Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERRise of Renewables

Europe's Renewable Energy Ambitions Lift Wind Turbine Makers' Prospects

Europe-based wind turbine original equipment manufacturers (OEMs) are set to capture growth from a surge in offshore energy projects as the EU steps up efforts to become climate neutral by 2050.

With their own ESG targets to cater for, wind turbine producers will need to balance costs and profitability against sustainability, while meeting demand for ever larger cost-competitive products.

Recent pandemic-led supply chain disruptions highlight the importance of OEMs having sufficient resources to manage existing pipelines and support future growth.

Europe has established itself as a seat of offshore technology on the back of advanced know-how, supportive policies, and governments' targets. The continent's push to cut greenhouse gas emissions to 55% below 1990 levels by 2030, and become climate neutral by 2050, implies a huge increase in renewable energy sources. The EU's November 2020 Strategy on Offshore Renewable Energy proposes that offshore wind capacity should reach at least 60 gigawatts (GW) by 2030 (including 1 GW of ocean energy) versus 25 GW at year-end 2020, and 300 GW by 2050 with ocean energy capacity at 40 GW.

Greece Transitions Power Market to Lure Renewables Investors

The Greek renewable energy market is set for a wave of new development and investment, as high power prices and generous subsidies lure international players.

Read the Full ArticleForeign Investors Flock to Spain's Booming Renewables Market

Spain has become the hottest ticket in town for international investors in renewable energy, with the government's green policies and a favorable power market helping to spark overseas interest.

Read the Full ArticleAn Offshore Wind Heavyweight, U.K. Squares Up to 'Tough' 40-GW Target

Having pioneered offshore wind for more than two decades, installing more than 10 GW in its waters to date, the U.K. now finds itself at a pivotal moment as it shoots audaciously for an almost fourfold increase in capacity by 2030.

Read the Full ArticleEuropean Offshore Wind Will Continue To Lead Global Growth

Offshore wind will likely remain a European story for the decade to come, and one where large utility companies will likely continue to dominate.

Read the Full ArticleEnergy Transition

The Energy Transition And What It Means For European Power Prices And Producers

European power prices showed a stronger-than-anticipated rebound in 2021. This follows a drop of more than 20% drop in 2020 amid COVID-19 lockdowns and weaker economy; the improvement stemmed mainly from a surge in gas prices and to a lesser extent carbon prices, which reach a record high of close to €60 per ton.

We think power prices will continue to increase in 2022-2023, as supply tightens. Europe's more ambitious environmental targets will accelerate closures of thermal and nuclear baseload generation, which renewables cannot fully replace over the coming three years, leading to greater weather-related price volatility in the interim.

European power companies will generally benefit from this high price environment. This is because their generation portfolios are almost fully hedged this year, after which they will benefit from higher prices, thereby supporting investments in the energy transition. This is also positive for the development of a European power purchase agreement (PPA) market for renewables, due to more favorable strike prices and good margins, albeit increasing pressure on power suppliers with short generation portfolios.

Europe's Biggest Coal Plant to Shut Down by 2036

Polish authorities plan to shut down Europe's largest and most polluting coal-fired power station, the roughly 5,000-MW Bełchatów Power Plant, by 2036 as part of a plan designed to ensure the region around the coal plant and its associated lignite mines can get access to EU funds to finance the transition out of fossil fuels.

Read the Full ArticleU.K. Regulator Calls on IEA to Draw Up Global Transition 'Deal' for Oil and Gas

The International Energy Agency should help draw up a transition "deal" with the oil and gas industry globally—of the kind adopted in the U.K.—which could become the focus of global climate talks subsequent to this year's COP26, the head of the U.K.'s Oil & Gas Authority said Sept. 9.

Read the Full ArticleNorway Committed to Long-term Oil, Gas Despite Climate Crisis

Norway, Western Europe's largest oil and gas producer, remains politically committed to supporting its petroleum industry despite rising global pressures to halt oil and gas activity due to global warming, the country's deputy energy minister, Tony Christian Tiller, has said in an interview.

Read the Full ArticleLow carbon hydrogen is poised to play a key role in hard-to-abate energy applications. For global hydrogen markets to emerge, however, massive scale up is needed across production pathways using both renewable and fossil-based feedstocks, and transport costs need to come down.

