Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

COP28 In Review

The UN's annual climate change conference (COP28), held at the end of 2023, marked a new milestone in global climate policy. World leaders agreed to a historic text pledging to transition away from fossil fuels in energy systems. However, the deal faced criticism for lacking concrete targets and not matching the urgency of the climate crisis.

The historic text was part of the first-ever global stocktake, a process in which countries and stakeholders assessed their progress toward meeting the goals of the Paris Agreement on climate change. The global stocktake resulted in a commitment to triple renewable capacity and double energy efficiency by 2030, among other measures. “This is the first time that all fossil fuels, not just coal, were included in that final outcome language, which is very important,” Anna Mosby, a research analyst at S&P Global Commodity Insights, said on the Platts Future Energy podcast.

But some believe that the deal doesn’t go far enough. The global stocktake “provides enough loopholes to countries to get out of it. ... The planet right now needs a much more successful COP," Nishtha Singh, assistant director of climate at the Asia Society Policy Institute, told S&P Global Commodity Insights.

Under the Paris Agreement, countries are required to submit a new nationally determined contribution in 2025, outlining their climate targets and policies. Each country’s pace of implementation will depend on the market and political climate. Thanks to government incentives, S&P Global Commodity Insights expects the US, Europe and China to “consolidate over 70% of global renewables additions during 2024–30.” Meanwhile, Australia plans to have 82% renewable power in its electricity grid by 2030, with natural gas as a backup. Other regions such as the Middle East will have more difficulty decarbonizing due to energy-intensive industries and growing populations.

A major point of discussion at the conference was how creative finance can encourage private investment in climate solutions and help drive the energy transition of developing countries, which are often the most vulnerable to climate change-related events such as droughts and floods. COP28 did see progress with the activation of the Loss and Damage Fund, a funding mechanism to help these countries cope with such effects. However, according to S&P Global Sustainable1 writer Esther Whieldon, this fund and other financial pledges from COP28 still fall short of the trillions of dollars needed to help developing countries adapt and decarbonize.

Nature and biodiversity loss also received more attention at COP28 than in past years. The global stocktake “underlines the vital importance of protecting ... and sustainably using nature and ecosystems for effective and sustainable climate action,” wrote Lindsey Hall, head of ESG Thought Leadership at S&P Global Sustainable1.

COP28 marked significant steps in global climate action, but more specific plans are needed. S&P Global Commodity Insights currently expects the world to miss the Paris Agreement goal and warm by 2.4 degrees Celsius by 2100 — a trajectory that will increasingly hurt company finances and the world economy going forward.

Today is Friday, January 19, 2024, and here is today's essential intelligence.

Written by Claire Delano.

