Discover more about S&P Global’s offerings

Published: September 14, 2023

Many governments around the world have been making progress mobilizing public and private capital to accelerate the energy transition, with significant money inflows into projects in recent years. These inflows are necessary to meet the tripling of funding needs for low-carbon projects across sectors by 2030 to meet 2050 net-zero goals.

These inflows are particularly pronounced in the United States, China and the European Union – responding to high-level policy goals, yet executed through distinctive financing channels. These achievements, however, still fall short of what is needed to meet net-zero greenhouse gas emissions goals as laid out in the Paris Agreement – particularly given lower activity outside these key regions.

We see capital flows currently strongly favoring renewable power generating assets, namely wind and solar, with less focus on, for example, transmission and storage. This dislocation between policy intent and current investment is likely to result in integration bottlenecks and dysfunctioning energy markets unless market design evolves quickly.

Adapting policies and regulations also comes with risks for developers and investors, with reduced visibility and predictability in market forecasts.

National governments and global financial institutions have placed capital allocation at the heart of their energy and industrial policies to accelerate and shape the energy transition. Governments are turning to capital markets because of the immense scale of investment expected to be needed in the coming decades. It is estimated that current targets agreed to by the world’s major economies under the Paris Agreement would require at least tripling of global energy transition investment (including all decarbonization) to more than $5 trillion each year between 2023 and 2050, well beyond what government balance sheets can handle alone. Investment in renewable generating assets is a key part of the transition, with estimated annual investment of $1.4 trillion1 through 2050.

