Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSMarket Dynamics

Recession Fears, Waning Confidence Make For Uneasy Summer In US Metal Market

Summertime is supposed to be when the living is easy. At least that's how the old song goes.

However, with recession concerns swirling, consumer confidence waning and demand softening, this summer has been anything but easy on the US metal market.

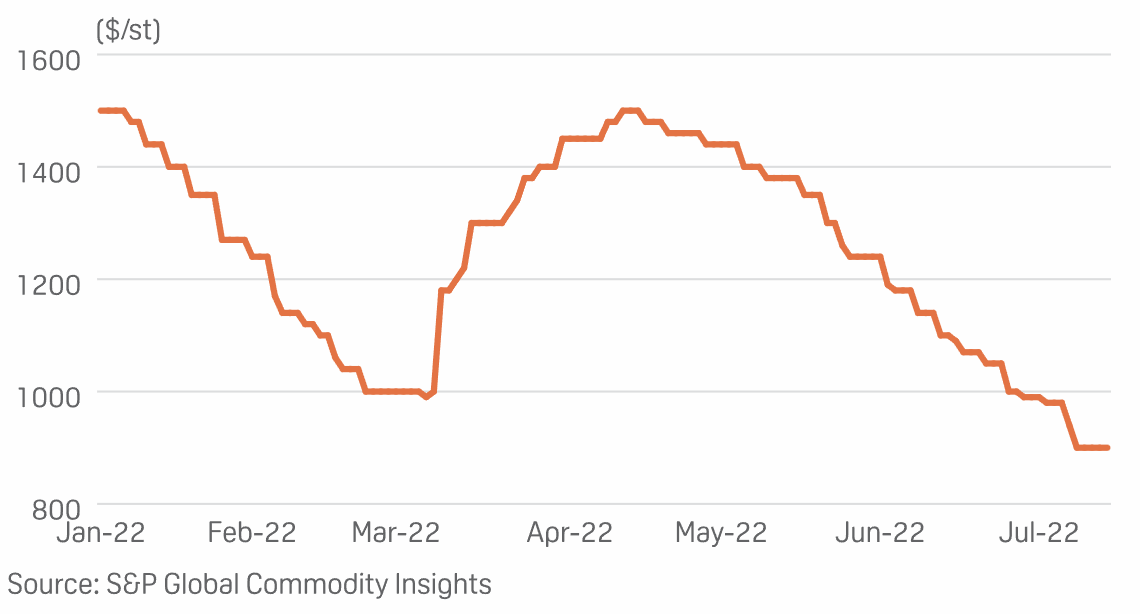

At the same time, prices for a number of headline products – from hot-rolled steel to primary aluminum, ferrous scrap to pig iron – have been in a steady decline following a rapid runup in the early part of the year.

The upturn came just after domestic metals markets appeared to be stabilizing from record price highs in 2021. And the current downturn is yet another example of the continuing challenges of an uneven post-COVID economic recovery.

U.S. Hot-Rolled Coil Down 40% Since April

Q1 2023 Steel Demand, Price Direction Unclear, More Output Cuts Needed: Eurometal

The end of 2022 and the beginning of 2023 look blighted with uncertainty due to high energy costs, inflation and a new green deal, participants at the European steel distributors' association Eurometal Regional Meeting event held in Milan told S&P Global Commodity Insights.

Read the ArticleDeteriorating Prices, Inflation a 'Double Whammy' for North American Steel Market: Stelco CEO

Deteriorating pricing and demand coupled with inflationary pressure on input costs is a "double whammy" for North American flat-rolled steelmakers, making this downturn different from previous troughs, Stelco CEO Alan Kestenbaum said Aug. 11.

Read the ArticleCliffs Expects Automotive Steel Demand Rebound By Year-End: CEO

Cleveland-Cliffs anticipates steel demand from the automotive industry to improve by the end of the year, rebounding from floundering steel consumption in automotive industry since 2020 due to lower vehicle production, CEO Lourenco Goncalves said July 22.

