Tech Disruption

Tech-Driven Oscar Health Sets 'Ambitious' IPO After Private Fundraising Success

Oscar Health has drawn strong funding support from private investors and will now look to garner similar support in public markets in an upcoming IPO.

The tech-minded health insurer secured $140 million in new funding in December 2020 and has raised about $1.6 billion from private sources, "making it one of the health insurance unicorns that raised the most from private sector," IPOX Schuster LLC analyst Kat Liu said in an email to S&P Global Market Intelligence.

"It's an ambitious offering for a healthcare company of its profile, but not for an up and coming technology company," Avalere Health LLC founder Dan Mendelson said in an email. He expects Americans to become increasingly willing to use telehealth and believes the Biden administration's bid to "expand the affordability and availability of insurance" will help Oscar Health.

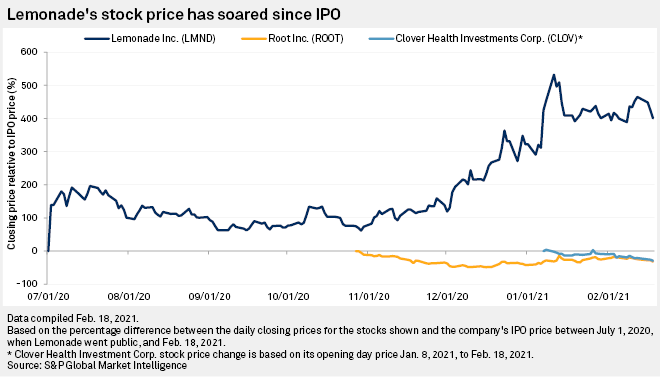

Liu, who described the initial IPO price range as "quite reasonable," said Oscar Health picked a good time for its IPO plans given the "high valuation, market sentiment etc." She noted that Lemonade Inc. is up over 400% since its IPO on July 1, 2020.

AI Helps Hospitals Navigate PPE Shortages, COVID-19 Hot Spots

The incoming CEO of group purchasing organization Premier Inc. says the past year has exposed many issues with the U.S. health system, including problems with the supply chain and over-purchasing, but harnessing artificial intelligence and machine learning may offer a solution.

Read the Full ArticleFast, Agile' Digital Direct-to-Consumer Companies Are Transforming Healthcare

A growing reliance on telehealth and wearable tech during the pandemic has created opportunities for ambitious direct-to-consumer digital health companies looking to take market share from more established healthcare rivals.

Read the Full ArticleChina's Big Tech to Continue Disruption of Healthcare Sector Despite Crackdown

China's crackdown on internet companies, including Alibaba Group Holding Ltd., is unlikely to affect their burgeoning healthcare businesses and could transform the medical sector into a key battleground for e-commerce and tech companies.

Read the Full Article

Telehealth

Teladoc Sees Post-Pandemic Growth Opportunities After Record-Breaking 2020

Following a record-breaking 156% increase in worldwide visits to its platforms, Teladoc Health Inc. CEO Jason Gorevic said he remains confident that the company has plenty of opportunities to continue to grow membership.

During a Feb. 24 earnings call, Gorevic described 2020 as a "transformational year" for Teladoc, noting that the telehealth company onboarded 15 million new paying members. Fourth-quarter revenue was $383 million, an 145% increase year over year, and Gorevic said the company also saw organic growth of 79% when excluding the InTouch Health and Livongo acquisitions.

COVID-19 Hinders Women's Access to Healthcare; Telehealth Can Help – Nurx CMO

On March 1, Nurx announced that Jennifer Peña would be joining the company as chief medical officer. Peña previously served in the U.S. Army and completed an internal medicine residency at Walter Reed Army Medical Center.

She also served at the White House Medical Unit under the Obama and Trump administrations, including as physician to the vice president. Most recently, Peña served as medical director for virtual primary care at digital health insurer Oscar Health Inc.

Peña spoke to S&P Global Market Intelligence about her new role at Nurx and how the company is looking to solve access and affordability issues when it comes to female health concerns. The following is an edited transcript of the interview.