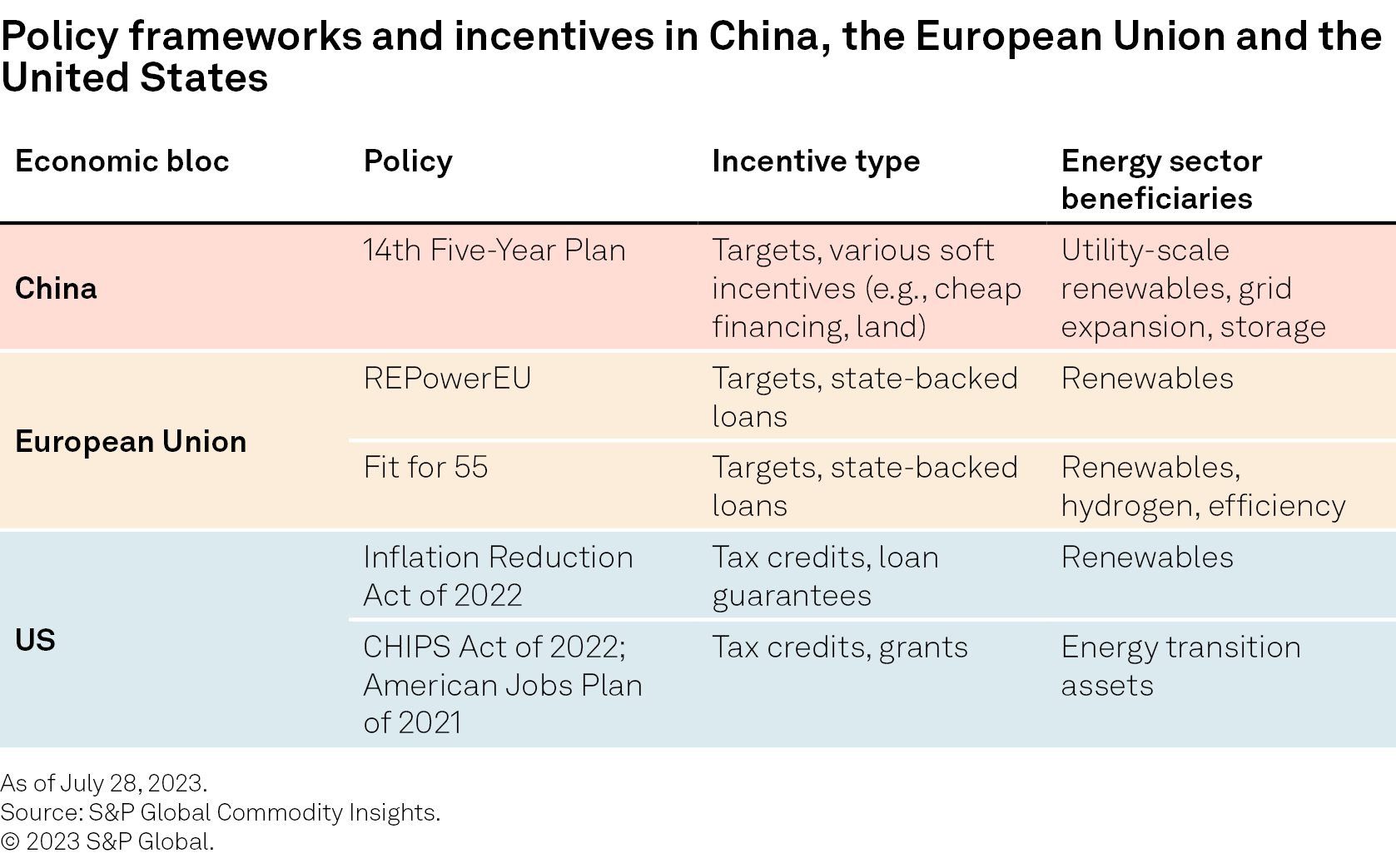

Current S&P Global Commodity Insights Inflections Reference Case forecasts expect $700 billion per year of renewable energy investment through 2050, which means that the annual funding gap to meet the net-zero modeled target could be as large as $700 billion. The global renewable energy funding gap is also highly concentrated in emerging markets due to higher risk, and hence, lower appetite from investors. For example, while 65% of the global population lives outside of the markets in China plus the developed economies as analyzed in this paper, clean energy investment in those same countries is only 20% of the global total. In contrast, the markets on which we focus in this report— the United States, Europe and China — do not face the same degree of underinvestment risk. In these markets, investment capital is more available and the financing gap is smaller, albeit still not sufficient to meet the region’s net-zero goals. Investments in developed economies are more likely to be investment grade, and where they fall short of investment grade, sophisticated local capital markets are able to cope with the associated risks. To spur green spending, governments have rolled out new incentives through different types of financial mechanisms aimed at de-risking investments and reducing decarbonization costs to boost capital availability and allocations. Such policies have evolved over time. In the US and Europe, historically, there was an initial bias toward renewable power (renewable portfolio standards, government offtake contracts and feed-in tariffs in Europe, and investment tax credit/production tax credit in the US) and now finally toward industrial decarbonization (in the US, the Inflation Reduction Act of 2022 [IRA]; in Europe, the change of Emissions Trading System rules and auctions for hydrogen and carbon capture and storage). There are some differences between the US and European policies. In the US, the IRA gives tax credits to a variety of projects and investors, who can pick where they want to direct the flow of funds. In contrast, there is less flexibility in Europe because the policy framework and incentive for each investment type is quite different.

1 International Renewable Energy Agency (IRENA) World Energy Transitions Outlook 2023, www.irena.org.

However, relying on private-sector actors to ultimately make investment decisions is transforming existing market structures and business models in ways that were not necessarily envisioned. Governments, for instance, might not have expected the market response to be so heavily tilted toward investments in generating assets, particularly solar photovoltaic (PV) assets. Those technologies and markets are primed for private-sector investment in ways that technologies for industrial decarbonization such as green hydrogen, another major goal for policymakers, are not. In some ways, it is understandable that asset managers are directing their funds into generating assets (particularly solar PV). Solar PV has generally become a bankable, proven technology and operates under contracts or feed-in tariffs, generating steady returns. However, the pronounced influx of cash into renewables will likely have disruptive implications for existing power and fuel markets that are likely to become significant over time.

Each major economic bloc and each country may have taken a slightly different approach to leveraging global finance and capital, but the global similarities are more striking than the national or regional differences, with governments drawing from the same toolkit of solutions (see the table “Policy frameworks and incentives”). The emphasis in the US IRA toward incentives to unlock capital allocation has initiated a race to provide investment opportunities across the world. One difference, though, is that the US and Europe are seeding new and greenfield development of local supply chains, whereas China is both defending and expanding its supply chains.

The acceleration of this process builds upon an existing toolkit established and now maintained by financial institutions, both public and private, and financial regulators, both national and global. Financial and capital firms have carved out a significant role as the market makers of the energy transition by enabling governments and corporate sectors to measure the risks of climate change as channeled through financial asset pricing, and to support investment opportunities in decarbonized energy and electrified infrastructure. Government policies such as the IRA and RePower EU have provided a degree of policy and regulatory certainty to financial investors. These investors took the initiative to map the implications of climate-change risk and assess the potential of new technologies to shift asset pricing, and now governments are relying on those early efforts as pathways to reshaping energy policy. While activist groups and others primed these frameworks, increasingly it is banks and institutional investors that are creating the data streams (e.g., pricing and emissions analysis), frameworks and strategic playbooks for both upgrading and decarbonizing industrial economies.

In examining the rapid deployment of renewable power production capacity in response to policy changes, while there are global similarities in the approach, there remain important regional variations in the mechanisms by which capital is allocated.