ACCESS THE TOPIC PAGEHydrogen Economy

How Snam's CEO Wants to Turn a Major Pipeline Company Into a Hydrogen Powerhouse

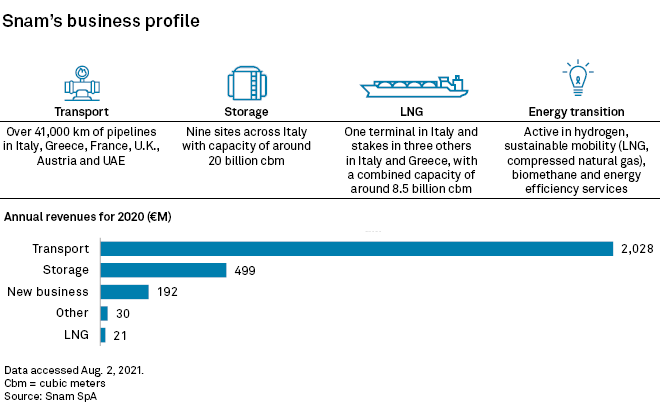

Since becoming CEO of Snam SpA in early 2016, Marco Alverà has turned one of the world's largest natural gas companies into a trailblazer in the burgeoning hydrogen economy.

The Italian utility, which operates pipelines across Europe, is now spending half its four-year, €7.4 billion investment budget on getting its infrastructure ready for hydrogen, the "new oil" that has emerged as a key tool in reaching global net-zero emissions.

Alverà, meanwhile, is about to publish his second book about hydrogen in just two years, showing how the fuel's meteoric rise has surprised even its most ardent advocates.

"I joined Snam with a vision of using [the company] to become a global leader in green molecules," the CEO said in a video interview this month. "I didn't know at the time how quickly hydrogen was going to hit the road."

The former investment banker, who previously worked at utility Enel SpA and oil and gas major Eni SpA, now spends most of his time on initiatives related to Snam's net-zero goal for 2040. That includes replacing and upgrading its 41,000-kilometer network of pipelines for the hydrogen era, piloting decarbonization projects with industries from steel to glass and working with other utilities on a pan-European effort to link up infrastructure that critics of fossil fuels have long derided as a stranded asset.

"There are few CEOs of gas infrastructure companies that have led the debate on hydrogen like Marco has at Snam," Graham Cooley, CEO of ITM Power PLC, a U.K.-based maker of hydrogen electrolyzers, said in an interview. "They're a great example for the gas industry and indeed for the whole oil and gas sector."

Snam invested €33 million in ITM in October 2020, an early example of a wider trend of utilities backing providers of hydrogen technology. A month later, the company spent about €400 million to acquire one-third of Industrie De Nora SpA, a family-owned Italian company that also makes components for hydrogen production.

’

At Dawn of Clean Hydrogen Era, Industrial Gas Giants See New Horizons

Having churned out hydrogen supplies for decades, the big three industrial gas giants now find themselves center stage in the emerging low-carbon hydrogen economy.

Read the Full ArticleAvoid Blue Hydrogen, Go All-in on Green, Advisory Council Urges Germany

Germany's hydrogen strategy should center around "green" hydrogen, made using renewable power, and avoid investments in hydrogen made with fossil fuels, including "blue" hydrogen deriving from natural gas with carbon capture, a government advisory council recommended June 23.

Read the Full ArticleRussia Bets on Hydrogen Future as Pressure for Cleaner Fuel Mounts

Russia has embraced the current uncertainty over hydrogen demand and commercial viability, hoping to transform the sector in the coming years with the help of western partners as pressure from importers for cleaner fuel intensifies.

Read the Full ArticleBankers Eye Europe's Renewable Hydrogen Opportunity with Caution

Project finance banks are eyeing Europe's emerging renewable hydrogen opportunity with caution, even if ambitious deployment targets indicate private-sector financing needs of Eur430 billion ($508 billion) by 2030.

Read the Full ArticleHydrogen Fever in EU Puts 2024 Target of 6-GW Electrolyzer Capacity in Reach

European electrolyzer project proposals are not far off the EU's target of 6 GW of capacity by 2024, which would be able to produce up to 1 million mt/year of renewable hydrogen, according to data from S&P Global Platts Analytics.

Read the Full ArticleThe COVID-19 pandemic has altered the global energy sector’s shift from fossil-based systems of energy production and consumption—including oil, natural gas, and coal—to renewable energy sources like wind and solar, as well as lithium-ion batteries.

