Looking Ahead

Supply Chain Strains and Rising Costs Will Pressure Profitability in 2022

Global nonfinancial corporates appear to be taking supply chain disruptions and soaring cost inflation in their stride. S&P Global Ratings’ analysis suggests that in 54 out of 78 global sectors, most companies are finding it very easy or somewhat easy to pass on costs. Based on the last 12 months' results, EBITDA margins look set to hit a new high in 2021.

Cost increases have been absorbed or negated in a variety of ways – demand offsets, demand shifts, product mix adjustments, hedging, indexation, positive operational gearing, cost pass-throughs, and keeping pay growth low. In S&P Global Ratings’ view, profit margin pressure will start to ratchet up in 2022. S&P Global Ratings’ analysts expect supply disruption will persist until the end of 2022 for more than half of all sectors.

Pay barely above 2019 levels is unlikely to be sustainable amid strong growth and rising costs, and signs of upward pay pressure are particularly apparent in North America.

While the global hard-stop triggered by COVID-19 and its associated restrictions proved a difficult operating environment for the corporate sector, the global restart has not been without its challenges. Clearly the direction of travel has been positive, with vaccines easing health risks and a barrage of fiscal and monetary policy helping companies avoid drastic labor cuts, providing supportive financing conditions and boosting revenues.