Read the ArticleGreen Steel

Boston Metal Blazing Path For 'Green' Steel Without Scrap, DRI: CEO

Boston Metal has plans to produce steel with low carbon emissions that could fully drive a decarbonized steel industry unlike current "greener" methods, CEO Tadeu Carneiro says.

Liberty Steel Ostrava To Install Hybrid EAFs In Czech Republic In Green Steel Push

Liberty Steel Group, part of the GFG Alliance grouping, said July 8 that it has signed a contract with global plant manufacturer Danieli for delivery of two hybrid electric arc furnaces (EAFs) to the integrated Liberty Ostrava steel mill in the Czech Republic as part of the mill's green steel drive.

Read the ArticleThe Platts Market Data - Metals dataset provides over 2,400 ferrous steel, steel raw materials, and nonferrous metals prices and indicators from all global regions. With this dataset you have access to end-of-day assessments, correlations and third-party data for the latest ferrous and nonferrous price assessments as well as historical data.

ACCESS MOREChina

Why China’s Economic Measures May Not Be Enough To Drive Up Consumer Demand

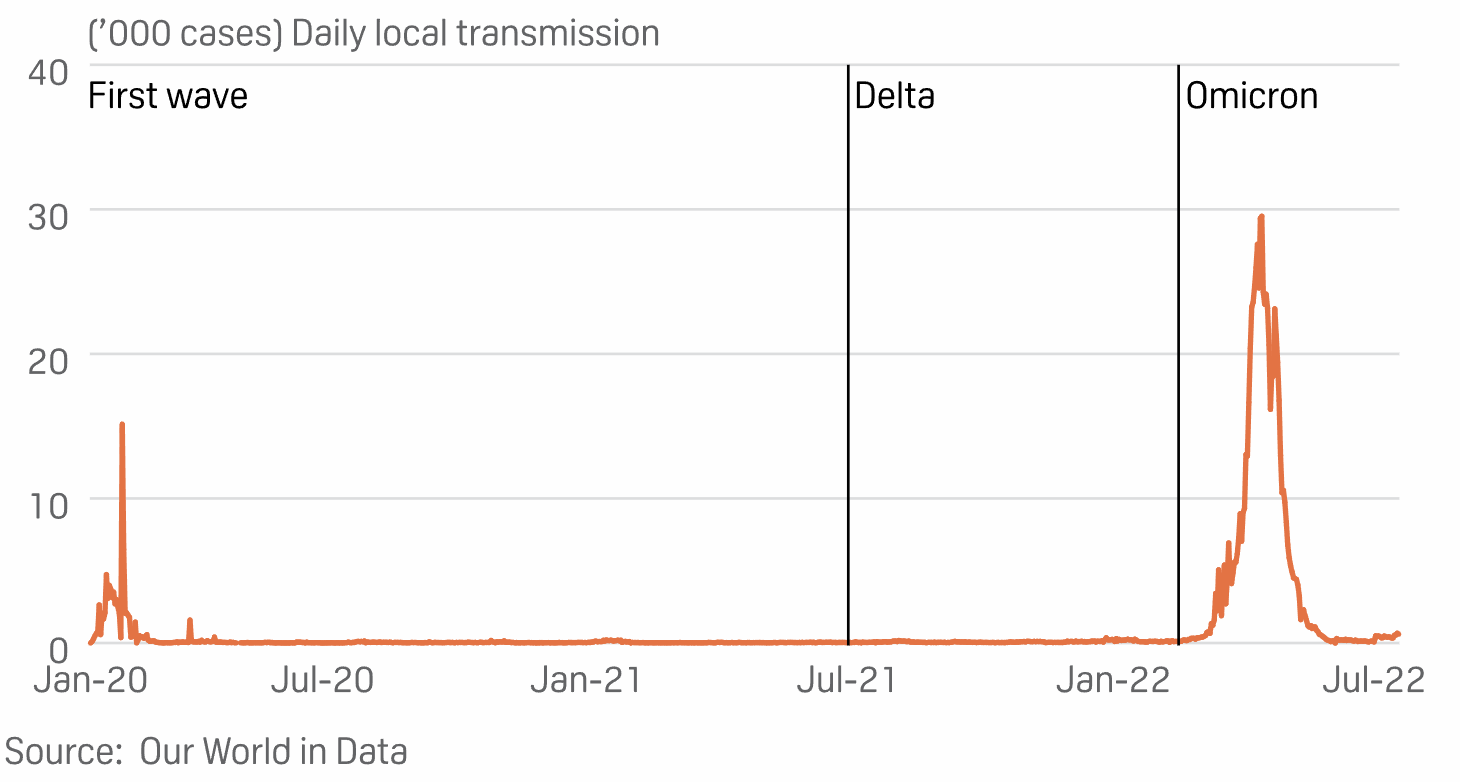

China's economic activity has started to recover from the late-May COVID-19 resurgence, while the government has also been stepping up fiscal and monetary stimuli to support the recovery. However, recovery this year is likely to face a bumpy ride and remain relatively weak compared to the waves in 2020 and 2021, with the spread of the omicron variant proving more difficult to contain.

The slowdown in property sector will only further compound China's economic challenges. Expectations for any steel demand growth for the remainder of 2022 may need to be tempered.

The omicron resurgence lasts longer

