Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSMarket Dynamics

U.S. Equities Market Attributes June 2022

Enter the bear, exit the bull. We decidedly entered a bear market this month, as higher inflation, higher interest rates and a slowing economy pushed the S&P 500 into official bear territory (down 20% from its last closing high, in this case Jan. 3, 2022’s 4,796.56). It reached a closing low of -23.55% (3,666.77, on June 16), then seesawed upward, as buyers went bargain hunting, but with slower trading than when sellers dominated the market.

The S&P 500 closed the month at 3785.38, down 8.39%, and it closed at -16.45% for Q2 (the worst Q2 since 1970’s -18.87%) and -20.58% YTD (the worst start to a year since 1970’s -21.01% ). Last Fourth of July, investors were opening their half-year statements with a 14.41% gain; now it’s a 20.58% decline.

At this point, inflation is being placed squarely as the fall guy for the market declines, as the market’s “expert” historians cite the Fed’s “excess” stimulus programs as the reason for the 40-year high inflation rate, and then the Fed’s attempts to Volker its way out of inflation and avoid a recession, with the market still split on if they can avoid one (but more seeing it than not).

Index Returns

Stagflation Ahead? Understanding the Drivers and Economic Impacts of Higher Inflation

Dealing with high inflation is never simple. With stagflation, it's even more complicated. Stagflation is typically marked by slow economic growth combined with relatively high unemployment and rising prices—think late 1970s and early 1980s.

Read the ArticleGlobal Credit Conditions Q3 2022: Resurfacing Credit Headwinds

Sharp monetary tightening is putting a brake on global growth, with inflation, energy security, and geopolitical uncertainty being the chief risks.

READ THE ARTICLEGlobal Economic Outlook Q3 2022: Rates Shock Puts The Economy On A Slower Path

Six short months ago the macro landscape was markedly different from today. The U.S. and eurozone economies were expected to grow at around twice their potential rates in 2022; emerging markets were closing the gaps.

READ THE ARTICLEGlobal economics provides comprehensive and consistent economic forecasts and analysis to help our clients identify business growth opportunities, measure industry performance, and quantify market risk—for 206 countries.