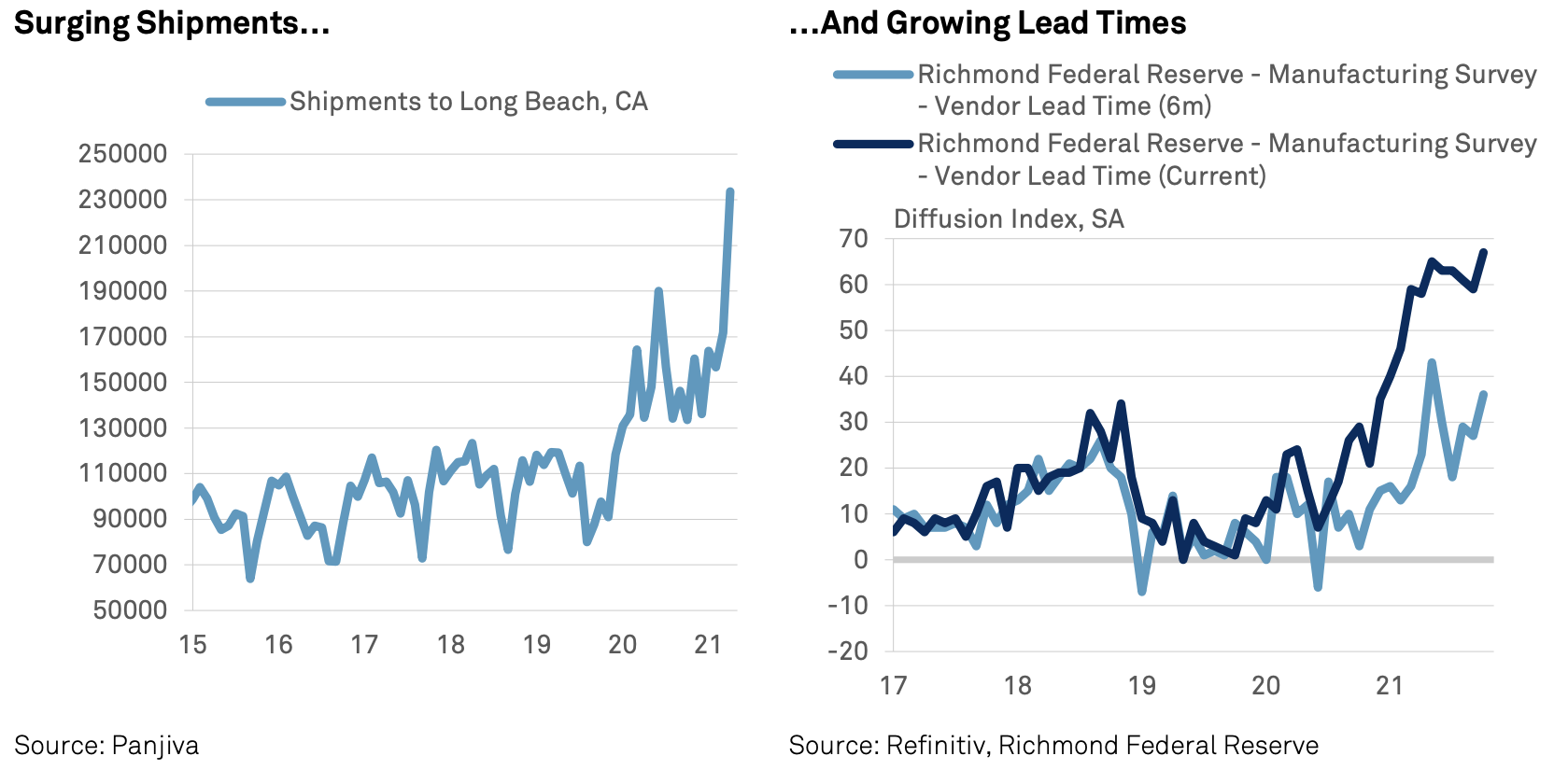

Nonetheless, the sheer scale of pandemic-related disruption and altered consumption patterns, along with existing political pressures on supply chains, have created considerable difficulties. Input and freight costs have risen dramatically, shipping volumes have surged and created bottlenecks, and lead times for manufactured goods have worsened.

Input Costs Have Soared Above Pre-Pandemic Levels

The magnitude of input cost inflation in the past couple of years is extraordinary and has taken the prices of a swathe of key production inputs far beyond their pre-pandemic levels.

S&P Global Ratings research shows the percentage changes in prices for a global basket of input costs, encompassing agricultural goods, energy, forest products, metals and precious metals, and key technology items. Of the 52 items shown, prices for only two fell (wool and cocoa), and for another two (palladium – used in catalytic converters – and coffee) rose less than 10%. The average increase versus pre-pandemic levels has been 95% and the median 52%. Even if rates of increase slow, these are substantial level changes in input costs.

Equally large rises in the freight costs of moving these items also add to the greater input-cost burden.

Corporates: Will Supply Shortages And Surging Costs Sink Margins?

Profit margin pressure will start to ratchet up in 2022. Supply disruption is likely to persist through the year, cost mitigation efforts weaken, and pay pressures intensify.

READ THE FULL REPORTEarly Signs Indicate Supply-Side Pressures Are Easing

The recent surge in the growth rate of consumer prices to a 30-year high sparked calls from the market for the Federal Reserve to move much faster on raising rates, with markets pricing in the first rate hike at its June 2022 meeting, with more priced in later in the year.

READ THE FULL REPORTAmazon, Large Retailers Well-Positioned to Weather Holiday Supply Chain Pain

Persistent supply chain constraints are expected to have an uneven impact on e-commerce this holiday season, with Amazon.com Inc. and other large retailers better positioned to meet demand than smaller merchants, retail experts say.

READ THE FULL ARTICLE'Exceptional Market' Conditions in Shipping to Persist Until Q1 2022, Says Maersk

A.P. Moller-Maersk – the largest shipping company in the world -- expects the ongoing exceptional market situation caused by the global supply chain disruptions to continue until the first quarter of next year, it said Nov. 2.

READ THE FULL ARTICLELabor and Supply Chain Woes Chill Retail Spirits for Holidays and Beyond

An ongoing merchandise supply-and-demand imbalance and labor shortages will pressure retailers' performance and profitability well into 2022.

