Economic Conditions

U.S. Real-Time Data: Job and Mobility Trends Improve as Rising Prices Dampen Consumer Enthusiasm

The job market is improving at a steady pace, indicated by S&P Global Ratings’ real-time trackers. Initial claims for the week ended June 5 were 376,000, falling by 9,000 from the previous week. After hovering around 800,000 for almost nine months, from August 2020 to April 2021, initial claims have been declining more rapidly since May, by an average of 26,000 per week, despite a relatively small drop in the first week of June. The faster decline in initial claims reflects stronger labor demand from businesses, especially the more labor-intensive service sector, which created 99% of new jobs in the private sector in May, according to the Bureau of Labor Statistics' nonfarm payroll data.

Businesses do seem to want more help. Indeed daily job postings remained 27% higher than their pre-pandemic level as of May 28, almost unchanged from last month. The Conference Board also indicated that in May, there were markedly more people who found that jobs are plentiful than those who found that jobs are hard to get. The difference between the share of consumers holding the two opposite opinions widened in May to 34.6 ppt, from 21.6 ppt in April, and has increased for four consecutive months.

A Long Way Back To Full Employment

The economy added 559,000 jobs in May, almost the average pace over the previous three months. At this rate, the jobs market will reach its pre-pandemic full employment trend in the first quarter of 2023, but the May pace will be difficult to maintain past summer as the burst of jobs to start in reopenings are the low-hanging fruit.

The labor market reclaimed 66% of the payroll jobs lost in March and April 2020, while hours-worked have reclaimed a larger 79% of the drop, which means hours have been recouped by fewer employees working longer hours.

Labor demand is outstripping supply and holding back capacity utilization (besides supply chain constraints). While we expect further substantial gains in the jobs market this summer, labor shortages will likely be a constant theme this year and a constraint to U.S. GDP as businesses return to normal.

Read the Full Report

Employment Implications

Unfilled Jobs Soar to Record High as U.S. Employers Struggle to Hire New Workers

U.S. business owners claim they have millions of job openings but few workers willing to fill them.

And with the U.S. slowly emerging from the coronavirus pandemic, economists say this brewing labor crisis threatens the economic recovery as lost sales start to pile up.

"Some have had to turn away business and scale back operations due to being short-staffed," said Holly Wade, executive director of the National Federation of Independent Business' research center, in an interview. "Others are trying to meet demand by working longer hours, paying overtime and bonuses for employees willing to work extra hours, but those adjustments are not sustainable over the long run.

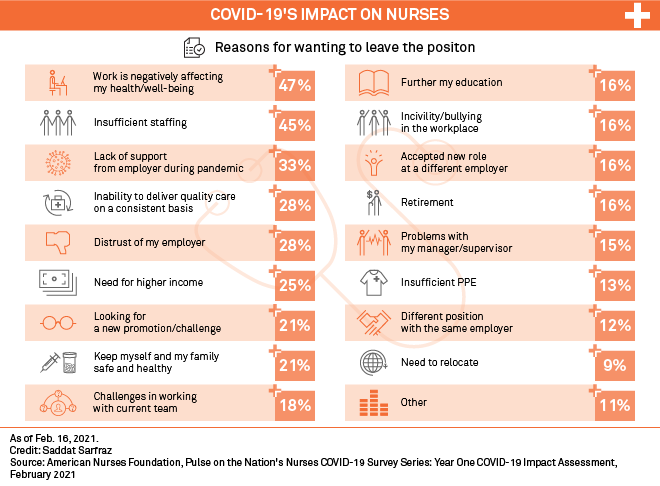

Hospitals Battle Burnout, Compete for Nurses as Pandemic Spurs U.S. Staffing Woes

U.S. hospitals are still seeing the effects of a tightened labor market due to the COVID-19 pandemic, even as federal funding and the vaccine rollout could offer some relief for the industry.

Higher Wages

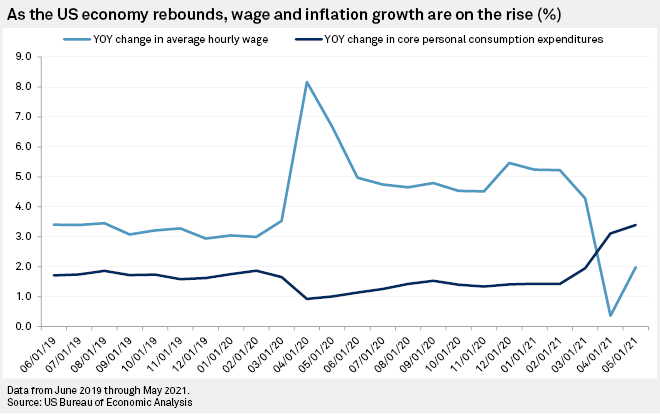

U.S Wages Expected to Jump in June, but Will Not Make Up for Inflation

U.S. workers' wages are on the rise, but so is inflation, which means rising prices of gasoline and groceries are effectively canceling out any gains for employees' wallets.