Different ways of structuring access to capital, the variety of financial institutions in each economic bloc, and the regulatory context in which investors channel their funds to new projects all meaningfully impact the character and speed of the global renewable power rollout.

Like their global capital markets counterparts, major economic blocs have relied on the tools available to them, often in ways that align with the kinds of financial institutions that facilitate investments in their national markets.

As we turn to examine the capital transition in China, the European Union and the United States, the strikingly different ways each market funds renewable power additions in response to similar net-zero policy changes provides a more detailed understanding of the emerging funding gap.

China’s energy transition will require a substantial increase in investment over the next few decades, even though it already accounted for nearly half of the global energy transition sectoral spending in 2022. China’s primary energy mix currently remains highly reliant on fossil fuels and demand is expected to continue to grow, implying a long period of massive funding is necessary to build up a “modern energy system” that is non-fossil dominated by around midcentury. China’s power sector is taking the lead alongside this transition through accelerated investments mainly in renewables generation capacity, power grids and energy storage.

China applies top-down policy decisions and mechanisms for this immense government ambition. Its central and key local state-owned enterprises dominate investments in the power sector. Their strengths are based on continuous government support (both operationally and financially) and decent capability for large projects (such as utility-scale renewables and big hydro). The financial system essentially is under state control and dominated by state-owned banks.

Greater contribution from the private sector would be necessary to achieve China’s ambitious carbon neutrality goal. Policymakers have been trying to promote private investment, yet incentives for private capital and appropriate regulatory frameworks would need to be expanded through deepening market reform. Private capital is constrained in a small portion of commercially viable projects. Public finance continues to play a central role in the majority of projects and in new energy technology innovation.

Most of the funding is raised domestically. A high percentage comes from state-owned banks and national development finance institutions. Chinese companies favor debt financing as lending rates have been kept at low levels to boost the economy, and renewables projects can access preferential rates. As one of the largest green finance markets, China’s green loan book for clean energy projects grew sharply by 32%-35% year over year during the past few years, attaining an outstanding balance of 6.8 trillion renminbi ($954 billion) as of June 2023 (see the chart “China’s green loan book for clean energy is growing vigorously”). China unveiled its Green Bond Principles in July 2022, attempting to adopt globally accepted norms to attract a wider pool of capital. In 2022, over half of its green bond issuance proceeds were used for clean energy.

As China’s power market reform deepens, renewable power will see growing market-based trading, so that prices can fluctuate more freely based on market conditions, meaning possible future return volatility too. This may help improve power system flexibility and renewable energy integration, as well as reduce generation capacity reserve. China is establishing a “unified national energy market” designed to contribute to continued strengthening cross-regional power trading, local power markets coordination and ancillary services expansion, by 2030 as targeted. China’s Renewable Energy Law and supporting policies, such as tax breaks and prioritized purchases of renewable energy, will remain instrumental to enable the high growth of investment.

In the US, the federal structure limits the degree to which central government mandates can directly shape energy investment. A trio of laws passed by the US Congress and being implemented by the Biden administration have the potential to collectively drive well over $1 trillion in investment capacity to energy transition assets, but they rely on state and local governments, companies and capital markets to select how that funding is allocated and used.

While the American Jobs Plan and the CHIPS Act both contain extensive funding for energy transition assets, it is the IRA that most clearly unleashes the private sector to freely direct investment that can qualify for after-the-fact incentives. In the IRA, US policymakers have revised the tax code to reward energy transition investment no matter which company undertakes it.

The resulting rush of investment and capital commitments has attracted global attention. In the 10 months since the passage of the IRA, private equity firms have committed more than $100 billion to new renewable energy investments that would qualify for tax credits in the next six years. That new deployment has the potential to transform the US power markets with more than 350 gigawatts (GW) of new generating capacity, and it is on top of the roughly $120 billion in new corporate capital commitments that generally carry longer deployment timelines.

When added to the loan guarantees and grants available through all three laws, the federal government has matched state-level mandates and programs with unparalleled largesse that rewards a blend of reshored manufacturing capacity and new energy infrastructure investment. While the resulting deal flow is frontloaded into incorporating renewable energy into the US power system and associated advanced manufacturing, industrial decarbonization efforts linked to hydrogen production and carbon capture utilization and storage (CCUS) project buildouts are rapidly approaching financial close and the start of construction. US private-sector commitments to CCUS projects in 2023 amount to roughly $3.4 billion, less than 5% of the roughly $120 billion committed to US renewable energy buildout by private-sector investors and companies this year.

