Discover more about S&P Global’s offerings

Climate-related disasters are leading to increased claims across the insurance industry. As floods, heat waves, fires, and extreme weather becomes more common, insurers are re-evaluating their exposure.

The tragic wildfire that recently destroyed most of Lahaina, Hawaii, is the deadliest in modern U.S. history. The death toll already surpasses that from the 2018 Camp fire, which destroyed the town of Paradise, Calif.

Insured property losses will be significant, but S&P Global Ratings doesn't expect to take any rating actions as a result. The rated property/casualty insurers that are active in the Hawaii property insurance market are large national insurers or part of large multinational insurance groups. Losses for reinsurers are expected to be low.

Life insurers will be paying death benefits to the survivors of covered individuals who perished, while health insurers will be covering the cost of care for people who were injured. S&P Global Ratings doesn't expect to take any rating actions on insurers in either of these markets.

Read the Full ReportTotal Canadian gas production was estimated at 17.7 Bcf/d June 7—down from a peak of more than 18 Bcf/d in late May. Prior to the outbreak of wildfires across Alberta in early May, Canadian gas production had averaged about 18.5 Bcf/d from January through April, legacy IHS PointLogic data from S&P Global Commodity Insights showed.

Read the Full ArticleMassive forest fires scorching swaths of Quebec in recent weeks have forced some gold miners to suspend operations and many explorers to halt fieldwork due to safety concerns and restricted access to public lands.

Read the Full ArticleCanada's crude production has been reduced in recent weeks by wildfires in Alberta, tightening price discounts for some Canadian crude grades. While the bulk of output has returned, and longer-term output is expected to rise 500,000 b/d by 2030, high development costs are threatening that outlook, with Equinor announcing a delay of its Bay du Nord project.

S&P Global Commodity Insights' Jeff Mower, director of Americas oil news, discusses these market conditions and their impacts with Americas crude pricing reporter Julia Pecha and Calgary correspondent Ashok Dutta.

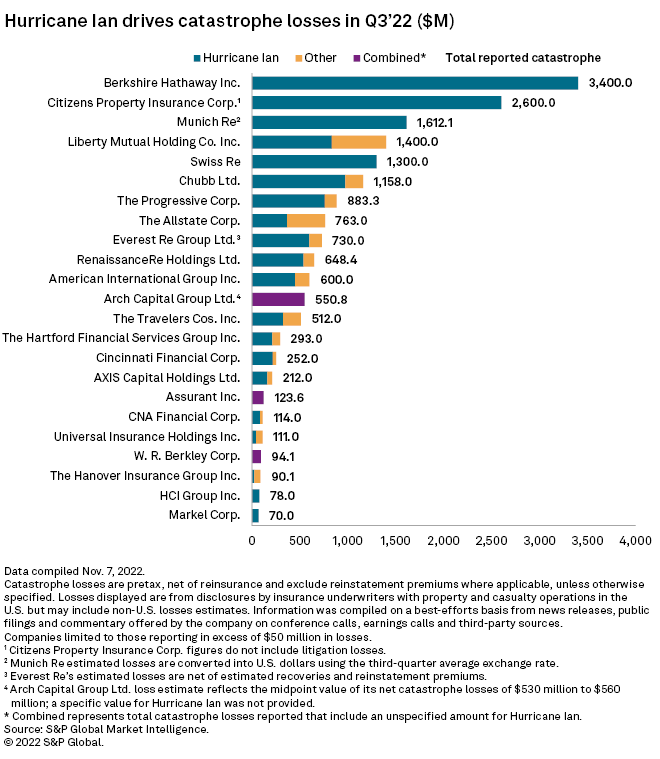

Learn MoreDamage from Hurricane Ian led to significant catastrophe losses for many large property-casualty carriers and reinsurers and for Florida's insurer of last resort, Citizens Property Insurance Corp., during the third quarter of 2022.

Many of the reporting companies in the S&P Global Market Intelligence analysis were affected by the hurricane, which hit the southwest coast of Florida as a Category 4 storm on Sept. 28 with 150 mph winds and dumped over 10 inches of rain on the state.

Berkshire Hathaway Inc.'s insurance and reinsurance operations reported catastrophe losses of $3.4 billion from Ian, the highest of any insurer that has reported specific losses.

