Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Without Gender Data, Women Are Invisible

Economists are sometimes accused of reducing human beings to the hypothetical concept of Homo economicus — an individual who always behaves in rational self-interest. Apart from the fact that actual human beings frequently behave irrationally in the face of economic choices, the concept of Homo economicus is, by default, male. Meaning that economics and market analysis frequently assume all actors are men and therefore ignore crucial gender-based differences. Such an assumption affects expectations around workplace culture, communication styles, benefits and differing pay in various sectors of the economy. S&P Global, in partnership with The Female Quotient, is publishing a set of new research using gender-disaggregated data to coincide with the World Economic Forum Annual Meeting in Davos, Switzerland.

Looking at gender differences in workforce participation across industries helps to identify which sectors tend to employ more men than women and vice versa. Using productivity measures for these sectors as a rough proxy for implied compensation, it is possible to identify which sectors are driving gender disparities in compensation.

S&P Global studies of two sectors in which more men than women have traditionally been employed — energy and technology — revealed that women working in these industries value workplace flexibility. The backlash against remote work in many areas of the economy may lead to declining participation by women in these and other sectors. Other drivers of workplace satisfaction for women include visible women in leadership, equitable and transparent compensation practices, and paid family leave policies. Bullying and harassment remain common in the energy and technology sectors and are strong drivers of workplace dissatisfaction for women employees.

An S&P Global study of the educational background of CEOs found that a science, technology, engineering and math educational background was typical for both men and women, regardless of whether the company was in a high- or low-STEM intensity sector. Men CEOs had a slightly higher percentage of STEM educational backgrounds than women CEOs. This difference became more noticeable in low-STEM intensity sectors. This may mean that boards are selecting for educational backgrounds that are more typical among men, even in sectors where a STEM background is not required.

A multiyear study on communication and leadership styles comparing men and women CEOs found that women display more empathetic, inclusive and adaptable communication styles, particularly in crises such as the COVID-19 pandemic. Men CEOs tend to talk more than women about traditional financial metrics. This may reflect differences in educational background.

More work remains to be done to disaggregate gender data on the macroeconomic and individual sector and company levels. Measurement is the first step in addressing serious gender disparities.

Today is Wednesday, January 17, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Economy

Emerging Markets Conclude 2023 On Better Note Than Developed Markets

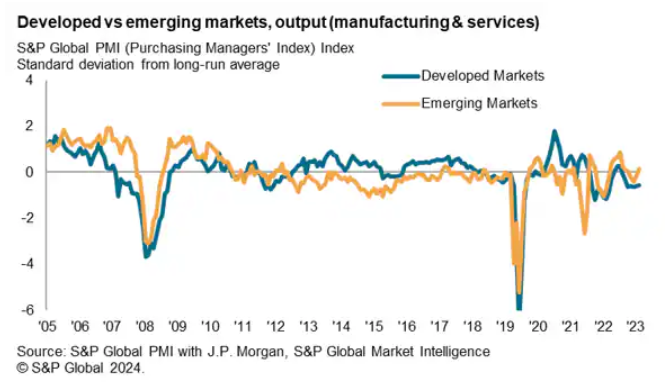

The divergence between emerging and developed markets continued into the end of 2023, with faster economic expansions among emerging economies contrasting with a sustained fall in developed world output. Underpinning the divergence in performance into the end of the year remained a divergence in demand conditions, with the degree of price inflation likewise varying between regions to in part drive the growth trend disparity.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Capital Markets

Global Private Equity Deal Activity Plunges In 2023

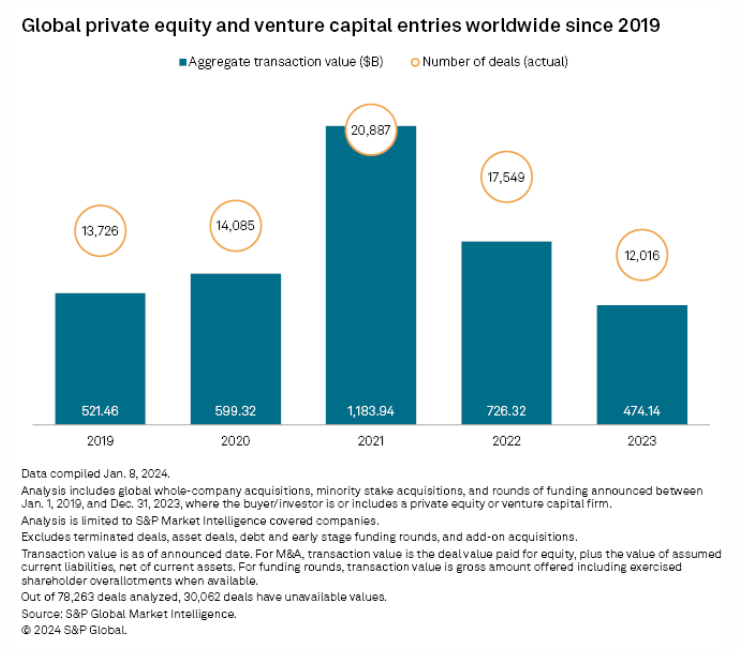

Global private equity and venture capital deal value and volume in 2023 were at their lowest in at least five years. Transaction value declined 34.7% year over year to $474.14 billion, while deal count fell to 12,016 from 17,549, according to S&P Global Market Intelligence data. Multiple factors including inflationary headwinds, rising interest rates and geopolitical unrest led many investors to step back from making deals in 2023, Pete Witte, lead analyst at EY Global Private Equity, said in a report. However, private equity remained active, with the asset class accounting for a quarter of the total M&A activity.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Global Trade