ACCESS THE TOPIC PAGEClimate Policy

Climate Risk Vulnerability: Europe's Regulators Turn Up The Heat On Financial Institutions

Europe's recent regulatory climate stress tests aim to reveal the vulnerabilities for the banking sector. Beyond some limitations, not least in data quality, S&P Global Ratings sees them as a valuable way to start to gauge environmental and climate-related risk exposure. They should also indicate whether the institutional framework can be effective in addressing systemwide risks. We have been increasingly incorporating environmental considerations and data into our credit rating analyses. As testing becomes more sophisticated over time, it should suggest whether banks' management teams need to adjust risk appetites, develop tools to better monitor and manage climate-related risks, and even consider changes to their business models.

Increasingly brutal and frequent extreme weather events that have lashed Europe in recent years mean policymakers need no reminder of the potential severe macroeconomic and social implications of climate change. While eyes are focused on what may emerge from the United Nations Climate Change Conference (COP 26) in the fourth quarter, in July the European Commission released its "Fit for 55" legislative proposal to underpin the EU's commitment to comprehensively address climate change. It targets a reduction in net greenhouse gas emissions by at least 55% by 2030, in line with a broader ambition to become the world's first climate-neutral continent by 2050.

Catalyzed by a strong political consensus, a mandate to ensure financial stability, and increased investor interest, European regulatory authorities have accelerated their efforts to identify climate-related risks (namely, physical and transition risks) and to assess the financial sector's exposure to these risks. The translation of climate-related risks into quantifiable financial risk has been one key output from this work.

Supervisors' climate stress tests were able to identify the main sectors and geographies generating transition and physical risks for banks' assets and sought to quantify their exposure to these risks. As such, they provide a forward-looking view on how different climate scenarios could affect banks' assets. Supervisors are not yet penalizing banks with higher capital requirements for such long-range risks, but they are ratcheting up the pressure on bank management to proactively tackle these risks.

Proposed EU Standard Seeks to Bring Clarity to Ballooning Green Bond Market

A proposed EU Green Bond Standard seeks to cement Europe's leadership in the green debt market by creating a go-to European standard, but it may find limited appeal among international issuers unable to comply with the bloc's strict new rules defining what is "green."

Read the Full ArticleEC Proposes 40% Renewables Share in Final Energy Demand by 2030

The European Commission has proposed a target of at least 40% for renewables in the bloc's final energy demand by 2030 in a revised Renewable Energy Directive (RED), Energy Commissioner Kadri Simson said July 14 in a Brussels press briefing.

Read the Full ArticleEC Unveils Broad Roadmap for Cutting Greenhouse Gas Emissions by 55% by 2030

The European Commission on July 14 unveiled one of its most ambitious packages of legislative proposals ever, publishing plans for new legislation across numerous sectors designed to achieve its target of a 55% cut in greenhouse gas emissions by 2030.

Read the Full ArticleTough Road Ahead for EC's Decarbonization Plans: Platts Analytics

Europe faces a tough challenge in meeting its revised 2030 target to cut greenhouse gas emissions by at least 55% below 1990 levels, S&P Global Platts Analytics warned in a report July 14.

Read the Full ArticleEU Unveils Major Climate Plan, Says Fossil Fuel Economy 'Has Reached Its Limits'

EU officials outlined a vast slate of policy proposals to reach the bloc's climate targets, becoming the first major economy in the world to set out a detailed roadmap for how to reach net-zero emissions.

Read the Full ArticleGlobal sustainability policies are evolving rapidly. In the European Union, ESG regulations like the green taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) are changing the way companies do business.

READ THE REPORTMarket Dynamics

Global Green Bond Sales May Set Record in 2021 on Europe's Sustainability Push

Global green bond sales are expected to recover and may set a new record this year led by Europe, which on July 14 announced an ambitious plan to reduce its net greenhouse gas emissions by at least 55% over 1990 levels within this decade.

'Plain Wrong': Wind Industry Pushes Back Against Spanish CO2 Clawback Law

Europe's wind power industry has pushed back against a planned Spanish law aimed at clawing back profits made by zero-carbon assets built before the creation of the EU Emissions Trading System, Europe's carbon market.

The law, proposed June 1 and under consultation until June 10, will apply to hydro, nuclear and wind plants built prior to 2005. Lawmakers argue these plants have benefited unduly from higher power prices, which have risen in Spain and across Europe more generally in part because of spiking carbon prices.

Renewables Industry Searches for Answers to Labor Crunch, Gender Imbalance

The race in Europe to rapidly ramp up renewables capacity could soon lead to a labor crunch with roles in engineering and project management becoming harder to fill.

Read the Full Article