Subscribe to start every business day after the break with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERGlobal

Global Credit Conditions Q3 2021: Reopening, Reflation, Reset

Credit trends are improving rapidly, albeit with significant differences across regions and sectors. The primary positive drivers remain intact: rebounding economies, vaccination progress, plentiful liquidity, and a strong appetite for risk even at the weakest end of the credit spectrum. S&P Global Ratings has revised their 2021 global GDP growth forecast up to 5.9% and see upside risks. Crucially, the U.S. and China—which account for almost 40% of the global economy—are both growing rapidly.

S&P Global Ratings expects China’s GDP to grow 8.3% this year, and for the U.S. economy to expand 6.7%, in the biggest jump since 1984. A rapid vaccine rollout in the U.S. has made for a rapid easing of social restrictions, allowing social and economic activity to normalize and reinforcing massive government stimulus programs. Emerging markets, however, remain a concern given that it could take another year to achieve widespread vaccination in those countries. Vaccine-resistant variants remain the primary risk to global normalization, given their potential to undermine even the most successful rollouts and potentially force the reimposition of restrictions.

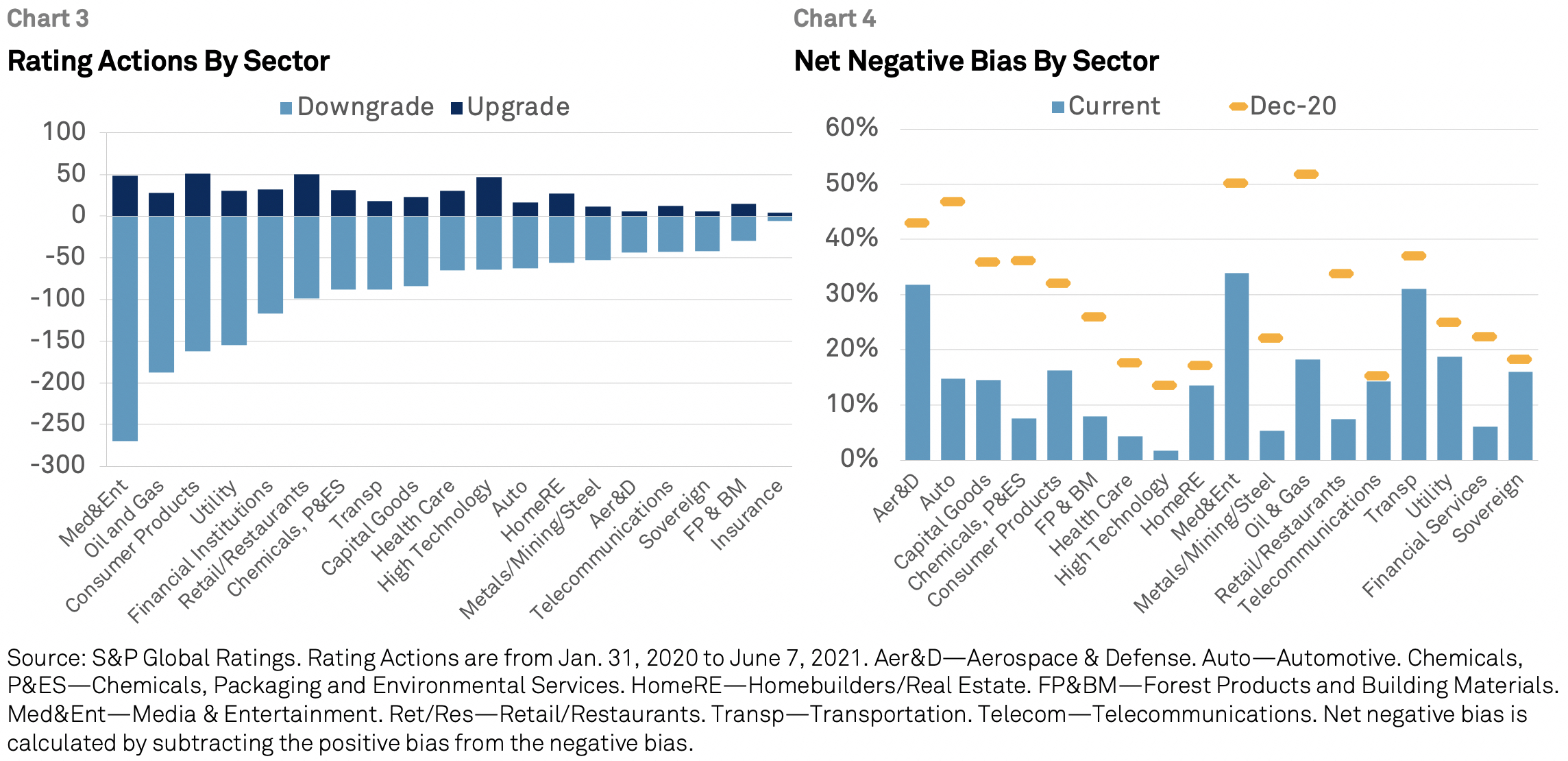

Reflecting these positive factors, there have been three times as many upgrades as downgrades this year (see chart 1). That said, these upgrades remain a fraction of the total 2020 downgrades triggered by the pandemic and the collapse in oil prices. Companies at the lower end of the scale, in the ‘B’ and ‘CCC’ categories, have accounted for the majority of upgrades (see chart 2). Many of these more vulnerable issuers, which represented the bulk of last year’s downgrades, are benefitting from favorable financing conditions and a better-than-expected economic recovery. Media and entertainment, consumer products, retail and restaurant, and technology are among the sectors that have seen the largest number of upgrades—on the back of the economic rebound, easing of social restrictions, and pick-up in oil prices (see chart 3).

Global Financing Conditions: Bond Issuance Remains Strong Despite An Expected Modest Contraction

With financing conditions still favorable across all asset classes, issuance totals in the second quarter remained robust.

Read the Full ReportIndustry Top Trends 2021: Key Themes

2021 will likely see a sharp rebound in aggregate revenues and cash flows, but this isn’t quite the panacea for credit quality it appears. Beneath the surface, there’s a wide divergence in prospects across and within sectors, right down to individual product mixes.

Read the Full ReportEuropean Corporate Credit Outlook Midyear 2021: Back The Way We Came