ACCESS MORECorporates

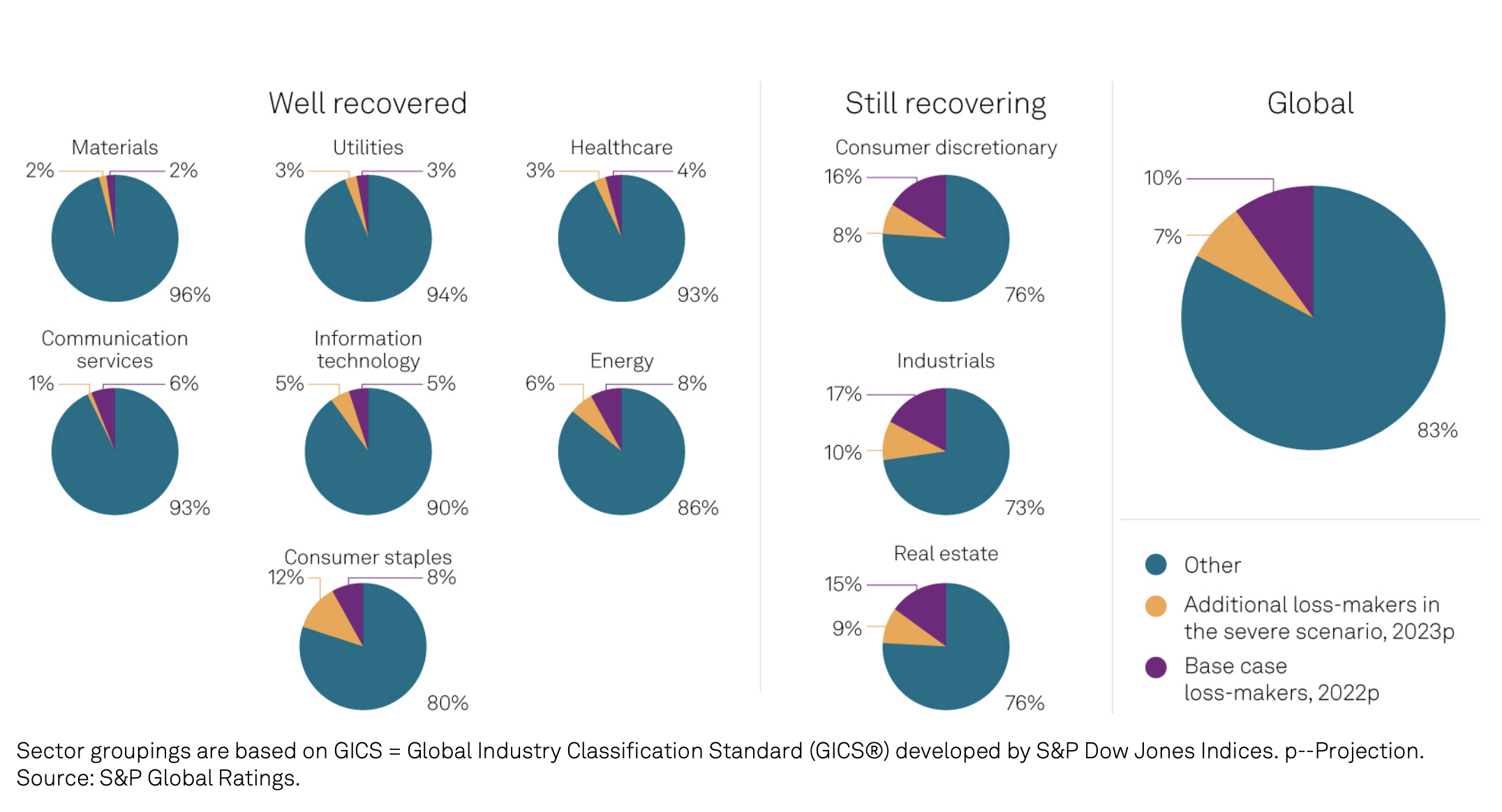

Global Debt Leverage: If Stagflation Strikes, Still-Recovering Corporate Sectors Hit Hardest

In our stagflation stress test, we found the mostvulnerable sectors are those not recovered from the COVID crisis, namely consumer discretionary, industrials and real estate. This may vary for our rated issuer pools.

The most at-risk corporate issuers are in real estate, transportation, aerospace and defense, business and consumer services, and metals and mining.

Unsurprisingly, Still-Recovering Industries Fare Worse In The Stress Test

Global Debt Leverage: If Stagflation Strikes, Loss-Making Corporates Will Double Globally

The inflation situation is worsening, compounded by Russia’s invasion of Ukraine and China’s somewhat-contrarian lockdown approach to controlling COVID infections. The Federal Reserve has significantly raised its Funds Rate and is beginning to taper its asset holdings (quantitative tightening).

Read the ArticleThe Heavy Hand Of Inflation On China Consumer Entities—Who Will Be Hit, And How

Rising costs and slipping demand are hitting the credit profiles of Chinese consumer-facing companies. Over the next three to six months, we will likely revise downward our revenue or profit expectations for about 40% of rated consumer entities in Greater China. The effects will be most acute for firms with limited ability to pass through costs to their customers, or which sell highly discretionary goods and services.