The wage figures and employment changes for June — set to be released in the U.S. Labor Department's July 2 jobs report — will offer greater insight into how the domestic economy is progressing on its recovery from the COVID-19 pandemic. The fresh data may also give clues as to when the Federal Reserve will start to roll back its support for the economy, which has largely supported markets since the crisis began.

Wages Rise for Lower-Income Workers Amid New Demands, Tight Labor Market

A wage revolution may be underway. Lower-income workers have greater bargaining power than before the pandemic, according to economists interpreting new data. Employers are facing an unusually tight labor market and struggling to fill a record-high number of open positions. Companies are offering more pay to lure people, while prospective employees are demanding higher wages to get back to work.

The reservation wage — the minimum required for a worker to take a new job — jumped 21% from November 2020 to March 2021 for workers making $60,000 or less per year, according to the Federal Reserve Bank of New York's latest survey of consumer expectations released on May 10. Meanwhile, the reservation wage for workers making more than $60,000 fell by 7% over the same time.

Inflation Pressure

Tighter U.S. Labor Market Required for Inflation to Outstrip Fed's Goal

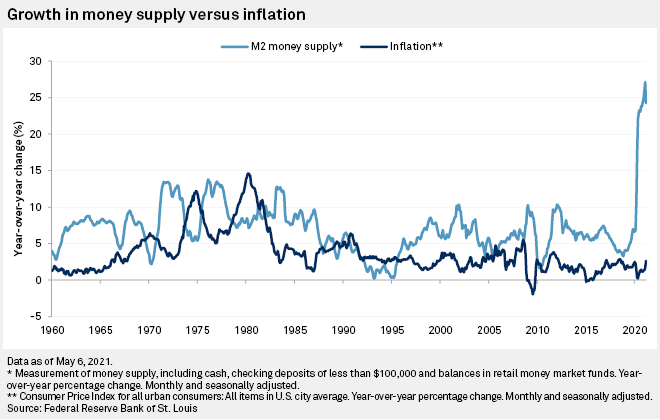

Inflation is on track to rise to levels not seen in 14 years and the Federal Reserve is betting heavily that the stay at these heights will be brief. But if this substantial jump is not temporary, or "transitory" as Fed Chairman Jerome Powell has frequently said, the consequences could be dire for the domestic economy's post-pandemic rebound, analysts said.

The Fed has signaled it will not deviate from its loose monetary policy until its employment and inflation goals have been met, objectives Powell has not defined in order to give the central bank flexibility going forward. Employment, which still lags its pre-pandemic level, needs to see multiple months of million-job growth before Fed officials earnestly begin discussions of tapering bond purchase, analysts said..

U.S. Recovery Could be Upended if Fed's Bet on 'Transitory' Inflation Proves Wrong

Inflation is on track to rise to levels not seen in 14 years and the Federal Reserve is betting heavily that the stay at these heights will be brief.

But if this substantial jump is not temporary, or "transitory" as Fed Chairman Jerome Powell has frequently said, the consequences could be dire for the domestic economy's post-pandemic rebound, analysts said.

If rising inflation has staying power, bond and equity markets could be upended, consumer spending may collapse and, as the U.S. slips further into a recession, the Fed might be forced to end $120 billion in monthly bond purchases and hike interest rates far earlier than anyone expected.

Read the Full Article

Return to the Office

Reimagining the Workplace: Adapting to a New Normal

What is the office for? In the wake of the global coronavirus pandemic, corporations have begun to question their real estate footprint. At the same time, few issues are more immediately polarizing for employees. Some emphasize the benefits of collaboration and proximity in the office, while others are reluctant to return to lengthy commutes when remote work has been a time of increased productivity for many white collar workers. Corporations and employees alike are calling into question the office’s necessity as a space for collaboration and advancement. Businesses are realizing the extent to which they can achieve their commercial goals while employees work remotely. But what are these companies and employees missing in the absence of propinquity?

Key Takeaways

- Historically, the office has been a space where people can conduct work-related tasks, interact, ideate and collaborate to develop their careers.

- By using the frequency of online communication between co-workers as a proxy for collaboration, S&P Global’s data science team developed a hybrid office/remote model that allows employees to safely return to the office by minimizing office occupancy rate while maximizing collaboration opportunities and in-person interactions.

- This model achieves an approximate 50% improvement on 3 days in-person interaction compared to random scheduling when at the office and offers 80% of the critical in-person interactions throughout the week compared to the pre-COVID era’s office-only model.