The credit outlook is rapidly improving, thanks to powerful policy stimulus, successful vaccine rollouts, rebounding profits, and a deluge of liquidity. Corporate confidence and a focus on growth means a continuing focus on M&A and a boom in European capex.

Read the Full ReportAsia-Pacific Corporate And Infrastructure Midyear Outlook 2020

Significant downside risk persists for rated companies in Asia, with negative rating outlooks on nearly 20% of the investment grade portfolio and about 30% of the speculative grade portfolio.

Read the Full ReportLatin America Corporate and Infrastructure Credit MidYear Outlook 2020

The sovereign’s lengthy debt restructuring is increasing risks of default among corporations. The latter face one of the fiercest crises in decades stemming from economic strains in 2019 and 2018, while the government’s delay in reaching an agreement with bondholders has prevented many issuers from refinancing their obligations.

Read the Full Report

EMEA

Trade Credit Arrears May Impact European Firms' COVID-19 Bank Loan Repayments

European companies' ability to repay their COVID-19 loans is at risk as they face delayed payments on invoices, according to market participants.

Companies across Europe saw a sharp increase in the number of suppliers delaying payments over the course of the pandemic, according to trade credit balance data from S&P Global Market Intelligence and CreditSafe. As of April, these delayed payments were still far more commonplace than they were before the COVID-19 crisis.

"Depending on the size of the amount owed by the customer, and the scale of the delay in paying the invoice, late payment could well affect a company's ability to pay their COVID-19 loans back — or pay in full without having to defer payment of another debt," said Colin Haig, president of U.K. insolvency and restructuring industry body R3.

Social Unrest In South Africa Is A Reminder Of Institutional And Structural Constraints To A Fragile Recovery

Acute civil unrest in some parts of South Africa has disrupted the operations of some retailers and supply chains. Although order has been largely restored, with a slow resumption of supply chains, S&P Global Ratings believes the damage to elements of the country's retail and financial infrastructure, economy, and consumer and investor confidence will take longer to repair.

Read the Full ReportIslamic Insurers May Not Sustain Strong Profitability Throughout 2021

Unlike in the corporate sector, where the pandemic led to widespread downgrades in 2020, our credit ratings on Islamic (Takaful) and conventional insurers in the Gulf Cooperative Council (GCC) have remained broadly stable over the past 18 months, supported by relatively strong capital buffers.

Read the Full ReportCoronavirus Coverage In Europe, the Middle East, and Africa, the effects of the second wave of COVID-19 are proving to be more severe than initially expected. The recovery will largely hinge on the ultimate success of vaccine rollouts and easing of lockdown restrictions.

