Discover more about S&P Global’s offerings

With global leverage reaching new peaks and a higher cost of debt, can governments, corporates and households finance climate, digital and demographic transition?

Published: January 10, 2024

Global leverage trending up and structurally higher interest rates will increase the financing bill for governments, corporates and households.

Additional investments will be necessary to address climate-related risks, the energy transition, digital transformation and an aging population, with developing economies disproportionately affected.

International collaboration and a combination of public and private capital will be required to make the transition affordable globally, although increasing geopolitical fragmentation will make this more difficult.

High interest rates are increasing the burden of servicing global debt. We estimate that global debt-to-GDP leverage will rise by a moderate 3% to 238% by 2030, reaching a high of $336 trillion under a baseline scenario. However, factoring in a possible $37 trillion in additional transition investments due to climate mitigation and adaptation, digital transformation, and aging, we project leverage to rise 9% if financed exclusively through debt. The combination of higher interest rates and transition costs will be particularly onerous for developing economies given their more limited financial capacity.

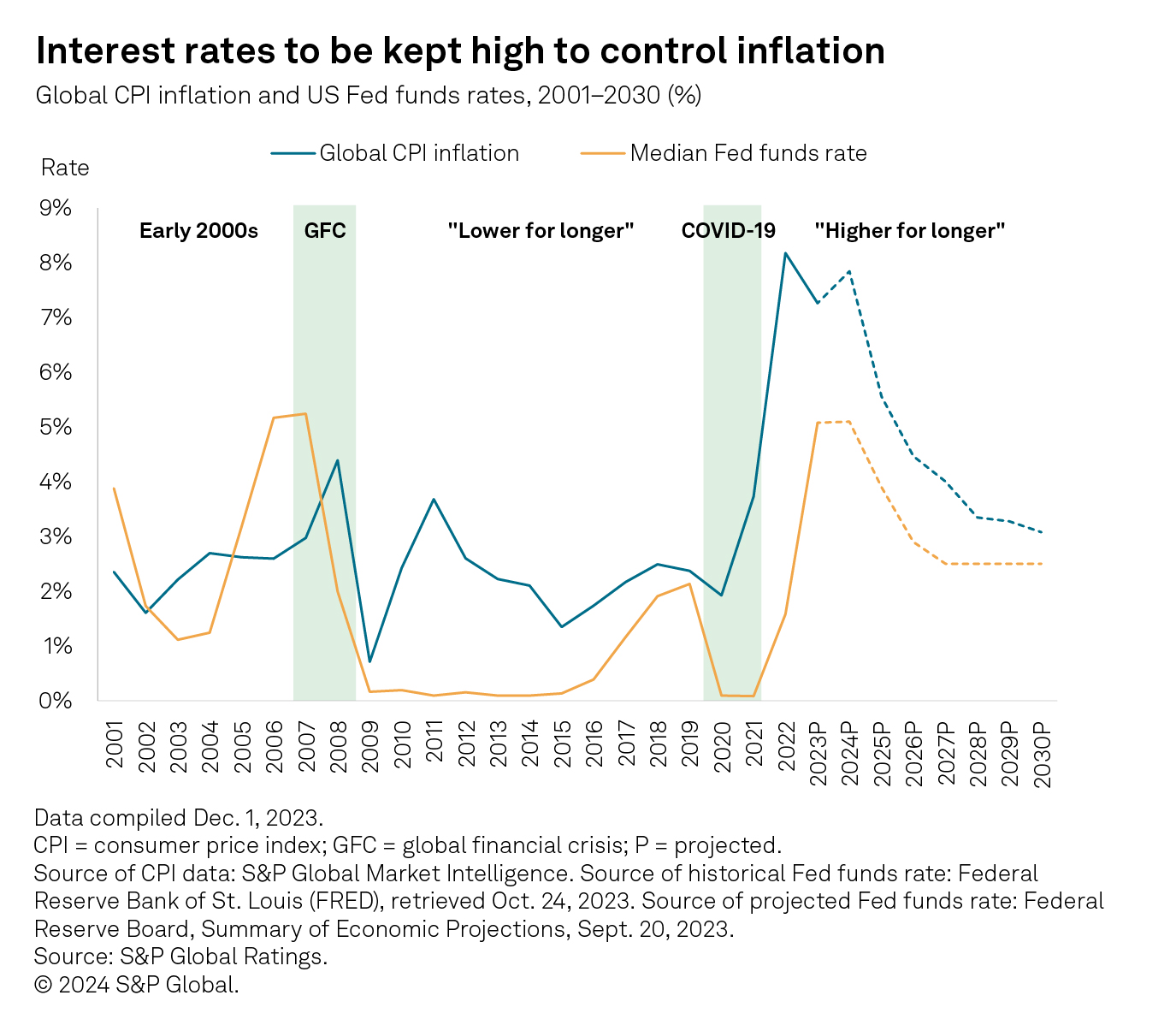

With the end of the Washington Consensus leading to more constrained trade and higher costs of doing business, and with the structural rise in investment needed to combat climate change, price pressures are likely to become structurally higher (see “End of the Washington Consensus” to learn more). Most major central banks are committed to achieving their inflation targets (e.g., 2% for the US Federal Reserve) over the medium term. We assume they will do what is needed to achieve those objectives, which means central banks are likely to keep policy rates structurally higher to achieve their inflation targets. Put another way, the world’s real equilibrium interest rate (r* (r-star)) has risen and is likely to stay higher through 2030 than in the post-global financial crisis decade. The chart below shows global consumer price index inflation and US Federal Reserve funds rates for 2001–2022 and projected 2023–2030.