READ THE FULL REPORT

Semiconductor Shortage

Global Auto Sales Forecasts: Supply Disruption Slows Recovery

S&P Global Ratings is revising downward their expectations for global light vehicles sales in 2021 and 2022 in light of the intensifying shortage of semiconductors, which resulted in material unit losses during the third quarter. Visibility remains low because the supply-demand imbalance of chips continues to be amplified by some further negative events, such as the production shutdowns and resurgence of COVID-19 in Malaysia. Because the chip shortage has spread to consumer electronics, S&P Global Ratings assumes that auto production will continue to be constrained into 2022 before gradually returning to normal in the second half of next year.

In S&P Global Ratings’ revised scenario they now expect light vehicles sales will increase moderately by about 2%-4% this year (versus our previous projections of 8% to 10%). This translates to sales just below 80 million units in 2021 compared to 83-85 million units in our previous projection in May this year. Based on the limited visibility on semiconductor supply since the crisis first emerged, S&P Global Ratings expects the shortage will extend into 2022. This has led S&P Global Ratings also to revise downward their projection of light vehicle sales for 2022 to 84 million units (from 87 million in our projection earlier this year). S&P Global Ratings nevertheless assumes supply constraints will ease gradually, leading to a recovery of light vehicle sales to 90 million by the end of 2023. This is because macroeconomic conditions remain fairly supportive globally, notwithstanding a flatter-than-expected recovery from the COVID-19 shock.

S&P Global Ratings doesn't believe the supply-chain crisis on its own will affect auto manufacturer ratings. Despite the persisting lack of visibility combined with the sizable unit losses to production year-to-date, S&P Global Ratings still considers the semiconductor crisis as a temporary supply shock at this stage, exacerbated by other negative events this year that have also led to unexpected production downtime. However, a more prolonged crisis, with major production shortfalls exceeding S&P Global Ratings' 2022 horizon, could lead to more profound revisions to our forecasts of issuers' earnings and cash flows, which could increasingly affect ratings. In S&P Global Ratings' view, the crisis highlights the critical importance of supply-chain management for original equipment manufacturers (OEMs) and has exposed areas of vulnerability. Microchip bottlenecks are all the more acute because of the increasing tech content of more digitized and connected vehicles coming onto the market. This is leading to an increasing number of partnerships in this area (such as VW-Infineon, Hyundai-Magnachip, GM/Qualcomm, Renault-Qualcomm, Mercedes-Nvidia, Toyota-Panasonic, and Stellantis-Foxconn) not just to secure future supply, but increasingly also to gain greater control over the design and development of semiconductors. S&P Global Ratings doesn't, however, expect OEMs to produce in-house.

Chip Shortage to Persist Through 2022 as Smaller Players Feel Bigger Impact

Big-name chip manufacturers announced a slew of new products and partnerships at CES this year but made no mention of the ongoing chip shortage. For smaller players at the show, it was a much bigger topic of conversation.

READ THE FULL ARTICLECommodities 2022: Vehicle Makers Face Challenging Year Amid Persistent Chip Shortage

Global vehicle manufacturers found themselves struggling to meet demand in the second half of 2021 as production was hampered by a semiconductor chip shortage—and supply is not likely to return to normal in 2022.

READ THE FULL ARTICLEU.S. Automakers Provide Varied Production Outlooks Amid Chip Crunch

U.S. automakers expressed varied opinions during third-quarter earnings calls regarding the timeline of their respective inventory recoveries after months of production outages in 2021 caused by the global semiconductor shortage.

READ THE FULL ARTICLEAround the Tracks: Vehicle Makers Lower Annual Forecasts Amid Parts Shortage

A global semiconductor shortage affected vehicle makers over Q3 as they struggled to maintain production to meet firm demand.

READ THE FULL ARTICLEApple Set to Power Through Chip Shortages with Steady Growth

The global chip shortage is plaguing companies around the globe, and Apple Inc. is no exception. But several industry analysts who follow the company think it will fare better than its competitors due to the combined strength of its market power and burgeoning services business.