ACCESS THE TOPIC PAGEEmerging Markets

Emerging Markets Monthly Highlights: Faster Vaccination Pace Still Not Sufficient to Beat The Pandemic

S&P Global Ratings has increased their 2021 GDP growth projections for most major emerging markets (EM), as the economic impact of pandemic-related restrictions becomes less severe. GDP data for Q1 is clear evidence of this trend, surprising to the upside in several EMs, mainly due to stronger-than-expected domestic demand, and in many cases, activity in services, even as new daily COVID-19 cases reached new record highs at that time in some countries.

However, the risks to our economic outlook for EMs are skewed to the downside and have risen in recent weeks as a new COVID-19 wave takes hold in several countries, mostly due to the Delta variant. In some EMs, new daily virus cases have reached new highs, prompting some governments to reimpose lockdown measures. Even if the impact of lockdowns on activity has lessened, the on-and-off measures act as a drag on the economic recovery. In the absence of a faster vaccination pace, the exit from the pandemic-related downturn could be delayed for several EMs.

Credit Conditions Emerging Markets Q3 2021: Slow Vaccination Prevents A Robust Recovery

Credit conditions in emerging markets (EMs) continue improving, supported by sustained economic recovery in developed countries and in many cases improving domestic demand as EM economies are able to resume activities.

Read the Full ReportEconomic Outlook Emerging Markets Q3 2021: Despite Rising Resilience, Vaccinations Are The Key To Recovery

Emerging markets (EMs) continue to struggle with managing the pandemic as cases remain stubbornly high and lockdowns continue; however, the economic impact of restrictions has lessened.

Read the Full ReportEMEA Emerging Markets Sovereign Rating Trends Midyear 2021

Seven of the 53 emerging market (EM) sovereigns we rate in EMEA carry negative outlooks, down from 12 at end-2020. No sovereign rating is on positive outlook.

Read the Full ReportThe outlook for the global economy is brightening. As levels of vaccinations and activity vary across regions that need to pull out of the pandemic together, estimates for when the global economy will recover range from Q2 to the end of 2021.

ACCESS THE TOPIC PAGELatin America

Latin America Industries Most and Least Impacted by COVID 19 from a Probability of Default Perspective