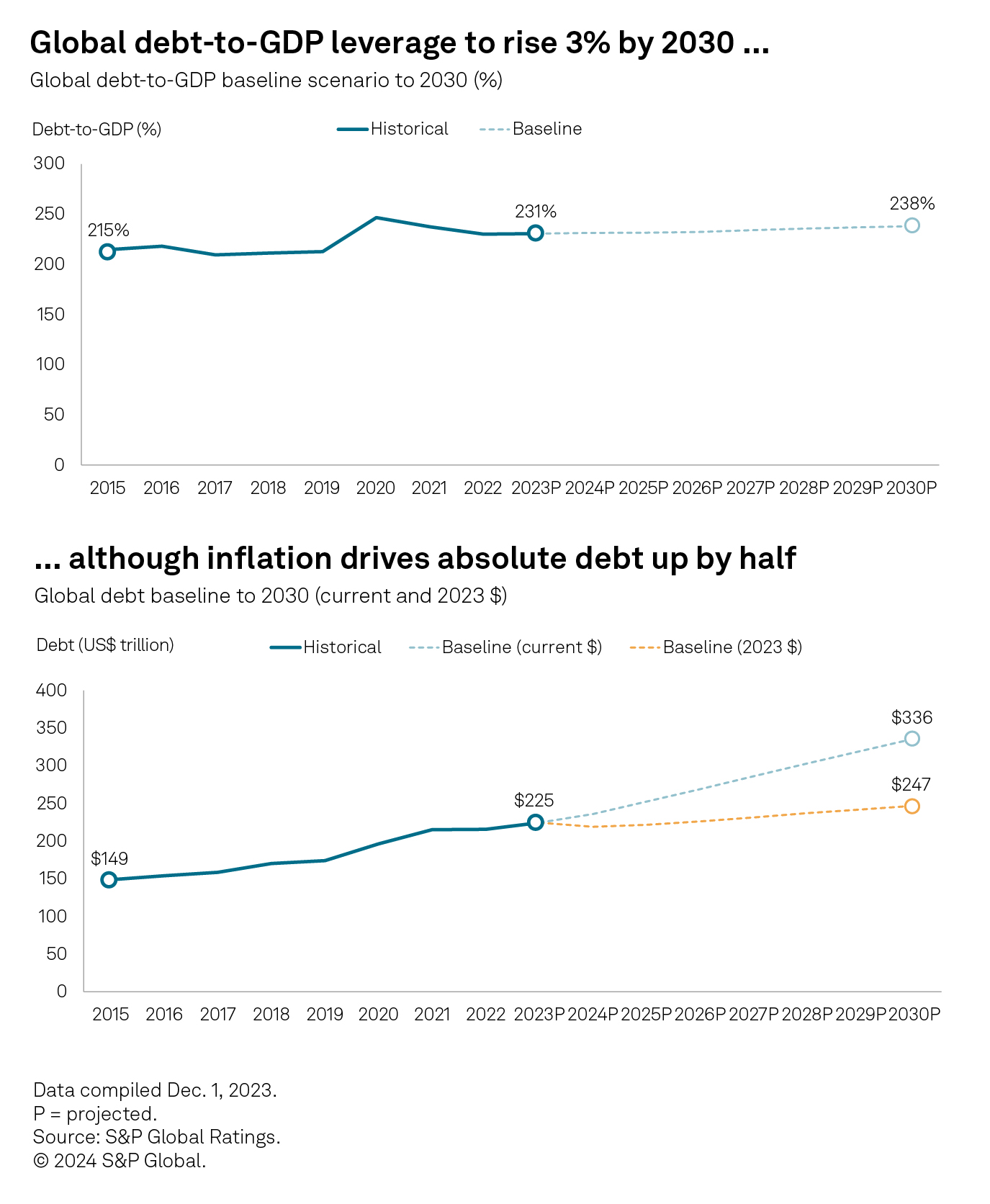

We project debt-to-GDP leverage to grow 3% to 238% from 231% over 2023–2030. This translates to a compound annual growth rate of 0.4% (see next subsection for details). Inflation will drive up both absolute debt and nominal GDP. We anticipate that absolute debt will rise by half to $336 trillion by 2030, from $225 trillion in 2023. Removing the effects of inflation, absolute debt would have grown only 10% to $247 trillion (in 2023 dollars; see chart). (Note: In this paper, global debt comprises the debt of nonfinancial corporate, government and household sectors, excluding the financial sector, to avoid possible double counting.)

We expect emerging markets’ leverage to grow twice as fast as that of mature markets. This is not surprising given that as emerging economies develop, their degree of financialization tends to increase. Our baseline projection is for the leverage of emerging markets to grow 6% to 211%, with emerging markets (excluding mainland China) up 7% to 133% and mature markets up 3% to 257%. The US and China — the two largest economies, accounting for almost half of global GDP — could see their debt-to-GDP increase to 269% and 295% in 2030, from 254% and 283% in 2023, respectively. Together, these countries could hold 53% of the world’s debt in 2030.

The US and China — the two largest economies, accounting for almost half of global GDP — could see their debt-to-GDP increase to 269% and 295% in 2030, from 254% and 283% in 2023, respectively.

We project corporate and government leverage to increase four times faster than household leverage. Our baseline projection is for the debt-to-GDP leverage of the global corporate sector to grow 4% to 88%, the global government sector to climb 4% to 87% and the global household sector to stay relatively flat at 62% (see charts). We see the household sector as more interest rate sensitive, as the average household has less headroom to increase income over a short period.

We do not expect much incremental corporate borrowing over 2024–2025 because of the impact of high interest rates, subdued M&A activity and more financial risk aversion from corporate managers. From 2026 to 2030, we expect corporate debt-to-GDP to increase from a combination of more moderate borrowing costs and a return to risk- seeking behavior by investors.

We forecast government debt, mainly driven by fiscal dynamics in mature markets, to remain fairly high, at 87% of GDP by 2030, instead of retreating to lower levels, as would have been expected from the post-pandemic recovery. This is also assuming the cost of funding will be higher than before the pandemic. If we add to this other factors likely to increase pressure on government balance sheets, such as an aging population, climate mitigation and adaptation, and technological challenges, the need for governments to pick up momentum on fiscal consolidation will become imperative to maintain current levels of creditworthiness. Nonetheless, governments are likely to prioritize their spending as they are already doing so with the energy transition and aging-related issues.