China took less than two months to contain the COVID-19 outbreak in 2020 and the delta variant resurgence in 2021. But due to the highly contagious nature of the omicron variant, it took China nearly three months – from early March to early June – to control the coronavirus outbreak in 2022. And this came with a price.

China employs a dynamic zero-COVID policy toward the pandemic, which means certain social restrictions and lockdowns will be repetitively implemented in the foreseeable future to contain new waves of the virus, keeping the rate of economic and steel demand recovery slow.

China’s COVID-19 Cases

China's Manufacturing Steel Demand Rebounds in August, Further Improvement to be Modest

China's manufacturing steel demand rebounded in August and is expected to improve further in September and October on higher seasonal manufacturing activity.

Read the ArticleChina's Distressed Property Sector, Rising Steel Output Offer Bleak Market Outlook

China's property sales continued to trend lower in August, despite more policy easing for home buyers and loan interest rates already below 2009 levels.

Read the ArticleChina's Construction Steel Demand Likely to Remain Low for Rest of 2022

China's domestic demand for construction steel is likely to remain low for the rest of 2022, market participants told S&P Global Commodity Insights, with the key indicator of excavator sales declining for the fourth straight month in July.

Read the ArticleChina Steel Trade To Fall In Coming Months As Weak Demand Outlook Weighs

China's semi-finished steel exports retreated 3.1% on the month to 278,000 mt in June, falling for the first time in three months, the country's customs data showed July 21.

READ THE ARTICLEThe SNL Metals and Mining dataset allows you to explore the in-depth coverage on mining properties and companies, covering a wide array of commodities. Keep track of ongoing sector activities including initial exploration, project developments and commodity production.