READ THE FULL ARTICLEBattery Supply Chain

Electric Vehicles and the Nickel Supply Conundrum: Opportunities and Challenges Ahead

As many countries shift towards achieving a more sustainable future, major economies are also adopting and promoting electric vehicles in an effort to reduce carbon emissions from traditional internal-combustion engine, and ultimately help the transport and power sectors contribute towards reaching the 2-degree C Paris Agreement goal.

One of the key commodities to realizing this ambition is nickel. Unlike other battery materials such as cobalt and lithium, nickel is unique in not being primarily driven by global battery demand. About 70% of the world's nickel production is consumed by the stainless steel sector, while batteries take up a modest 5%.

S&P Global Market Intelligence forecasts global primary nickel consumption to rebound year-on-year due to stainless steel capacity expansions in China and Indonesia. Demand outside China is expected to be the main driver of global growth in volume terms in 2022 and global consumption is forecasted to rise at a compound annual growth rate of about 7% between 2020 and 2025.

The battery sector's nickel demand is also expected to accelerate substantially, with many predicting it to near 35% of total demand by the end of the decade.

But while based on the above supply of nickel seems abundant, the production of nickel-rich cathodes in lithium-ion batteries requires a more stringent, high-purity Class I nickel (i.e. greater than 99.8% purity) as feedstock to produce the key ingredient: nickel sulfate. Traditional stainless-steel feed of nickel pig iron (NPI) and laterite ores have not been suitable for the production of such batteries.

Saudi Arabia Could Play Important Role Critical Mineral Supply Chains: Conference Panel

Saudi Arabia could play an important role in the critical mineral supply chains, due to its reliable and lower cost energy, optimal geological location to serve different areas, welcome investment climate and aim to diversify its industries, keynote panelists told the Future Minerals Forum held in Riyadh and virtually Jan. 12.

READ THE FULL ARTICLEBottlenecks for Critical Materials Likely, but Surmountable – FREYR Battery CEO

FREYR Battery is a European company developing industrial-scale lithium-ion battery manufacturing that will go into electric vehicles, energy storage systems and marine applications. The company uses technology from 24M Technologies Inc., a U.S.-based spinoff from the Massachusetts Institute of Technology.

READ THE FULL INTERVIEWChina's Energy Shortage Fuels Inflationary Pressure on Battery Supply Chain

China's energy shortage is curbing lithium and battery production, adding to inflationary pressures and supply tightness throughout the supply chain.

READ THE FULL ARTICLERegionalization of Battery Supply Chains Advances, but Challenges Persist

Increasing investment in so-called battery gigafactories in the West is a natural step towards regionalizing supply-chains, but it will take more than just funds to topple China's dominance in the battery industry.

READ THE FULL ARTICLECarmakers Try to Head Off Supply Crunch with Battery Recycler Investments

Investors are pouring hundreds of millions of dollars into recyclers of battery materials, hoping to ease metal shortages, localize supply and make the electric vehicle industry more sustainable.

READ THE FULL ARTICLE

Shipping Delays

U.S. Supply Chain Issues Will Worsen Into 2022 as Transportation Woes Persist

U.S. supply chain woes will worsen in the near term before easing up well into 2022 as bare shelves persist bare and prices rise.

Transportation is the biggest supply-side problem facing businesses as ships wait to unload off the California coast, said Oren Klachkin, lead U.S. economist with forecasting and analytics group Oxford Economics. Warehousing is also backed up, said Joel Naroff, president of consulting firm Naroff Economics. Bottlenecks in both areas must be fixed before there is a significant reduction in supply chain issues, Naroff said.

"With luck, in six months we should have visible progress, but it could take 12 months before major progress or resolution becomes clear," Naroff said in an interview.

Supply chains are still feeling the effects of the pandemic, which forced businesses to shut down or shift production as consumer needs changed. Consumers have had a difficult time finding certain goods throughout the pandemic as products ranging from appliances to cars to lumber and building materials have been out of stock and backordered. Future shortages may include healthcare products and domestic food production, economists said.