Investment

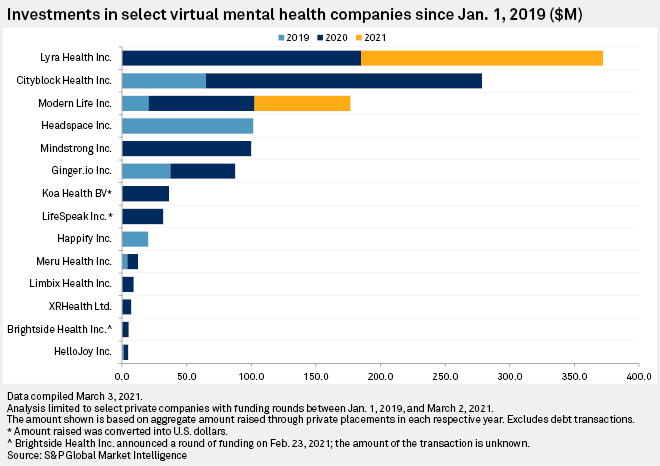

Digital Mental Health Investments Rise in Wake of COVID-19

Following a year of social distancing, lockdowns and job losses, 41.1% of U.S. adults reported symptoms of anxiety disorder or depression in January 2021, according to the National Center for Health Statistics and the U.S. Census Bureau's Household Pulse Survey.

These growing concerns have opened up a path for digital health companies with mental health platforms to raise capital and expand their customer base by offering services for employers to utilize for their workforces.

Over the past two years, investors have channeled millions of dollars into platforms that offer mental health and behavioral care services. Following the onset of COVID-19, firms ramped up their investments, leading to Lyra Health Inc.'s $187 million series E funding round and Modern Life Inc.'s $74 million round in January 2021 — the same month that another mental health company, Talkspace Network LLC, announced it would merge with blank-check company Hudson Executive Investment Corp. to form a combined entity worth about $1.4 billion.

PE Investors See 'Opportunity of a Generation' in EU Healthcare IT

The digitalization of healthcare offers private equity and venture capital investors a multitude of opportunities, but access to data and the appropriate handling of it is a huge challenge for all involved, according to sector specialists.

Read the Full ArticleEuropean PE Healthcare Deal Value Rises Sharply After Onset of COVID-19

Aggregate European private equity healthcare deal value reached $5.1 billion as of the end of February, up sharply from the $1.4 billion recorded for the entire first quarter of 2020, Preqin data shows.

Read the Full ArticleChina's Medical Services Providers Attract Investment Amid Surging Demand

Increasing demand and government support attract investment in China's medical services industry, such as home care and rehabilitation businesses. The market size of China's rehabilitation therapy industry reached 58 billion yuan in 2019 and is expected to grow 12.5% annually through 2024.

Read the Full Article

Pharma

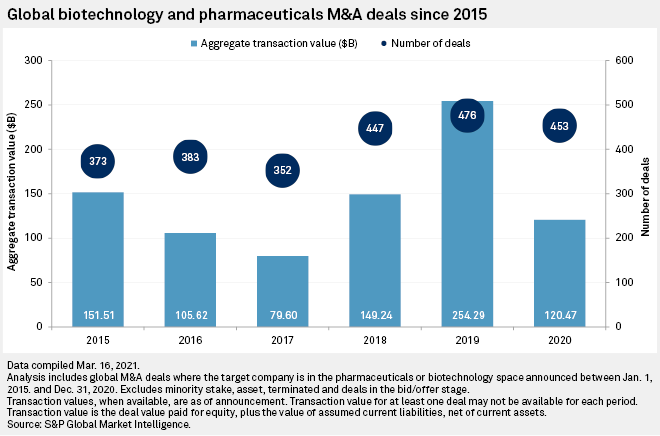

More Deals, Higher Prices Lead to Greater Antitrust Scrutiny for Pharma M&A

Add greater antitrust scrutiny to the list of headwinds facing the pharmaceutical industry in 2021.

Under the administration of President Joe Biden, the U.S. Federal Trade Commission is rallying fellow regulators in Canada, the U.K. and Europe to revise the way they study the impact of pharmaceutical M&A. Antitrust reviews generally involve examining product and pipeline overlap, and FTC acting Chair Rebecca Kelly Slaughter envisions a more sophisticated approach that includes a transaction's effects on prices and access to medicines.

"Pharma is an area that depends so heavily on innovation and entry of new products often developed by small competitors," Slaughter told reporters on a March 16 call. "We need to make sure that we're not just thinking about the sort of traditional questions of market share, and instead, we're really looking at these questions about innovation and what's going to get new treatments and new drugs to market so that consumers have access to them and, importantly, have access to them at prices that they can afford."

Recognizing that several of the top pharmaceutical and biotechnology acquisitions since 2015 were cross-border deals, the FTC is joining forces with its international peers to "take an aggressive approach to tackling anticompetitive pharmaceutical mergers," Slaughter said in a March 16 FTC press release.