The need for governments to pick up momentum on fiscal consolidation will become imperative to maintain current levels of creditworthiness.

While we expect global household debt leverage to remain relatively flat, there is a diverging trend between emerging and mature markets. We project emerging markets’ household leverage to reach 51% in 2030, from 46% in 2023, driven by a rise in per capita income and population wealth, financial development and easier access to credit, and above-average GDP growth increasingly supported by greater consumption. On the other hand, we expect mature markets’ household sector leverage to reduce by a few percentage points to 70% over the same period.

$37 trillion needed to finance transition over 2024–2030

The cost of climate inaction is substantial. Lower- and lower-middle-income countries face up to 12% of GDP being at risk of physical hazard losses by 2050 under a slow transition scenario and absent adaptation (see “Investment in climate adaptation needs have high returns on growth” to learn more). Meanwhile, the challenge of energy security, affordability and sustainability looks very different in developing economies than in Europe and the US, where per capita incomes are as much as 40 times higher (see “The multidimensional path to net-zero"). Concurrently, IT advances are continuing apace, e.g., generative AI (see Can generative AI create a productivity boom?”), requiring governments and corporates to make further investment. On the societal front, many countries are facing an increasingly aging population, which could stymie further economic growth. There is a cost in caring for such aging populations (see “The challenges of aging: Fast and slow”).

Besides the baseline scenario described above, we have developed a supplemental “cost of transition” scenario that assumes additional debt (over the baseline) is raised to fund climate mitigation and adaptation, digital transformation and an aging population. We have not compared results with other development pathways that countries might take, which could be more costly than this transition scenario (e.g., failure to act on climate change).