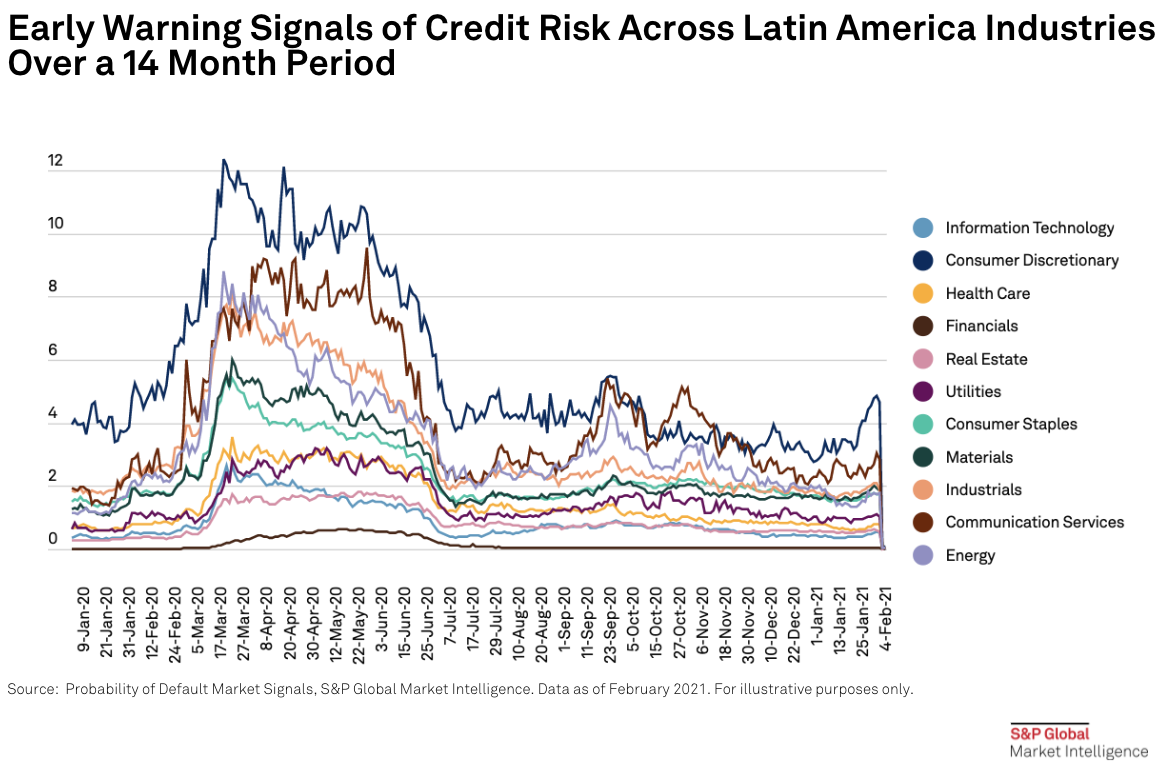

S&P Global Market Intelligence leveraged the PD Model Market Signals (PDMS) for a point-in-time view of credit risk in Latin America.

This model provides early warning signals of potential default. In the corporates space, S&P Global Market Intelligence looked to see which industries were most and least likely to be impacted over the period January 2020 through February 2021. Overall, there was a large spike in the probability of default for the Consumer Discretionary segment during during March-April 2020. This spike was closely followed by the Financials segment, which started to tick up in March before peaking in May 2020. However, probability of default scores dropped across all segments starting around July 2020, and have remained fairly stable since then.

Economic Outlook Latin America Q3 2021: Despite A Stronger 2021, Long-Term Growth Obstacles Abound

S&P Global Ratings has increased their 2021 GDP growth projections for the major economies in Latin America to 5.9% from 4.9%, due to better-than-expected performance of the services sectors so far this year. Households and business are adapting quickly to living in a pandemic, and lockdowns are having much less of an impact on activity than anticipated.

However, S&P Global Ratings has lowered their GDP forecasts for 2022 for most economies in the region, as monetary policy normalization, fiscal tightening, and less predictable policy actions will slow the recovery.

S&P Global Ratings' long-term macroeconomic assumptions are unchanged from last quarter, at roughly 2.5%, due to low levels of investment.

U.S. Real-Time Data: Growth Is Still On Track Despite Rising COVID-19 Cases

Despite the pickup in COVID-19 cases, tied to the delta variant, the pace of U.S. economic activity remains high. Mobility rates and reopening remained robust across most parts of the U.S. as people continued to visit restaurants and take trips.

Read the Full ReportCorporate Credit Risk Macroeconomic Recovery Projections Post-COVID-19

Global markets are approaching new peaks in their economic recovery. In the U.S., continuous government stimulus payments and efficient vaccine roll-outs have further revived both supply and demand for goods and services.

Read the Full ArticleThe divide between companies and industries that benefited from the crisis and suffered from structural shifts will widen as the U.S.’s approach to work and leisure further evolves. In LatAm, the recovery has been uneven across countries and sectors.

ACCESS THE TOPIC PAGENorth America

U.S. Corporate Bond Market Set Near-Record Pace as Fed Tapering Threat Looms

U.S. investment-grade corporate bond sales are on track for a near-record year, as companies look to lock in low-cost funding before the expected easing of Federal Reserve support.

Issuers such as Amazon.com Inc. and Verizon Communications Inc. sold $774.94 billion of bonds in the first half, a total only surpassed by last year's coronavirus debt deluge, according to data from LCD. M&A-related issuance surged 50% over the same period in 2020 to $115.48 billion. LCD has tracked investment-grade issuance since 2009.

Sales may also be comparatively busy in the second half of the year, as borrowers will likely want to raise funds for refinancing and near-record levels of M&A before the Fed starts to step back from bond buying. Treasury yields have already crept up from their 2020 lows as a rebounding economy and waning pandemic weaken the argument for central-bank support.

U.S. Public Finance Mid-Year Outlook: Beyond COVID?

Credit stability has returned for U.S. public finance and S&P Global Ratings expects it to continue for the remainder of the year. Strong economic growth has translated to positive revenue performance for most issuers and the economic outlook for the rest of the year is favorable.

Read the Full ReportU.S. Real-Time Data: Growth Is Still On Track Despite Rising COVID-19 Cases

Despite the pickup in COVID-19 cases, tied to the delta variant, the pace of U.S. economic activity remains high. Mobility rates and reopening remained robust across most parts of the U.S. as people continued to visit restaurants and take trips.

Read the Full ReportCorporate Credit Risk Macroeconomic Recovery Projections Post-COVID-19

Global markets are approaching new peaks in their economic recovery. In the U.S., continuous government stimulus payments and efficient vaccine roll-outs have further revived both supply and demand for goods and services.

Read the Full Article