Read the ArticleSupply Chains

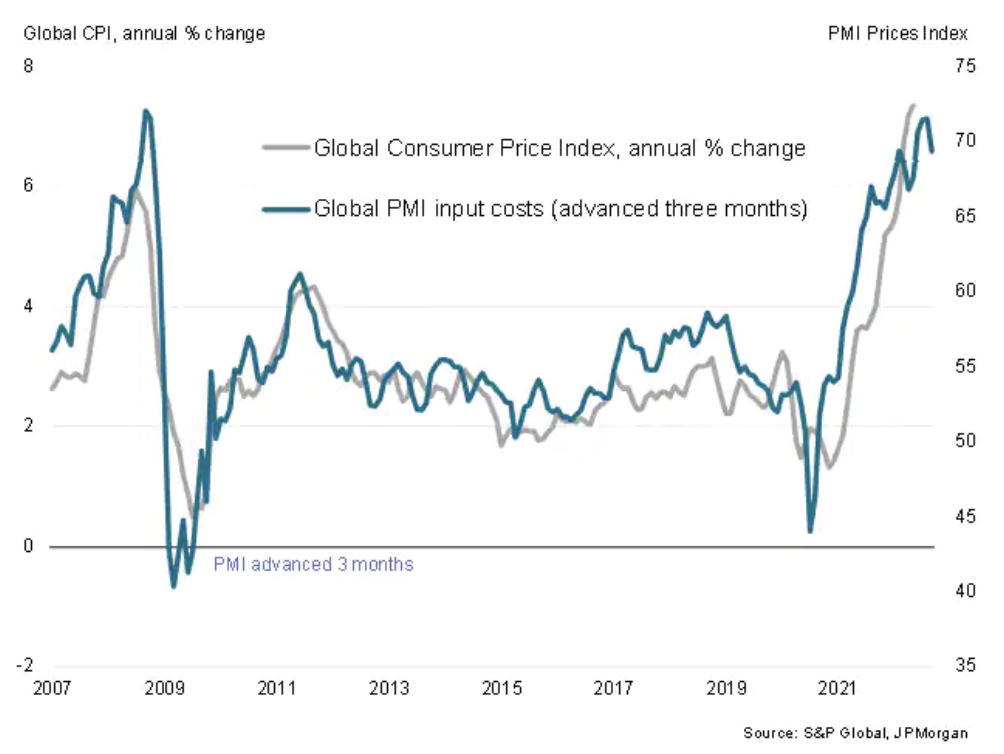

Global Inflation Peak Signaled As Supply Delays Ease And Demand Falters

The latest PMI data compiled for JPMorgan by S&P Global showed companies' input costs rising at the slowest rate for four months, signaling a cooling of global consumer price inflation in the coming months.

Global PMI Input Costs and CPI Inflation

U.S. PMI Data Show Demand For Goods And Services Falling In June, Taking Pressure Off Prices

June saw signs of an increasingly broad-based weakening of the US economy with demand now falling in both the manufacturing and service sectors. While the survey data point to a stalling of GDP at the end of the second quarter, a downshifting in the forward-looking new orders index and drop in companies' future output expectations hints at falling economic activity as we head through the summer.

READ THE ARTICLEThe Global Economic Climate Is Shifting, As Fighting Inflation Gains Urgency

With inflation at a fever pitch, central banks around the world are raising interest rates with new urgency, hoping to cool inflation by slowing growth of aggregate demand and achieving a closer balance with supply. Meanwhile, Russia's war with Ukraine and recent lockdowns in mainland China have further disrupted supply chains, adding to cost pressures.

READ THE ARTICLEGet detailed, actionable economic, risk, industry, and demographic data, at the regional, state, and city level. Utilize our curated, comparable, and forward-looking regional data to efficiently identify, evaluate, and monitor risks and opportunities in local contexts.

ACCESS MORE:Ask an Expert

Inflation, Inflation, And More Inflation

Fed tightening intended to lower inflation will slow the economy through tighter financial conditions: lower stock prices, higher bond yields, wider risk spreads, and a strong dollar.

Some effects are already being felt in the housing sector, where home sales have fallen, homebuilder sentiment has softened, mortgage applications have declined sharply, and some indicators of home construction activity have declined.

Akshat Goel is a senior economist in the U.S. Macro and Consumer Economics group at S&P Global Market Intelligence

Talk to the Expert