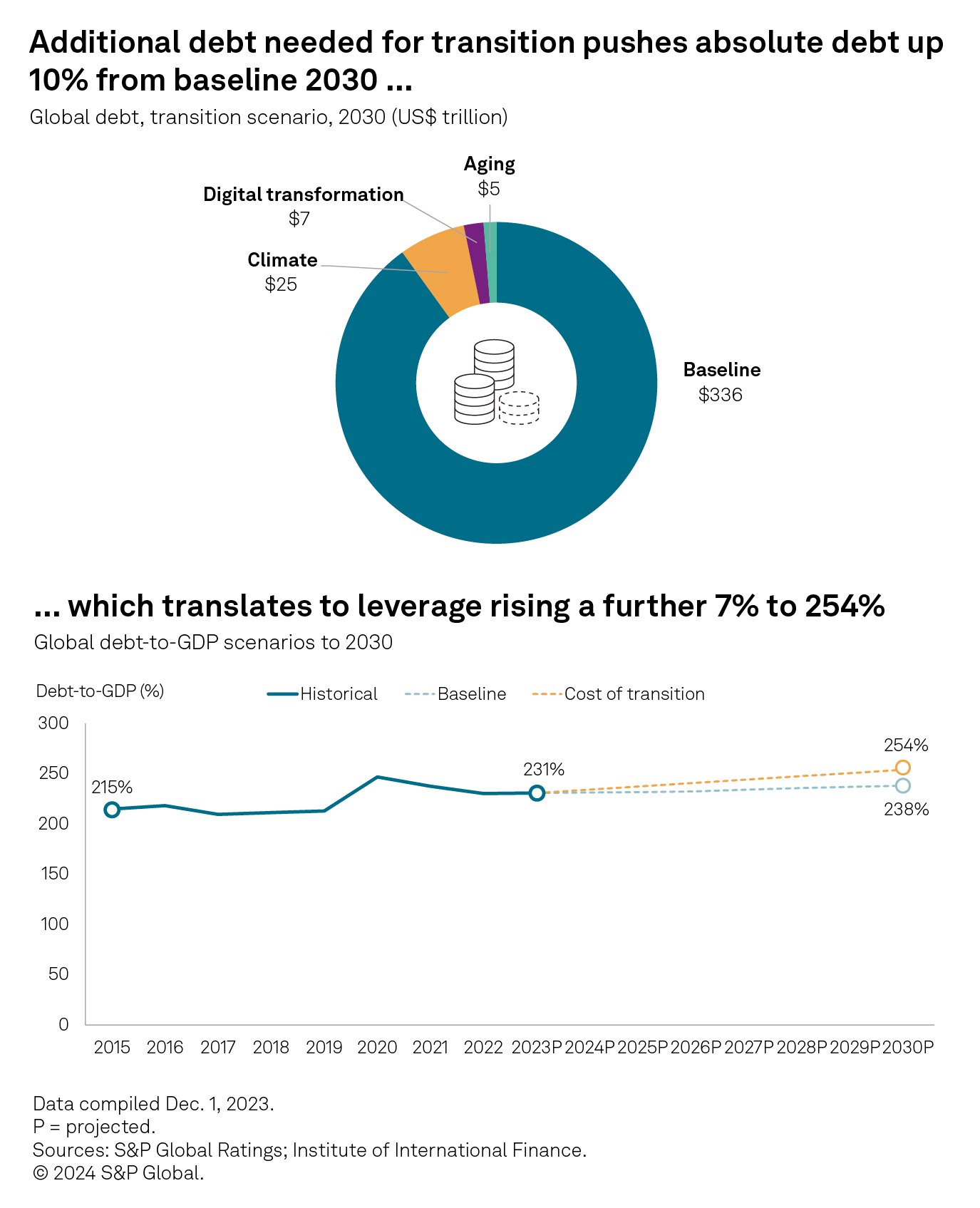

Climate financing takes up the largest share of debt for transition. We estimate that a cumulative $37 trillion of debt — $25 trillion for climate, $7 trillion for digital transformation and $5 trillion for aging — may have to be raised between 2024 and 2030 (see chart). In arriving at these transition sums, we have used a variety of proprietary and external sources. For climate, we refer to the Intergovernmental Panel on Climate Change’s “Sixth Assessment Report” and the UN Environment Programme’s “Adaptation Gap Report 2023.” For digital, we refer to the Organisation for Economic Co-operation and Development’s “A Roadmap Toward A Common Framework For Measuring The Digital Economy.” For aging, we drew on S&P Global Ratings' “Global Aging 2023” report. Our measure of climate mitigation costs includes those for the energy transition, and digital transformation costs are gross fixed capital investment in digital technology to transform nondigital processes and services into digital ones.

We acknowledge that there is always a high degree of uncertainty in such estimates and variability in ranges of estimates for this financing gap. For example, we note that more recent estimates around climate scenarios suggest higher financing needs or wider gaps. Also, other sources such as taxes, including a carbon tax, and equity financing could contribute to financing gaps. Nonetheless, the proposed transition scenario represents in our view a reasonable midrange estimate to support our discussion.