The wave of new investment in renewable power assets is accelerating faster than the broader capital market funding of investment in energy storage. Among private capital players, the proportions are more balanced, partly because those investors are deploying assets in markets where energy storage is rewarded in market design. If these assets are increasingly exposed to market prices, there could be a compounding adverse credit impact with price cannibalization occurring during periods of excess generation. Peak generation of renewable power, particularly solar, is not always aligned with peak demand. In the US, this impact is most notable in the duck curve for power prices in California, which signifies problems for the grid and curtailment of solar generation. In the absence of a similar boom of investment in storage and transmission, the risks of grid instability and pricing cannibalization will increase both at the global and US level.

The European energy crisis has accelerated the consensus and impetus for the development of renewables, with ever-higher goals of achieving 1,200 GW of installed renewables capacity (i.e., wind and solar ) by 2030 compared with 513 GW in 2021. Environmental considerations are no longer the only motivation for renewables development; keeping power costs down for consumers and ensuring security of supply for the EU are now vital priorities. Such concerns have materialized in the revised and very challenging goal set by the renewable energy directive to produce 42.5%-45.0% of the energy supply using renewables by 2030. The EU assumes that renewables will need to deliver approximately 70% of the power to meet the overall renewable energy target by 2040. Accelerating renewables growth will require more than goals and subsidies, and a series of nonfinancial complexities and hurdles must be overcome.

In the past year, the EU has proposed a review of the bloc’s energy market design and is close to an agreement. Among other changes, it will confirm that renewable projects in Europe can choose one of three business models:

—Operate as a merchant asset

—Sell power under a power purchase agreement (PPA)

—Participate in auctions and receive a government contract

The novelty of the agreement lies in the fact that the EU will require projects with government support or subsidies to include two-way contracts for differences (CFDs) instead of one-way contracts that provide unilateral protection to the generator. In practice, most new renewables project sponsors willing to contract their revenues would opt for contracts (either CFDs or PPAs) that provide the long-term visibility required to obtain financing2 , or alternatively, merchant contracts. Nonfinancial challenges stem from the lengthy permitting process in the EU, a growing shortage of grid capacity and bottlenecks in the global supply chain. Across Europe, it typically takes between three and six years to get a project fully permitted, as well as the grid connection, and the timeline is often longer in the case of wind power. This protracted process materially limits the market’s ability to deploy new renewables at scale and at pace over the short to medium term.

2 For further information on this topic, please see the S&P Global Commodity Insights report “EU’s Proposed Energy Market Redesign Mitigates Merchant Risks and Accelerates Renewables,” published April 3, 2023.

Europe aims over the coming decade to reinforce its supply chain and revert a negative trend cemented over the previous decade. According to the International Energy Agency, Europe’s share in all the manufacturing stages of solar panels (such as polysilicon, ingots, wafers, cells and modules) declined from 20% in 2010 to 8% in 2021. In comparison, China’s share, which was 29% in 2010, jumped to 80% by 2021. The cost to develop renewables, after falling for a decade, began to increase materially in Europe from the second half of 2020, which was then coupled with higher interest rates, pressuring the economics of projects that had already locked in offtake contracts. However, the cost appears to have peaked already and will decline. Thus, in our view, whereas the EU and member states’ governments can do little to mitigate the impacts of supply chain issues and of inflation and interest rates on the renewables capacity buildup, credit risks would be mitigated to some extent from improved visibility on the market structure, keeping certain protections on price floors for renewable projects and/or improving the permitting processes and timings.

Materially increasing the contribution from renewables while at the same time electrifying the end uses and hitting reliability targets requires more flexibility, including the extension of capacity remuneration to ensure the continuity of backup generation as well as the growth of new flexible supply technologies such as storage. Europe is very focused on generation, while investments in regulated networks — including interconnections — have not been prioritized. For example, in Benelux and Germany, it is increasingly clear that power grid operators need both faster permitting and much more capital to prepare grids for a massive renewables buildup and a wave of new grid connections, from EVs to electrified factories. Another example would be the limited electricity interconnection across the most populated EU countries, such as France, Germany, Italy or Spain.

The funding gap illustrated above persists across both developed and emerging economies, absent further policy interventions.

Financial firms and capital allocators may lead in the implementation of the energy transition, but they also follow as technology and politics change the markets and economies in which they operate. The degree to which financial incentives may dislocate energy markets and impact risk metrics for firms currently in those markets is increasing over time.

Financial and capital markets may be part of shaping the energy transition as they respond to government policy, but it is the realities of the energy transition that have created a vector along which governments are competing for economic preeminence.

It is the availability of progressively cheaper and more efficient renewable energy technologies, high-performance batteries and increasingly viable industrial decarbonization technology that ultimately create the context for policy creation that can rely on investment shifts to drive the energy transition.