Economy

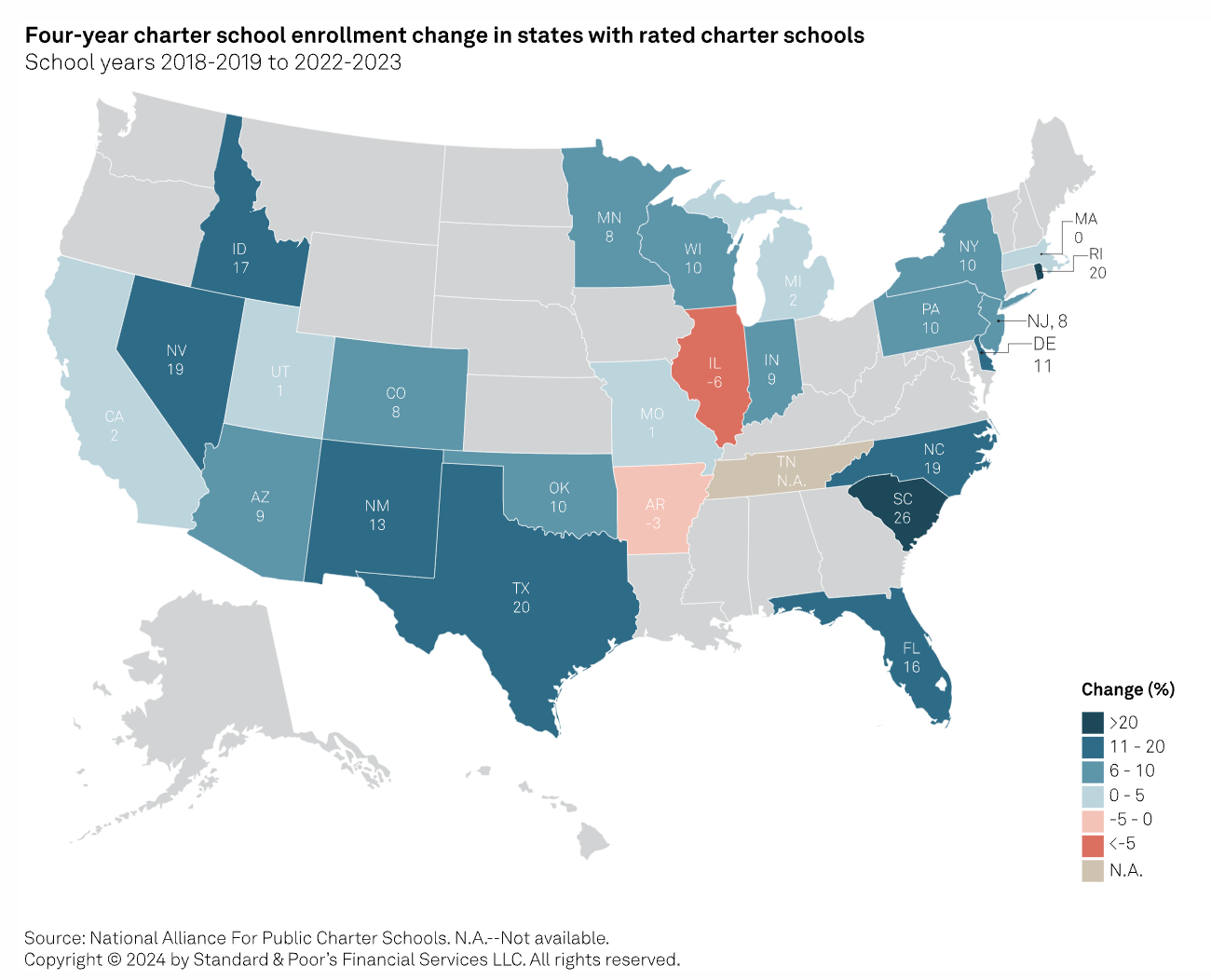

US Charter Schools 2024 Outlook: Credit Stability, For Now

US charter schools' credit fundamentals are stable for now, supported by continued healthy demand, generally favorable per-pupil funding and some cushion provided by still-available federal emergency relief funds. During 2024, S&P Global Ratings expects schools will focus on managing increased expense pressures and teacher shortages amid dwindling federal emergency support and slower economic growth.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Capital Markets

IPO Activity In Hong Kong To Recover From Slump As Interest Rates Fall

IPOs in Hong Kong could recover in 2024 as the global interest rate cycle turns and companies return to equities markets to raise funds for growth. Companies raised $5.90 billion via IPOs in Hong Kong in 2023, a drop of 29% over the previous year, according to data from S&P Global Market Intelligence. The number of deals fell to 67 from 72. Nearly half of the IPO activity happened in the fourth quarter of 2023, when companies raised $2.89 billion via 26 transactions, the data showed.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Global Trade