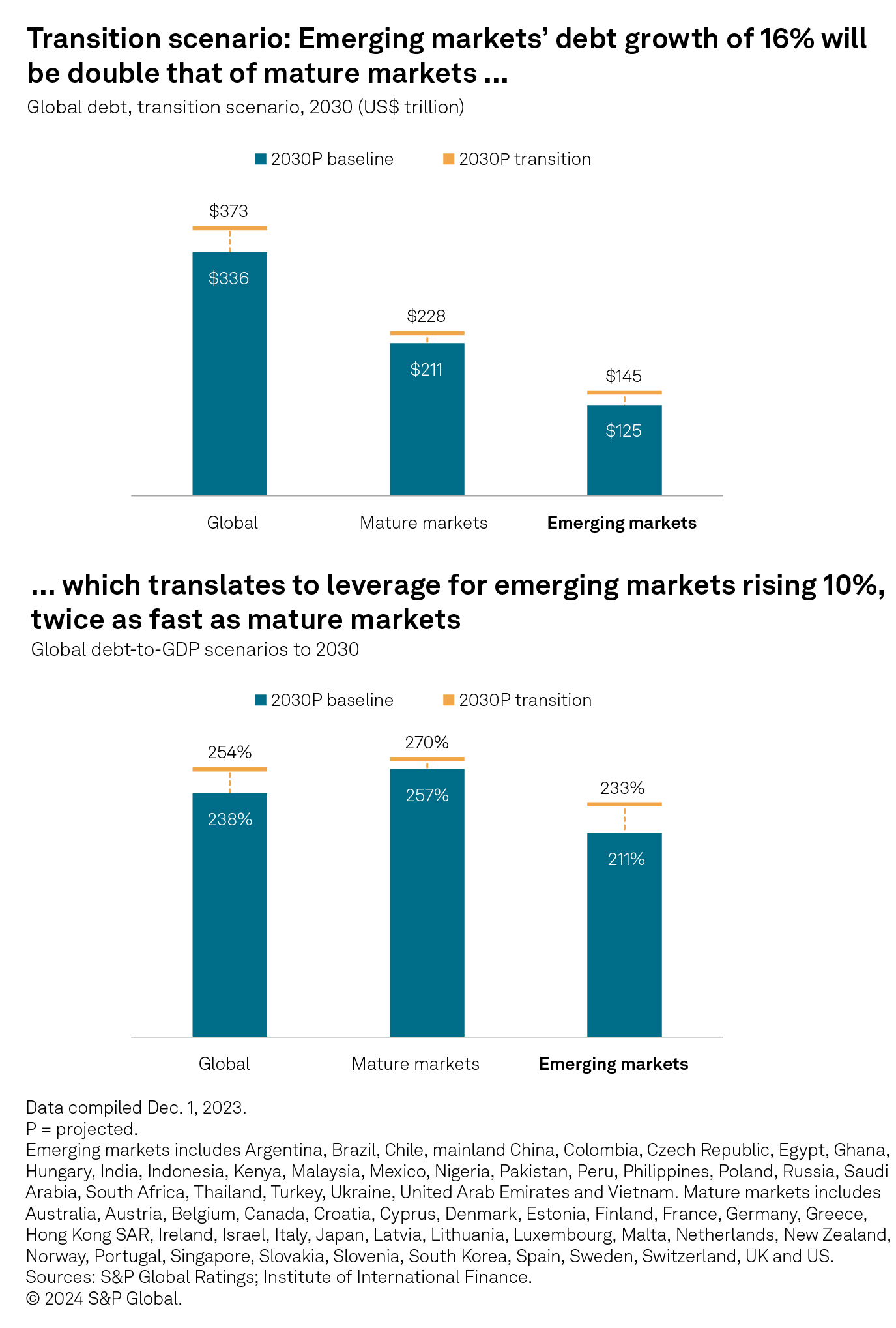

Cost of transition could push leverage up another 7%. In our scenario, absolute debt could grow to $373 trillion between 2023 and 2030, 11% more than the baseline $336 trillion. This translates to the global debt-to-GDP ratio rising to 254%, 7% more than the baseline 238% (see chart). Because the weight of physical risk falls disproportionately on low- and low-middle-income countries (see “Investment in climate adaptation needs have high returns on growth” for more on climate adaptation costs), we see the absolute debt and, consequently, the debt-to-GDP leverage rising faster for emerging markets than for mature markets (see charts below). The lower-income cohort of our emerging markets sample (classified as lower-middle-income economies by the World Bank) could fare even worse; they may see absolute debt increase 19% and debt-to-GDP jump 14% in the transition scenario compared with the baseline.