ACCESS MOREGlobal Trade

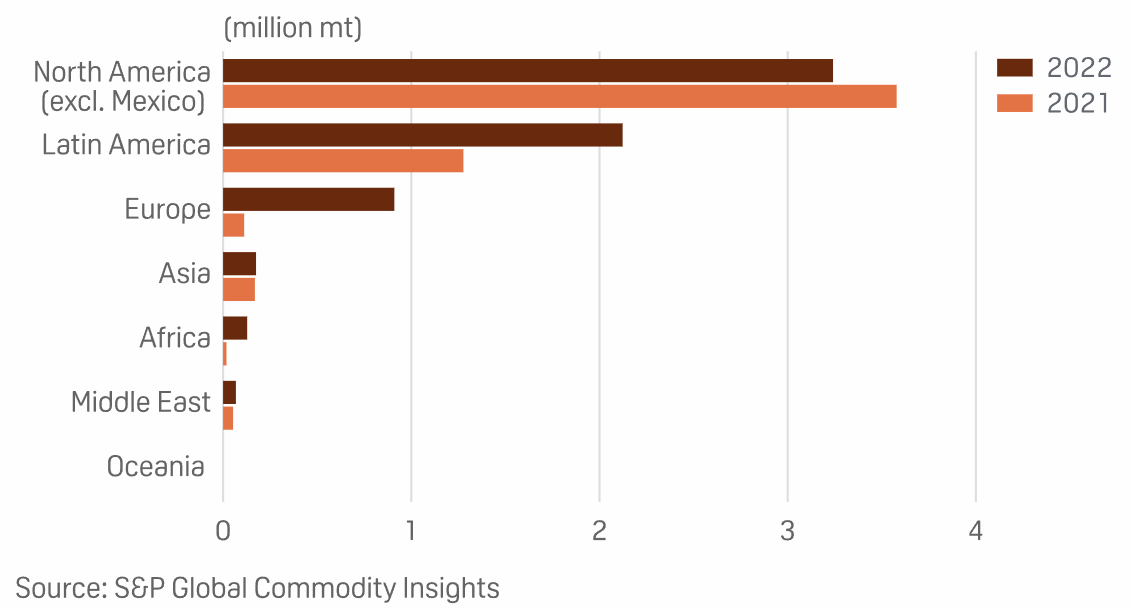

H1 Brazil Steel Exports to Europe Skyrocket 710% on Year Amid War in Ukraine

Exports of Brazilian steel products to Europe jumped 710% in the first half of 2022 to 909,828 mt, compared to 112,221 mt in H1 2021, filling the void left by regional suppliers Russia and Ukraine, according to latest data from national steel association Aço Brasil.

The export volume to Europe represented 13.4% of total Brazilian exports in January-June, compared to 2.2% in the same period of 2021, and was mainly composed of coated and uncoated flat steel products.

The supply restrictions derived from the Russia-Ukraine war also prompted Brazil to increase shipments to neighboring countries in Latin America, totaling at 2.12 million mt in H2, up 66.7% on the year. Shipments to Asia followed, totaling 174,663 mt, up 3.1% on the year, and shipments to Africa totaled 128,101 mt, up 594% on the year.

Brazilian Exports of Steel Products by Region, Jan-June

Geopolitics, Energy Costs, Shifting Trade Flows Put Italian Slab, Flat Steel Imports in Focus

Global geopolitics and economic sanctions have European steel rerollers looking for alternative sources of slab, forcing a persistent and long-term adjustment to trade flows that has decoupled the region from its traditional dependence on CIS area supply.

Read the ArticleEU Steel Consumption Set to Experience Third Recession in Four Years: Eurofer

The EU's steel consumption is likely to see its third recession in the space of only four years in 2022 as a result of quarterly drops that are foreseen over the second, third and fourth quarters, according to an outlook from the European Steel Association, or Eurofer.

Read the ArticleGerman Steel Market Sees Output Staying Low, Higher Prices: survey

German steel producers and traders expect prices to see some upward momentum over August amid low supply, as production levels are expected to drop, according to data from S&P Global Commodity Insights' monthly steel sentiment survey.

Read the ArticleSteel prices are plummeting although still above their long-term average. More declines will come so delay locking as long as possible. Beware steel production cuts if electricity is rationed.

Read MoreAsk an Expert

Have Metal Prices Reached A Melting Point?

Join our metals experts, John Anton and John Mothersole, as they delve into the volatility of metals pricing in the wake of the Russian invasion of Ukraine and with the growing COVID-19 outbreak in China.

These two factors are placing immense stress on steel, copper, and aluminum markets. And while we usually hear a singular global story—this month, regions are telling their own metals pricing tales. What does this mean for buyers, manufacturers, and consumers? How high is too high?

John Anton is the lead steel expert, as a director in the Pricing and Purchasing Service at S&P Global Market Intelligence.

Talk to the Expert