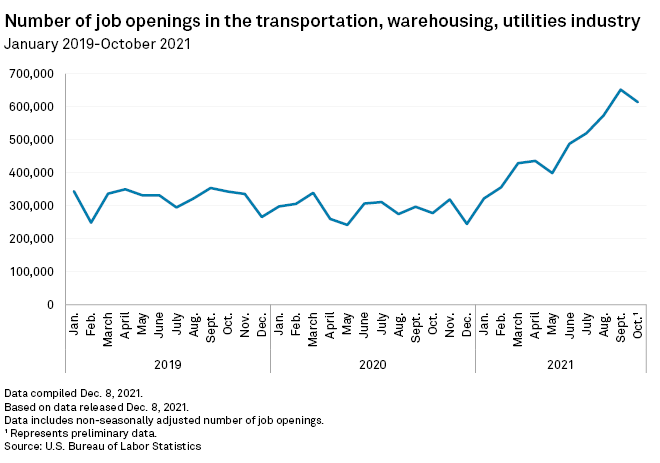

Labor has also been in short supply, complicating the recovery picture. The number of job openings in the transportation, warehousing and utilities industry steadily increased throughout 2021, until there was a slight drop in October, according to U.S. Bureau of Labor Statistics data.

Next shortage

Consumer goods are especially hard hit since the U.S. is reliant on overseas production. Companies that use just-in-time inventory with limited suppliers were not prepared for the bottlenecks the pandemic created.

It is difficult to pinpoint where the next shortage will be since almost every sector is experiencing supply chain issues, Klachkin said. A shortage of healthcare and cleaning goods may re-emerge with the news of the omicron variant, although more information about the variant's spread and health impact is needed, he said.

Port of Long Beach Notches Annual Container Volume Record Amid Import Rush

The Port of Long Beach said Jan. 19 it handled 9.38 million TEU during 2021, amid elevated demand for U.S. imports and constrained supply-side circumstances.

READ THE FULL ARTICLEContainer Ship Demolitions Dropped to Multi-Year Low in 2021: Alphaliner

Demolitions of aging container ships dropped last year to the lowest level in at least six years as high charter rates encouraged owners to keep ships operating, according to shipping intelligence provider Alphaliner.

READ THE FULL ARTICLENovember Container Volumes Rise at Port of Oakland, Drop at Los Angeles

Container throughput at the Port of Los Angeles fell in November as the port handled more smaller-than-average, unscheduled ships chartered to meet strong demand during the pre-holidays peak season.

Read the Full ArticleShipping Lines Eye Further Increases in Mid-December

All-inclusive trans-Pacific container shipping rates to North America held steady in the week to Dec. 10 with the expectation that shipping lines would push for further increases next week as demand strengthens.

READ THE FULL ARTICLESurcharges Widespread Amid Equipment Shortages, Congestion

All-inclusive trans-Pacific container shipping rates to North America strengthened in the week ended Dec. 3, as shortages of equipment and carrying capacity in North Asia worsened amid steady demand from cargo loaders.

READ THE FULL ARTICLEThe global economy has never been so connected nor so prone to disruption. Geopolitics, international events, extreme weather, and supply chain pressures can cause ripple effects across countries and industries.

ACCESS THE TOPIC PAGEImplications for Commodities

E-commerce Firms Eyeing Deals to Bolster Digital Reach, Supply Chain in 2022

Amazon.com Inc. and other U.S. e-commerce retailers are likely to pursue deals in 2022 that will further bolster their digital and technology capabilities, a move experts say will help them tighten their grasp on higher levels of online sales in the new year.

Amazon, Walmart Inc., and Target Corp. have emerged as beneficiaries of the pandemic, thanks largely to investments they have made in areas such as delivery, fulfillment, and curbside pickup operations.

