Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTEREconomic Recovery

Economic Research: Labor Force Exit Has The U.S. Economy In A Bind

As the U.S. economic recovery stabilizes, supply constraints seem to be the major hurdle to achieving higher growth. Finding U.S. workers will likely remain tough in 2022, weighing on productivity and economic growth. And those workers will cost more.

Our 2021 GDP growth forecast will likely shrink by another 20 basis points to 5.5%--still a 37-year high--after a 1.0 percentage point drop to 5.7% in September. Growth in 2022 will also slip, to 3.9% (was 4.1% in September).

At least 3 million people have exited the labor force since February 2020, according to the Bureau of Labor Statistics (other estimates show an even larger drop in labor participation). That's twice the number of unemployed workers, or almost two-thirds the 4.5 million people not working since February 2020 (see chart 1). The labor participation rate is 61.6%, a 45-year low, 1.7 percentage points below the already low February 2020 rate of 63.3%, and not much better than the 48-year low of 60.2% during the pandemic.

Prime-age workers, ages 25-54, account for 45% of the 3 million people who exited the labor force. Women account for 68% of that 1.4 million. Child care concerns and virus fears for their unvaccinated children under 5 are likely the main factors keeping them out of the job market. The return of prime-wage workers is key to stabilizing the job market. We expect that many of these workers could decide to reenter the workforce, but not until pandemic-related issues are resolved. Retirees account for a smaller share of the 3 million people who exited the labor force since February 2020, though their relative participation rate has dropped a massive 8.1%, over 5x that of prime-age workers.

These enormous job market constraints are crippling business capacity, resulting in much lower economic activity than would be the case if business operations were running smoothly.

We've found that labor supply constraints are largely the result of people exiting the labor force, rather than deciding to remain unemployed and receiving unemployment benefits. How quickly states reopened their economies, not when unemployment benefits expired, largely explained whether people remained unemployed, since most found work once businesses opened their doors. When adjusting the current 4.6% unemployment rate for all the people who left the labor force since February 2020, the adjusted rate is 6.4%, 1.8 percentage points above the headline rate.

How Long Will This Last?

The bigger question is whether the 3 million who left the workforce entirely since the pandemic will return. That depends on how much of the drop is structural and how much is temporary. We estimate that about 42% of the 3 million people who left the workforce since February 2020 are permanent, largely tied to retirement, while 58% are shorter-term, pandemic-specific decisions to leave the market.

Economic Outlook U.S. Q4 2021: The Rocket Is Leveling Off

Supply disruptions remain the leading suspect slowing the world's biggest economy, and the delta variant is now an additional drag.

READ THE FULL REPORTEconomic Outlook Asia-Pacific Q4 2021: Growth Slows On COVID-19 And Rising China Uncertainty

The pace of activity is slowing as the delta variant of the coronavirus has imparted a negative impulse to growth; shutdowns are crimping mobility and spending, reducing production and confidence.

Read the Full ReportEconomic Outlook EMEA Emerging Markets Q4 2021: Higher Inflation Persists Amid A Stronger Rebound

In EMEA, emerging economies have surprised again with stronger-than-expected growth numbers, primarily stemming from higher consumption and exports.

Read the Full ReportEconomic Outlook Europe Q4 2021: A Faster-Than-Expected Liftoff

The rebound of the European economy since restrictions were lifted in March/April has been surprisingly strong, both in terms of GDP and employment, leading S&P Global Ratings to raise their growth forecasts for 2021 to 5.1%, from 4.4% in our previous forecast.

Read the Full ReportEconomic Outlook U.K. Q4 2021: Recovery Still On Track

Despite a "pingdemic"-related pause in July, the U.K. economic recovery remains on track. We forecast GDP growth of 6.9% this year and 5.2% in 2022.

Read the Full ReportEconomic Outlook Emerging Markets Q4 2021: Vaccination Progress And Policy Decisions Remain Key To Growth

Emerging markets (EMs) economies are benefiting from a stronger-than-expected first half, accelerating vaccination rollouts, and lower tolerance for renewed restrictions on economic activity.

Read the Full ReportEconomic Outlook Latin America Q4 2021: Settling Into The New Post-Pandemic Normal Of Slow Growth

Latin American economies performed better than expected during the second quarter. The services sectors in the region were more resilient to the COVID-19 delta variant than S&P Global Ratings envisioned.

Read the Full Report

Credit Conditions

Credit Conditions North America Q4 2021: Risks Rise As Recovery Hits A Snag

While credit conditions in the U.S. and Canada remain remarkably favorable for most borrowers S&P Global Ratings rates, several factors have increased the chance that investors will soon seek higher returns—which would lead to an increased cost of capital, particularly for riskier credits. Complicating the matter is a fourth wave of the coronavirus pandemic that has torn through the region and will likely act as a drag on GDP growth through year-end.

In the U.S., inflation continues to run hot, to the degree that real (inflation-adjusted) yields on all corporate bonds have plunged into negative territory for the past several months. Even corporate debt in the ‘B’ ratings category has had negative real yields since June.