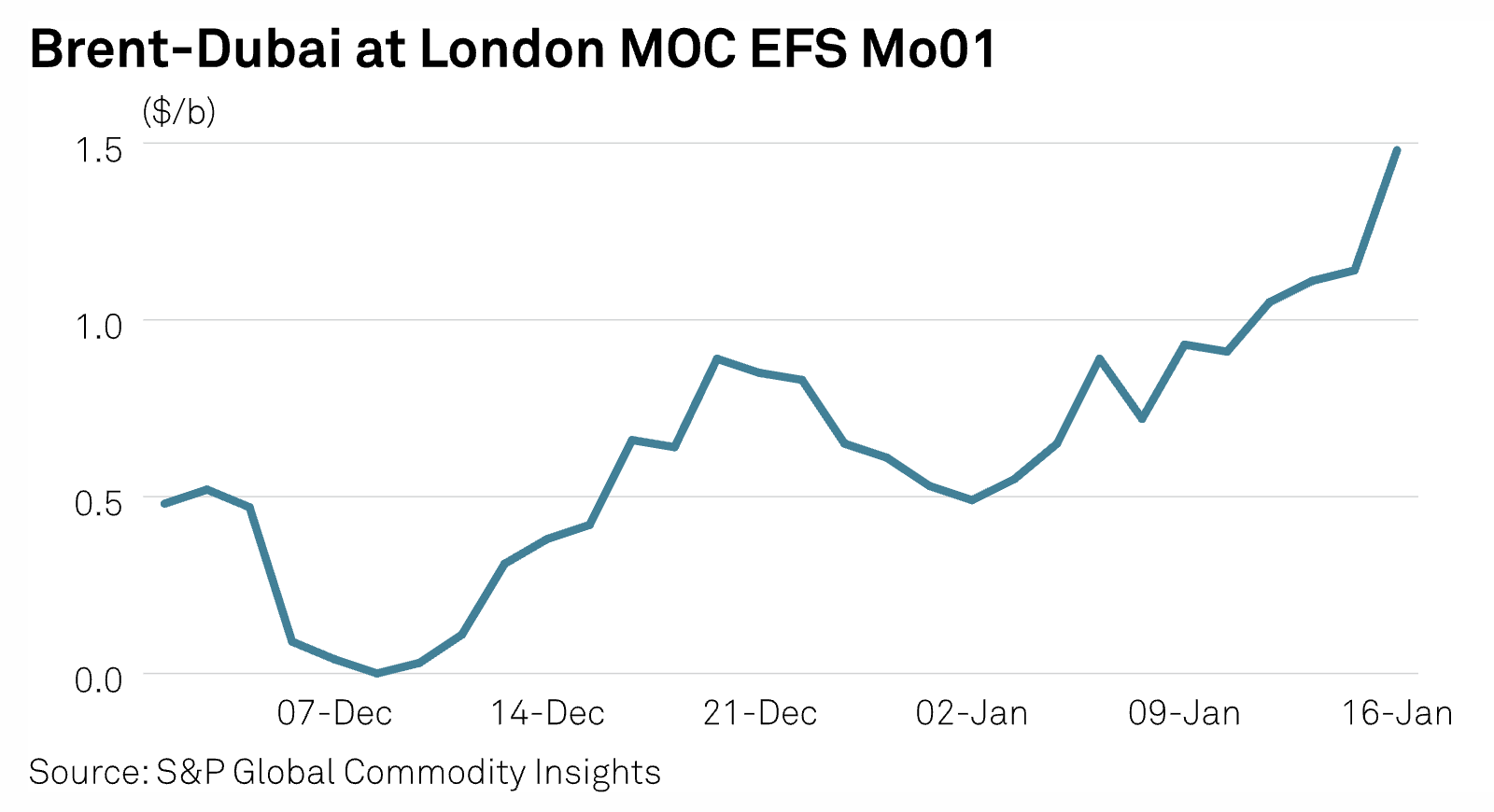

US Designates Houthis As A Global Terrorist Group, But Plans Big Sanctions Carveouts

The United States has designated the Houthis as a specially designated global terrorist group due to its ongoing attacks on ships in the Red Sea and Gulf of Aden, but the US is delaying the effective date for 30 days to provide time to develop "unprecedented" carve-outs to allow shipments of fuel, food and medicine. "The Houthis must be held accountable for their actions, but it should not be at the expense of Yemeni civilians," Antony Blinken, US Secretary of State, said in a Nov. 17 statement. "If the Houthis cease their attacks in the Red Sea and Gulf of Aden, the United States will reevaluate this designation."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