Red Sea Shipping Slumps After US Airstrikes In Yemen Trigger Retaliation Fears

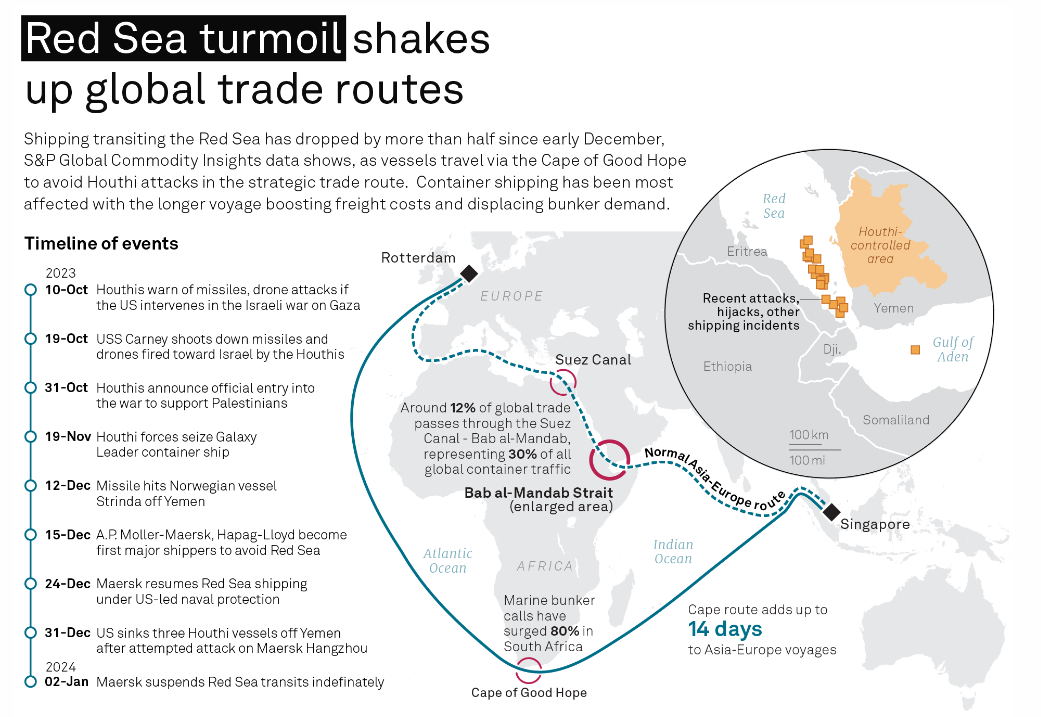

Commercial shipping entering the Bab al-Mandab Strait to exit or transit the Red Sea slumped sharply early Jan. 12, after major shipping bodies urged operators to avoid the Red Sea for up to 72 hours amid risks of retaliatory attacks by Houthi rebels in Yemen following US-led airstrikes overnight. By 1230 GMT, 20 commercial ships had entered the narrow waterway that connects the Red Sea and the Gulf of Aden, down from an average of 38 commercial ships over the same period in the four preceding days, according to S&P Global Commodities at Sea.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

Listen: 2024 Trends That Sustainability Leaders Are Watching

We’re kicking off the New Year at the ESG Insider podcast with a look forward to the big trends driving the sustainability space for 2024. In this episode, hear from two sustainability leaders about the topics they’re watching in the year ahead.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Energy & Commodities

Listen: Digging Space? Startups Set Sights On The Moon, Asteroids For Resources

The Energy Evolution podcast explores the challenges and changes facing the transition to cleaner energy. One challenge is obtaining the materials necessary for the transition, such as lithium, copper and rare earth metals. Space mining is a potential solution, with companies investing in research and development to mine asteroids and other celestial bodies for valuable metals and resources like water. The technology for space mining is in its early stages, and there are challenges, such as logistical and ethical considerations. Reporters from the S&P Global Commodity Insights team, Karl Decena, Kip Keen and Eri Silva, also discussed the potential impact of space mining on terrestrial markets and the need for regulatory frameworks for space mining.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

Tech Disruption In Retail Banking: South African Banks Move In Lockstep With System And Technology Innovation

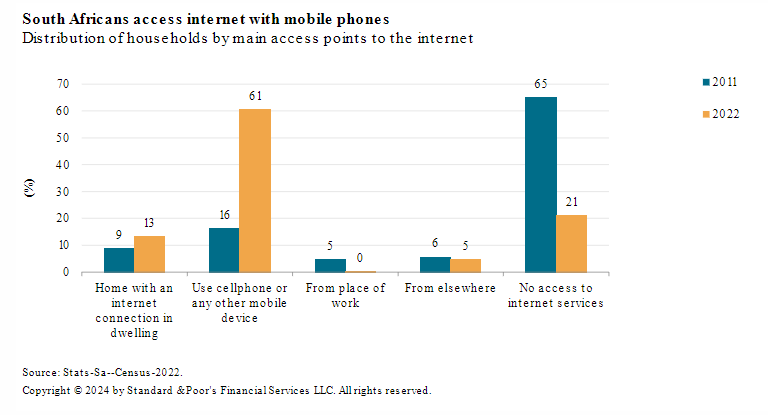

South African banks command a good reputation and financial performance because of their strong governance and regulatory oversight. They have strengthened their business models through adopting new technology, specifically online banking in the 1990s and mobile banking more than a decade ago. Banks' consistent profitability through economic cycles enabled them to stay ahead of the curve and accelerate their revenue diversification strategy.

—Read the report from S&P Global Ratings