Meanwhile, companies are struggling with inflated input costs, as supply constraints persist and unforeseen labor shortages take a toll. This may eat into profit margins, especially for those that find it hard to pass along these costs to customers. This pass-through may become more difficult as the coronavirus delta variant and the end of federal fiscal stimulus (along with the prospect that the Federal Reserve will soon taper its asset purchases) weigh on economic activity and demand.

Beyond inflation, other concerns could push investors into “risk-off” positions—not the least of which are the looming U.S. debt-ceiling crisis and the potential default of property developer China Evergrande Group (CC/Negative/—). While we believe legislators in Washington will work out a compromise to avoid the country’s defaulting on certain payments, authorities in Beijing may face a tougher task.

Credit Conditions: North America: As Recovery Rolls On, Inflation Risks Remain

Credit conditions remain largely favorable, although risks are looming—primarily those around inflation pressures and supply disruptions (including labor shortages) that many borrowers face.

Read the Full ReportCredit Conditions: Europe: Reining In As Full Recovery Nears

Strong demand and falling unemployment create a fundamentally positive outlook for credit in 2022, although cost pressures, monetary policy tightening, and Europe’s fourth COVID-19 wave, now compounded by omicron, are headwinds to monitor.

READ THE FULL REPORTCredit Conditions: Asia-Pacific: China Slows, A Chill Wind Blows

COVID-19 trends and policy responses, contagion risk from Chinese property woes, and rising inflation expectations have introduced regional uncertainty.

READ THE FULL REPORTCredit Conditions: Emerging Markets: Inflation, The Unwelcome Guest

Risks are increasing for emerging markets (EMs) as inflation keeps accelerating in many key countries, adding to existing challenges.

READ THE FULL REPORT

Market Dynamics

European Retailers And Consumer Product Companies Will Show Resilience Against Rising Costs

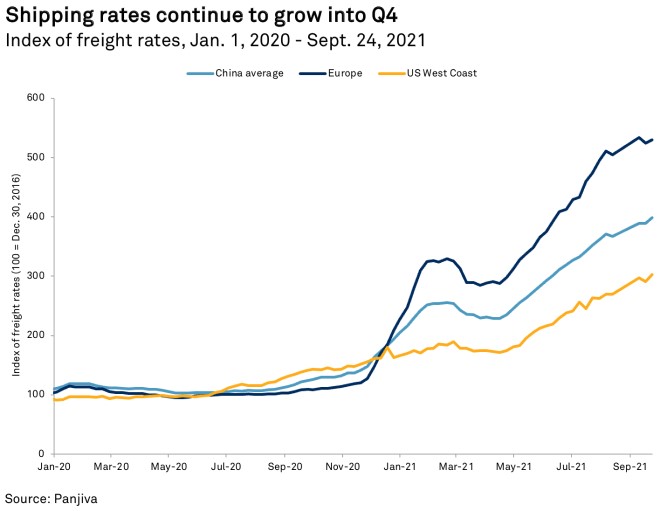

The strong economic rebound in Europe has created several pressures on retail and consumer goods companies. They face higher wages, price rises, shortages of raw materials, and increased costs for freight, packaging, logistics, and energy. While we do expect some squeeze on margins for the sector as a whole, most market leaders and large companies will be able to benefit from higher demand and offset higher input costs from a combination of internal cost-saving measures and selective price rises. A diverse supplier base, bigger order capacity, and superior supply chains and logistics will enable larger companies to gain more competitive advantage based on better product range and availability.

At the other end of the spectrum, highly leveraged companies with weak business risk profiles (35% of rated consumer product companies and 22% of rated retailers) typically have less bargaining power with respect to suppliers and services such as freight. While some regional players holding niche product leadership positions or those with an efficient local supply chains and low overheads will be less impacted, many smaller companies remain vulnerable to significant volatility in operating performance, strong competition, and tough execution amid persistent cost inflation. Many of these companies, still early in the process of recovery from pandemic-related shocks, will struggle to provide a customer experience that can compete with the reach, range, speed, and efficiency of larger players' well-developed global diversified supply chain capability. For these retail and consumer product companies, supply chain and logistical challenges and persistent inflationary headwinds, which we expect will continue into the second half of 2022, will result in margin pressure, slower deleveraging, and lower rating headroom.

Global Debt Leverage: Has Soaring Debt Sown The Seeds Of Crisis?

An immediate crisis stemming from the COVID-induced debt surge is unlikely, but inflation and the prospect of rapidly rising interest rates could weigh on credit quality.

READ THE FULL REPORTU.S. Jobs: Will The "Big Quit" Transform The Labor Market?

Labor constraints—partly structural—are likely to limit growth, add inflationary pressures, and expediate a tighter monetary policy.

READ THE FULL REPORTWeakening U.S. Economy Threatens Swelling Corporate Debt Mountain

Slowing U.S. economic growth and an expected rise in borrowing costs could leave American companies vulnerable after they gorged on debt during the pandemic.

READ THE FULL ARTICLEThe Decline of the Index Effect

The growth of passive investing has spurred suggestions that stock returns may be influenced by a so-called “index effect,” as trading by index funds responds to changes in index membership.