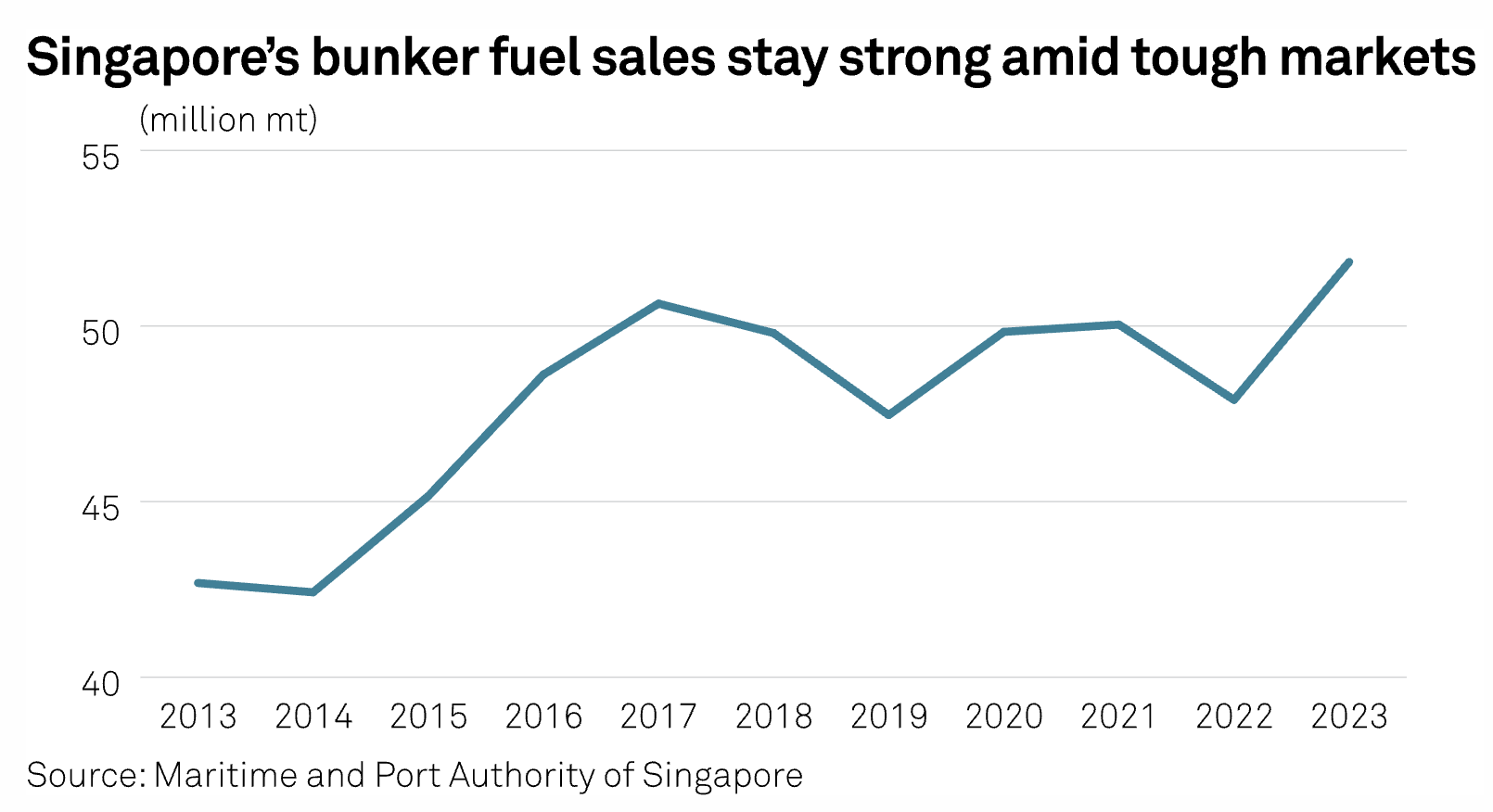

INTERVIEW: Singapore's EMF Steps Up Decarbonization, To Include LNG Bunkering In Portfolio

Singapore's top bunker fuel supplier, Equatorial Marine Fuel Management Services, is riding on a wave of decarbonization initiatives that include promoting the supply of methanol, biofuels, ammonia and LNG as marine fuels in the city-state, its executive director Choong Zhen Mao told S&P Global Commodity Insights in an interview. In 2023, marine fuel sales hit a record high of 51.82 million mt at the port of Singapore, the world's largest bunkering hub, latest data from the Maritime and Port Authority of Singapore showed, up from the previous record of 50.64 million mt registered in 2017.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Energy & Commodities

Listen: What's In Store For OPEC+ In 2024?

With OPEC suggesting in its monthly oil market report that global oil demand growth will outweigh an expected increase in non-OPEC supply across 2024 and 2025, market watchers will be keen to see how the group and its allies respond to still slumping oil prices. In this episode, S&P Global Commodity Insights’ Jim Burkhard, Rosemary Griffin and Charlie Mitchell join Herman Wang to discuss the key points of the group’s latest report, OPEC supply from a wider geopolitical and economic outlook, as well updates on Libyan output and Angola’s decision to leave OPEC at the end of 2023.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

How Is Buy Side Risk Technology Adapting To A Shifting Risk Landscape?

In a high-rate environment marked by heightened volatility, as well as an intensified focus on climate risk factors, the buy-side risk management landscape is undergoing a dynamic transformation. In this interview with Risk.net, Luke Armstrong, product head of buy-side risk at S&P Global Market Intelligence, discusses the expanding role of buy-side risk teams, the comprehensive integration of risk factors and how technology can help risk managers navigate a dynamically shifting risk landscape.

—Watch the video from S&P Global Market Intelligence