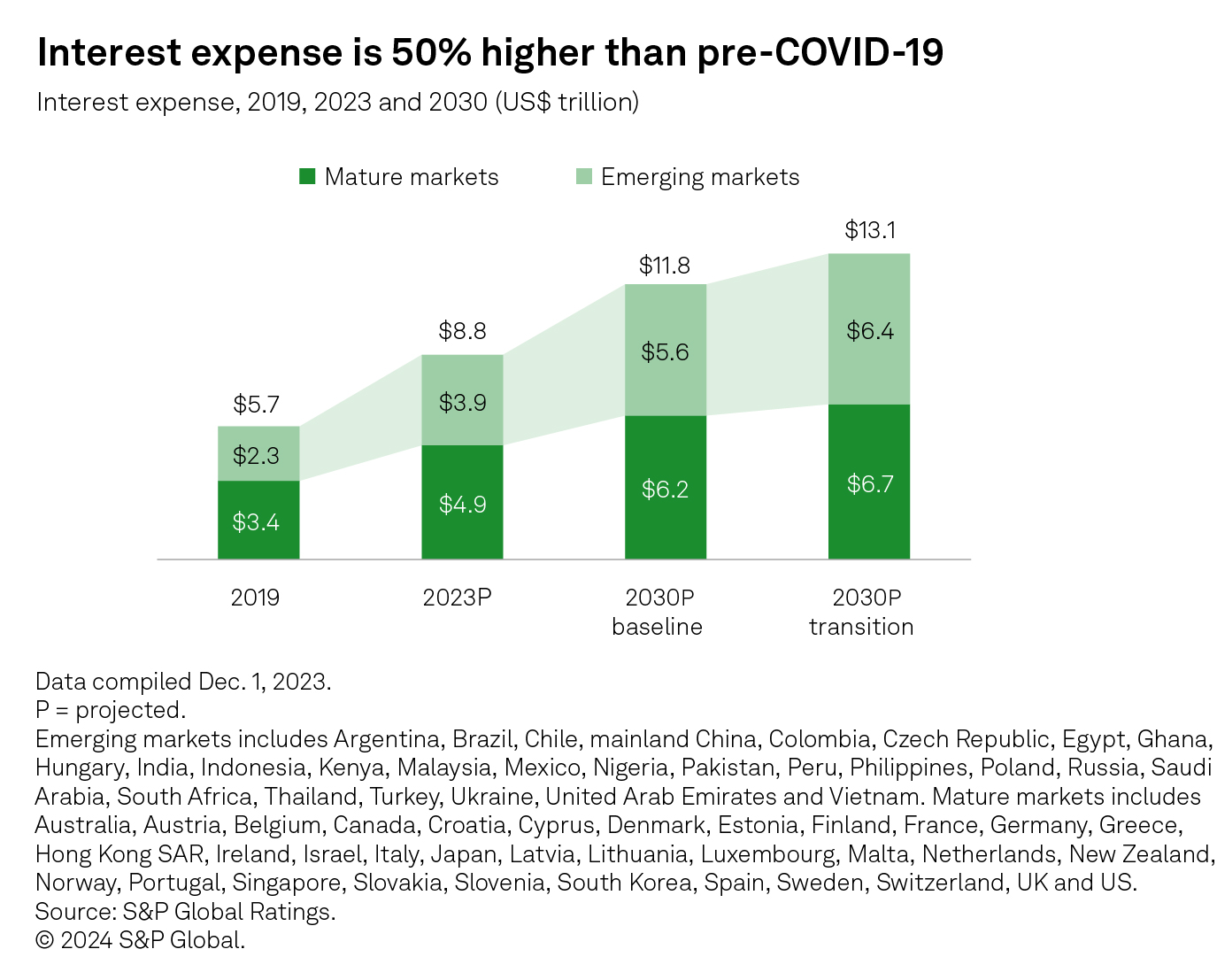

Interest expense will be higher than pre-COVID-19

We estimate that global borrowers are paying annual interest expenses of $9 trillion, 50% higher than 2019’s $6 trillion (see chart). In our baseline, this rises to $12 trillion by 2030 given higher nominal debt. Our cost of transition scenario shows the amount climbing 8% against the baseline to $13 trillion. We estimated interest to revenues for corporates from the financial statement data of 50,000 entities, sourced from S&P Global Market Intelligence’s Capital IQ database; for governments from S&P Global Ratings’ Sovereign Risk Indicators, published Oct. 9, 2023; and for households based on mortgage rates from national sources and disposable income data from S&P Global Market Intelligence’s EconoSim database.