Read the Full ArticleEconomic Research: Credit Markets Update Asia-Pacific Q4 2021

Asia-Pacific speculative-grade spreads widened significantly in July. August saw spreads partially reversed some of that increase for high-yield spreads, followed by another spike in September after the Evergrande liquidity shock.

READ THE FULL REPORTEconomic Research: North America Credit Markets Update Q4 2021

The U.S. economic recovery has hit a snag as supply disruptions slow activity, and the fourth wave of COVID-19 acts as an additional drag. We now expect full-year U.S. GDP growth of 5.7%.

Read the Full ReportSome U.S. Consumer Products Companies Could Fail The Inflation Stress Test

Supply chain constraints, labor shortages, the delta variant, and rising commodity prices are clouding the outlook for the U.S. consumer products industry road to recovery.

Read the Full ReportTop 100 Banks: Capital Ratios Show Resilience To The Pandemic

S&P Global Ratings expects risk-adjusted capital (RAC) ratios for the top 100 banks to remain resilient in the next two years, with some variation across countries.

Read the Full Report

Supply Chain Disruptions

Q4'21 Outlook: The Logistics of Seasonal Cheer

The fourth quarter of 2021 will likely look different than the holiday seasons in previous years. This is largely due to the ongoing high-water mark of imports flowing into the U.S. since March. Total imports in March were the highest recorded, an unlikely time for volumes that normally peak in October. The levels reached in March, May and August of just over 3 million twenty-foot equivalent units, combined with freight rates and traffic outside of Los Angeles and Long Beach, Calif., suggest that imports are near their maximum monthly capacity. This is greater than the 2.9 million TEUs recorded in the 2020 peak last October but any company that has not adapted may get stuck in congestion.

Labor And Supply Chain Woes Chill Retail Spirits For Holidays And Beyond

An ongoing merchandise supply-and-demand imbalance and labor shortages will pressure retailers' performance and profitability well into 2022. COVID-19 variants create additional uncertainty for the industry.

Read the Full ReportU.S. New Vehicle Prices Surge Amid Global Chip shortage with No End in Sight

On Sept. 14, the U.S. Labor Department reported that new vehicle prices in August climbed 7.6% from 12 months earlier, the largest annual percentage increase in more than 40 years. New vehicle prices have climbed an average of 3.4% each month from December 2020 through August 2021 and have not declined on a year-on-year basis since June 2020, the data shows.

Read the Full ReportEnergy and Commodities

Time for Europe and the IEA to Create a Strategic Gas Reserve

Record gas prices have sparked panic in Europe and left policymakers scrambling for answers. Solutions—like bailing out power suppliers, protecting vulnerable retail consumers with state subsidies, or pleading with Russia for more gas—just paper over the cracks. Building strategic gas reserves is a better long-term fix for price stability.

New Oil Price Spikes Possible in October Before Return Toward $70/b: Platts Analytics

Gas-to-oil switching and improving demand in Asia amid tighter inventories could boost crude prices, currently at a three-year high, through October, before increased supply from the OPEC+ producer grouping and elsewhere limits upside, S&P Global Platts Analytics said in a recent report.

READ THE FULL ARTICLEFuel for Thought: Spare Capacity in Focus as OPEC+ Output Hikes Coincide with Rising Oil Security Risks

Spare capacity is the oil sector's ultimate shock absorber. These buffers shot up to COVID-19-induced 35-year highs but are now rapidly reducing. A rising trend of security incidents in the Middle East, a tentative demand recovery and OPEC+ pumping more could see oil risk premium back on the market's radar.

READ THE FULL ARTICLEIn Waiting for the Right Price, India Now Faces a Coal Crisis

India's coal stocks have hit dangerously low levels, and alarm bells are going off in the country's power sector.

READ THE FULL ARTICLE

ESG

Corporate Physical Assets Increasingly in Harm’s Way as Climate Change Intensifies

Vital corporate assets around the world, including factories, transportation networks and power transmission lines, are increasingly in harm’s way as the planet endures a growing number of catastrophic weather events linked to climate change, according to a new analysis by S&P Global Sustainable1.

In a comparison of industries, physical assets owned by the utilities, materials, energy, consumer staples and health care sectors face the greatest danger from the consequences of a warming world between now and 2050, according to S&P Global Trucost data.

Decarbonization Efforts Are Shaking Up Global Energy Markets

Major support policies for rapid decarbonization--such as "Fit For 55" in Europe and a potential $3.5 trillion U.S. clean energy framework proposed by President Biden–represent a significant investment opportunity for electric utilities.

Read the Full ReportUtilities Face Greatest Threat as Climate Risks Intensify

Climate change is pushing power, gas and water companies to the frontlines of an intensifying battle against natural disasters that is set to increasingly hit the profits of businesses around the world.

Read the Full ArticleFuel for Thought: COP26 Climate Push Puts Middle East Oil and Gas Heavyweights on Edge

In the run-up to the UN's COP26 climate summit, Middle East oil and gas producers are going on the offensive.

Read the Full Article