expects this to continue.

Key Takeaways

- With a negative sector outlook, the hotel and lodging industry has begun the year facing continued disruption due to the ongoing pandemic. As vaccine rollouts pick up pace, S&P Global Ratings expects that European hotel operators and landlords will recover gradually, starting from the second half of 2021, though we don't expect a full recovery until 2023.

- Since the onset of the pandemic to the first half of 2021, hotel landlords could lose 15%-30% of fixed-lease and 50%-80% of variable rental income on average, compared with 2019 levels. Owners of economy to midscale hotels leased to creditworthy operators in markets that benefit from domestic demand and stronger government support should fare better and recover faster.

- Asset valuations for European hotel properties will likely decline, reflecting constrained daily occupancy levels, higher costs, and lower operating revenues. S&P Global Ratings assumes a 10%-15% asset correction relative to 2019 levels for the hotel real estate investment trusts (REITs) S&P Global Ratings rates.

- S&P Global Ratings' assumptions for commercial mortgage-backed securities (CMBS) also reflect S&P Global Ratings' view that hotel revenues will not recover to pre-COVID levels before 2023.

- In S&P Global Ratings' view, a reduction of between 10%-30% in business travel could happen over the next few years. Hotels catering to large groups and conferences would likely be the last to recover once the pandemic is controlled.

Travel

United Airlines Sees Rising Leisure Travel as Vaccines Increase

United Airlines sees the number of domestic leisure travel passengers in June moving closer to 2019 levels while leisure travel demand to other countries is gaining in popularity as more flyers take to the sky after a year of coronavirus pandemic lockdowns.

"During March we finally reached that demand inflection point we had been looking for, and we continue to see that resurgence today. Vaccine distribution gains in the US have renewed our desire as Americans to travel," said Andrew Nocella, United's chief commercial officer on the April 20 results call.

In comparison with the pre-pandemic levels of 2019, United sees domestic load factors for April were only "slightly behind," with May levels "slightly ahead" and expectations are for mid-June domestic leisure passenger load factors to be in excess of 80% of June 2019 levels.

Delta Air Lines' Recovery Takes Root as Domestic Travelers Return

Delta Air Lines, the nation's second largest airline, saw a major uplift in fliers at the end of the first quarter as coronavirus vaccine rollouts grew, finally becoming cash flow positive in March, CEO Ed Bastian said.

Read the Full ArticleSummer Travel to Push American Airlines towards Pre-Pandemic Seat Capacity

American Airlines expects its domestic and international seat capacity during the summer travel season to be within 10% and 20% of levels seen in the same period of 2019.

Read the Full ArticleEurope's 2021 Air Passenger Traffic Likely to Stall at 30%-50% of 2019 Level

Governments across Europe are finding it more difficult to control the COVID-19 pandemic, as numerous new virus variants have emerged which appear more transmissible and have led to concerns over vaccine efficacy.

Read the Full Article

Restaurants

U.K. Pubs, Shaken And Stirred, Look To Recover After A Cocktail Of Headwinds

With good progress on vaccinations and a roadmap for easing of lockdown and restrictions, pubs and restaurants in the U.K. can open their doors over the next few weeks. The reopening is set to be gradual and staggered, with venues in England allowed to have outdoor operations from April 12 and indoors from May 17; rules and dates vary across Scotland, Wales, and Northern Ireland.

While the welcome prospect of opening after several months and pent-up demand (booking levels remain very healthy) will drive footfall, S&P Global Ratings expects operating prospects will remain tough over the medium term. S&P Global Ratings expects many operators will take up to three years to rebuild their financial profiles to 2019 levels. Following the pandemic, customer behavior will continue evolving, so pub operators will have to be nimble with their offerings and formats to stay on top of fast-changing consumer preferences.

The closures and restrictions that aimed to control the spread of COVID-19 have taken their toll on the hospitality sector. Pubs have not been able to stem their cash burn even after the support extended by the government (furlough and rates holiday), suppliers (who have taken on most of the burden of inventory impairments), and landlords (through rent waivers and deferrals).

Even with Restaurants Rebounding, U.S. Food Retailers and Suppliers Are Expected to Stay Strong in 2021

Sudden COVID-19-related stay-at-home orders, extreme hoarding of food and other staples, and the rapid acceleration of e-commerce made food-at-home (FAH) companies one of the biggest winners in the U.S. retail and restaurant sector in 2020.

Read the Full ArticleU.S. Restaurants and Foodservice Distributors Face a Jagged Recovery While Food and Beverage Fare Better

Restaurant demand has partially rebounded thanks to growing quick service restaurant (QSR) sales while the casual dining sector still faces multiple obstacles.

Read the Full ReportU.S. Restaurants Face Higher Costs Under Biden Plan to Boost Federal Minimum Wage

U.S. President-elect Joe Biden's support for a higher federal minimum wage could raise the cost of doing business for restaurants as the pandemic continues to eat into industry profits and put pressure on its workforce, experts say.

Read the Full Article

Real Estate

French Real Estate Firms' Pre-Pandemic Caution Leaves Breathing Room for Lenders

As France comes to terms with another nationwide COVID-19 lockdown, the owners of non-food retail, hospitality and leisure properties, in particular, face a lengthy period of closure when they might have instead been looking forward to the opening of the country's tourism season during a busy Easter break.