The investments they make in 2022 will help them further capitalize on online sales as well as drive demand and efficiencies in areas such as content, delivery, and supply chain, said Tim Campbell, director of industry insights at e-commerce management platform CommerceIQ.

"With e-commerce, they have the reach, and now it's about making it better," Campbell said. "I think that's going to be the trend of 2022."

One of the biggest deals that could advance next year is Amazon's planned $10.56 billion acquisition of film and television company MGM Holdings Inc. It would mark the company's second-largest acquisition behind Amazon's 2017 purchase of Whole Foods Market Inc. for $14.62 billion.

An Amazon spokesperson told S&P Global Market Intelligence that completion of the MGM deal announced in May is "subject to regulatory approvals and other customary closing conditions, and we're working with regulators to respond to requests."

The Federal Trade Commission is investigating the deal but declined to comment for this story.

If approved, the deal would arm Amazon with a content library that includes more than 17,000 TV shows and 4,000 film titles, including the popular James Bond and Rocky franchises. The deal would also give Amazon more exclusive content to further lock consumers into Prime subscriptions, said Wade Holden, senior research analyst with Kagan, a media research group within S&P Global Market Intelligence. "They will be able to say 'if you want to stream all these thousands of titles, they are here on Prime if you want to subscribe,'" said Holden, who focuses on the motion picture industry.

However, the deal faces opposition from several activist groups that have pleaded with the FTC to block the transaction, saying the acquisition is anticompetitive and would enable Amazon to further leverage its dominance in streaming over competitors including Netflix Inc. and Walt Disney Co.'s Disney+ streaming service.

European Mobility Hit by Latest COVID Surge as Supply Disruptions Drag

Oil demand markers in most major European economies continued to fall in the week to Nov. 15, as governments react to rising COVID-19 cases in most countries while supply chain disruptions continue to drag on activity.

READ THE FULL ARTICLECommodities 2022: Container Market Turmoil Looks Set to Spill Into H1

After navigating choppy waters for more than a year now, market sources fear that despite some signs of a rebalancing in demand and supply, the container industry faces another challenging year in 2022—with port congestion issues set to remain a major pain point.

READ THE FULL ARTICLELong Delays at Indian LPG Terminals Tie Up VLGCs, Freight Hits 10-Month High

India's large imports of LPG to meet festive-season demand in November have sparked heavy congestion at its ports, forcing some vessels to wait more than two weeks to discharge cargoes.

READ THE FULL ARTICLEStretched Supply Chains Spur Commodities Prices Higher

The S&P GSCI, the broad commodities benchmark, rallied 5.8% in October. Performance was solid across sectors, with energy-related commodities continuing to outperform and grains and metals regaining some of their recent weakness.

Read the Full ArticleWhen Will Global Polyethylene Markets Return to Normalcy?

Global polyethylene prices and trade flows have been hit by challenge after challenge, from the coronavirus pandemic since early 2020, the deep freeze in the U.S. in February, to the recent container shortage that has driven freight rates to record highs.

LISTEN TO THE PODCASTNigeria's Dangote Refinery to be Operational by Early-2022 Despite Shipping Constraints

The 650,000 b/d Dangote refinery in Nigeria— set to be Africa's largest— is on track to be operational from early next year despite some delays caused by shipping constraints, Devakumar V.G. Edwin, an executive director at Dangote Industries, told S&P Global Platts on Nov. 1.

READ THE FULL ARTICLE

Supply Chain Finance

Supply Chain Finance Industry Ramps Up as Greensill Memory Fades

A major failure in supply chain finance has proven to be just a bump in the road for the nascent sector.

A Trade Finance Firm Ups Its Game With Supply Chain Intelligence

Members of the trade finance team had been relying on data available in the public domain, as well as insights provided by suppliers and other business partners, to identify good candidates for loans.

This was very time consuming and lacked the analytical rigor needed to build an attractive pipeline of opportunities, while minimizing risks for the firm.