Governments are likely to take the biggest hit. Despite an expected easing in interest rates, the global interest expense-to-revenue ratio is forecast to be 17% higher in 2030 than in pre-COVID 2019. The household sector is projected to experience the least change in its interest expense-to-revenue ratio, partly due to an assumed 1% increase in leverage ratios over the 2023–2030 period. The corporate sector is in the middle. We expect governments to bear most costs due to the climate transition, digital transformation and aging, which leads to worse ratios in our cost of transition scenario.

We estimate transition needs (particularly for climate adaptation and aging) will be more pressing for emerging markets.

Emerging markets will bear a disproportionate cost of transition. We estimate transition needs (particularly for climate adaptation and aging) will be more pressing for emerging markets. For example, we expect potential GDP losses from physical risks by 2050 (under a slow transition scenario and absent adaptation) to be more than four times greater for less developed countries than for their wealthier peers. Likewise, the increase in the old-age dependency ratio and age-related expenditure is far steeper for developing economies than for advanced economies, implying a greater scale of policy adjustment is required to offset rising aging pressures, although from a lower starting point. Emerging markets (excluding mainland China) governments could see their interest expense-to-revenue ratio rise by nearly half to 20.4% in the transition scenario in 2030, compared with 14.4% in 2019.

What if interest rates do not ease as much as expected?

We conducted a sensitivity analysis by adding a 50-basis-point increment to the anticipated 2030 interest rate for each geographic sector. Because of the continuing debt leverage buildup, albeit at a somewhat low compound annual growth rate, the government sector is most affected. In other words, government borrowers would suffer most if interest rates do not decline sufficiently over the next few years.

It is likely that debt may have to be raised beyond what is already planned to cover climate, digitalization and aging transition costs.

After a step-up during the COVID-19 years, it is likely that debt may have to be raised beyond what is already planned to cover climate, digitalization and aging transition costs. Coupled with this is the high likelihood that interest rates will settle at equilibrium levels higher than those pre-COVID-19. Policymakers will have to address the necessary trade-off between short- and longer-term costs to their economies and population, as the cost of inaction could become greater over time. Given the global nature of climate change and the disproportionate exposure of emerging markets, including lower-income countries, to physical and transition risks, a higher degree of international collaboration to support capital flows, as well as a combination of public and private capital, is needed to make the transition affordable for all. This collaboration could be constrained by an increasingly fragmented geopolitical environment (see our Q&A with Senior Vice President for Geopolitics and International Affairs Carlos Pascual to learn more).

For more detailed information on our analysis, read the full report Global Debt 2030: Can The World Afford A Multifaceted Transition?

Ruth Yang

Global Head of Thought Leadership,

S&P Global Ratings

ruth.yang2@spglobal.com

Gregg Lemos-Stein

Chief Analytical Officer,

Corporate Ratings,

S&P Global Ratings

gregg.lemos-stein@spglobal.com

Roberto Sifon-Arevalo

Chief Analytical Officer,

Sovereign Ratings,

S&P Global Ratings

roberto.sifon-arevalo@spglobal.com

Emmanuel Volland

Global Sector Lead,

Financial Institutions,

S&P Global Ratings

emmanuel.volland@spglobal.com

Paul Watters

Head of Credit Research,

EMEA,

S&P Global Ratings

paul.watters@spglobal.com

Jose Perez-Gorozpe

Head of Credit Research,

Emerging Markets,

S&P Global Ratings

jose.perez-gorozpe@spglobal.com

Next Article:

End of the Washington Consensus

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.