The blow will undoubtedly be hard felt, but many property businesses should take some comfort from the relative health with which they entered the pandemic. S&P Global Market Intelligence data shows that the median debt-to-equity ratio among French real estate small and medium-sized enterprises fell from 48.16% in 2015 to 34.01% by the end of 2019.

Key Takeaways

- France's major lenders retain significant exposure to the sector. BNP Paribas SA's gross exposure to commercial real estate, which is mainly in Europe, was €71.1 billion, 3.9% of the group's total on- and off-balance sheet commitments, as of Dec. 31, 2020.

- Doubtful loans totaled €1.64 billion, representing 2.3% of the bank's total exposure to the sector, the company's 2020 annual financial report showed. France's other two major listed lenders, Crédit Agricole SA and Société Générale Société anonyme, had exposures at default to real estate of €22.46 billion and €34.13 billion, respectively.

- Non-food retail, hospitality and leisure properties have borne the brunt of the damage inflicted on the property market by the pandemic. Landlords have struggled to collect rent from tenants whose income has collapsed as customers stay away from their premises.

- U.K.-based retail landlord Hammerson PLC, which has a portfolio of retail assets in France worth around £1.15 billion as of Dec. 31, 2020, collected just 58% of first-quarter rent from its French assets as of March 5.

- Owners of certain kinds of subprime properties in regional towns and cities — the kind more likely to be owned by real estate SMEs rather than large institutional investors — are also more vulnerable to the impact of the COVID-19 shock.

E-Commerce

U.S. Online Grocery Sales Growth to Slow But Remain Above Pre-Pandemic Levels

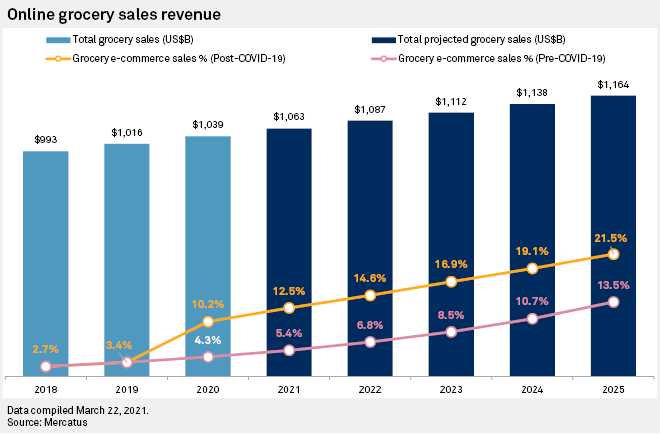

Online grocery sales in the U.S. will moderate this year after a pandemic-induced surge in 2020, but analysts expect growth to remain higher than pre-COVID-19 levels and benefit retailers pushing forward with investments in e-commerce operations and fulfillment capacity.

Next Round of Stimulus Checks Could Further Lift U.S. E-Commerce Sales

Large e-commerce players including Amazon.com Inc., Walmart Inc. and Target Corp. are likely to benefit from a third round of stimulus checks included in U.S. President Joe Biden's $1.9 trillion COVID-19 rescue package bill, with the cash infusion expected to spike already elevated digital retail sales.

U.S. e-commerce sales in 2020 hit an estimated $791.7 billion, accounting for 14% of total retail sales that year, according to figures from the U.S. Census Bureau. That is up from 11% of total sales in 2019 and 9.7% in 2018.

Ratings in the global retail industry have a moderate exposure to environmental and social factors. Consumer behavior is a key facet in the impact of environmental and social factors (whether favorable or not). Customers' preferences, perception of brands, and demographics are risks because most products in the retail industry are discretionary.

ACCESS THE TOPIC PAGESupply Chain Implications

Retailers Face Global Supply Chain Pressures as Backlogs Continue Amid Pandemic

Pandemic-induced demand remains high for everything from exercise equipment to home electronics, but U.S. retailers are struggling to get products in from Asia due to continued backlogs at ports, supply chain experts say.

Cargo limitations on steamships, coupled with a lack of available equipment and staff needed to haul products away from port facilities, have created ongoing congestion for large retailers from Costco Wholesale Corp. to Peloton Interactive Inc. A container ship that blocked the Suez Canal, while now freed, has had a ripple effect on the global supply chain system.

Shipping Surge Extends into February as Consumer, Pandemic Needs Remain High

There is little sign of a slowdown in U.S. seaborne import growth in February. Panjiva's data shows total shipments climbed 29.3% year over year and by 20.1% versus the same period in 2019. Imports of containerized freight climbed 20.0% year over year and by 15.0% compared to 2019, continuing an unprecedented sixth straight month of double-digit growth.

Shipments in January and February combined (to scrub the effect of the timing of the Lunar New Year on imports from Asia) were 17.9% higher year over year. That is likely to mean little respite for U.S. seaports that have experienced ongoing congestion, with resulting elevated costs for cargo owners, throughout the fourth quarter of 2020 and now into the first quarter of 2021.