COVID-19 Ignited Year of Risk, Rewards for Pharma Leaders

COVID-19 set in motion a wave of innovation and collaboration that has transformed the pharmaceutical industry, executives said as they reflected on the pandemic's first year.

Read the Full ArticlePharma Outlook: Eighth Straight Year of Credit Deterioration in 2021

S&P Global Ratings' outlook for the pharmaceutical industry is negative for 2021, with downgrades expected to again exceed upgrades, especially among Big Pharma companies--the trend for the last seven years.

Read the Full ReportBig Pharma Rallies on Share Buybacks as Most Companies Cut Back During Pandemic

Most U.S. companies shied away from share repurchases during the height of the COVID-19 pandemic in 2020, although the technology and healthcare sectors — drugmakers and big biotechs in particular — showed greater resiliency and a willingness to splash out on their own stocks.

Read the Full ArticleCOVID-19 Showcases Medicine Access Issues in Low-Income Nations at 'Warp Speed'

The COVID-19 pandemic has given investors new fuel to push for institutional changes at the world's top pharmaceutical companies to ensure equitable access to medicines in lower income countries.

Read the Full ArticleStay up to date with the latest news and insight from S&P Global Market Intelligence on healthcare developments.

ACCESS THE TOPIC PAGEResearch & Development

Gilead Bets on mRNA to Make HIV Vaccine Dream a Reality

Messenger RNA vaccines have already scored early successes during the COVID-19 pandemic and Gilead Sciences Inc. has bet that this technology could be used to achieve another pharma first: a long sought-after HIV inoculation.

With mRNA vaccines from Pfizer Inc.-BioNTech SE and Moderna Inc. receiving emergency use authorization to fight COVID-19, Gilead Senior Vice President and Virology Therapeutic Area Head Diana Brainard said in an interview that the stage is set to use the technology in other areas that have long stymied researchers, including HIV inoculation.

Gilead, which specializes in HIV therapeutics and daily preventative medications, has yet to develop a vaccine. But an HIV inoculation, because of the way the virus affects the body, has long been in preclinical circles.

"One of the biggest challenges that we face in HIV care is that no one's done it yet — individual patients have been cured through bone marrow transplant, which isn't really a scalable approach," Brainard said. "We don't really have a roadmap for what 'good' looks like there, even though there are a lot of hypotheses and a lot of educated guesses to achieve a cure."

One of the difficulties in HIV vaccine development is the transition from studies in animals to humans because the viruses are not the same.

Horizon CEO Says Pivots Helped Save 2020 Drug Launch Amid COVID-19 Challenge

Horizon Therapeutics PLC CEO Tim Walbert is looking back at the ways the company has had to navigate a successful drug launch in trying times stemming from the COVID-19 pandemic.

Read the Full ArticleChinese Drugmakers Play Catch Up on mRNA Vaccines Amid Pandemic

Wang Jing, CFO of Tianjin, told S&P Global Market Intelligence that its mRNA platform is maturing through in-house development as well as partnerships with whom it will work on an mRNA vaccine for COVID-19.

Read the Full ArticleCSL Sees Strong Flu Shot Demand, Plasma Collection Challenges Amid Pandemic

Sales of CSL's influenza vaccine business Seqirus increased 44% year over year during the six months ended Dec. 31, 2020, with a record more than 100 million doses sold in the Northern Hemisphere.

Read the Full Article

New Entrants

As Amazon Eyes Healthcare Disruption, Peers Consider Partnerships with Retailer

Retail behemoth Amazon.com Inc. continues to shake up the healthcare world by leaving one venture and launching a new one, leaving some industry CEOs determined to work with — not against — the disruptor.

Amazon's exit from the Haven joint venture announced Jan. 4 seemed to experts a way for the retailer to prioritize its much grander healthcare plans to revolutionize the delivery of drugs.

The Amazon Pharmacy platform — launched in November 2020 — is the company's effort to do so, allowing users to browse and purchase medications online and have them shipped to their homes. But Amazon's Haven exit also showed just how hard the healthcare industry is to disrupt in the first place.

Amazon Is Likely to Boost Its Own Healthcare Ambitions After Exiting Haven JV

Amazon.com Inc., JPMorgan Chase & Co. and Berkshire Hathaway Inc. are calling it quits on their healthcare joint venture.

Read the Full ArticleAmazon's New Pharmacy May Steal Market Share from CVS, Walgreens Amid Pandemic

Amazon.com Inc.'s move to launch an online pharmacy during the pandemic could help it squeeze market share away from competitors, including CVS Health Corp. as the e-commerce giant accelerates efforts to delve further into the healthcare arena, health and company experts say.

Read the Full Article