Citizens Property, the largest insurer in the Sunshine State, reported a catastrophe loss total at $2.6 billion. The company had processed 100,000 claims from policyholders affected by Ian as of Oct. 14, according to an email from company spokesman Michael Peltier.

Several of the smaller Florida-centric carriers reported losses as well. HCI Group Inc. reported $78 million in losses from Ian, Heritage Insurance Holdings Inc. had $40 million and United Insurance Holdings Corp. absorbed losses of $36.4 million.

Read the Full Article

Florida-based property and casualty insurers and other large carriers that underwrite auto and home insurance in the Southeastern US performed relatively well in the stock market this week despite the arrival of Hurricane Idalia.

Read the Full ArticleA recent winter storm sent a chill down the spines of investors as the wintry weather that plagued North America in December 2022 resulted in higher-than-expected losses for property and casualty insurers.

Read the Full ArticleIn 2022, the world experienced major climate-related disasters ranging from flooding and hurricanes to drought and extreme heatwaves. Moreover, 2022 was the sixth-warmest year on record, according to scientists at the U.S. National Oceanic and Atmospheric Administration, or NOAA.

Learn MoreS&P Global Ratings assesses the industry and country risk of New Zealand's property/casualty (P/C) insurance sector as intermediate. This assessment is the third lowest on our scale and is in common with China, Japan, Korea, Taiwan, the U.K., and the U.S.. The intermediate risk assessment derives from our view of the sector's moderately low industry risk and New Zealand's low country risk.

Read the Full ReportEfforts by U.S. property and casualty insurers to more accurately match rate to risk will drive outsized premium growth in those business lines and geographies most exposed to emerging perils.

The effects of climate change have caused some carriers to continually adjust their appetites for writing homeowners business in areas most exposed to hurricanes over the past 30 years. This process gained particular intensity after the devastating hurricane seasons of 2004 and 2005 led to a broad reevaluation of the frequency and severity of tropical cyclones.

Read the Full ReportCommercial auto consistently ranked as one of the U.S. property and casualty industry's worst-performing lines prior to the pandemic, but recent results suggest that the tide has at least temporarily turned.

Read the full articleS&P Global Ratings recently revised its view on the U.S. property/casualty (P/C) sector to negative from stable, reflecting our expectation of weaker credit trends over the next 12 months, including more negative than positive rating changes and a negative shift in the distribution of rating outlooks. S&P Global Ratings' view on the sector reflects several factors.

Inflation, and to some extent, competition, in motor and medical lines should drag on insurers' underwriting performance in 2022-2023. However, despite macroeconomic headwinds, insurance is one of the highest rated sectors globally. The report highlights our 2023 forecasts for key performance metrics, notably in relation to market profitability and growth.

In 2022, the global reinsurers saw another record year of natural catastrophe losses. The estimated insured losses of $125 billion were well above the long-term average expectation for the insurance industry. As a result, catastrophe budget expectations were exceeded for another year for the top 20 global reinsurers.

Despite the growing cost of natural catastrophes, and the apparent divide in strategy observed in recent years, 2023 and 2024 could be a turning point for visible earnings improvements in the space. More reinsurers may aim to grow their catastrophe exposures as pricing continues to improve and demand remains strong. Still, many reinsurers entered 2023 with a cautious stance on property catastrophe risk.

Read the Full ReportW. R. Berkley Corp. took advantage of some opportunities in the property catastrophe space during the most recent reinsurance renewal season but is holding off on taking a deeper dive into the market for now.

"We put more than a toe in the water, but not more than a foot, and that's just because of our view of volatility," CEO Rob Berkley said during an during a conference call. "In addition to that, we're going to see what type of opportunities there are in the first quarter and the balance of the year, particularly with some shortfalls in certain market participants' covers."

Read the Full ArticleEuropean insurers' and reinsurers' shorter-term goals to cut underwriting emissions are under pressure as several countries across the continent return to fossil fuels to stave off energy shortages triggered by the Russia-Ukraine war.

Read the Full ReportSeveral global insurers have recently announced more ambitious strategies to cut carbon emissions from their underwriting and investment portfolios, but exceptions and gaps in their policies cast doubt on the likely effectiveness of those targets.

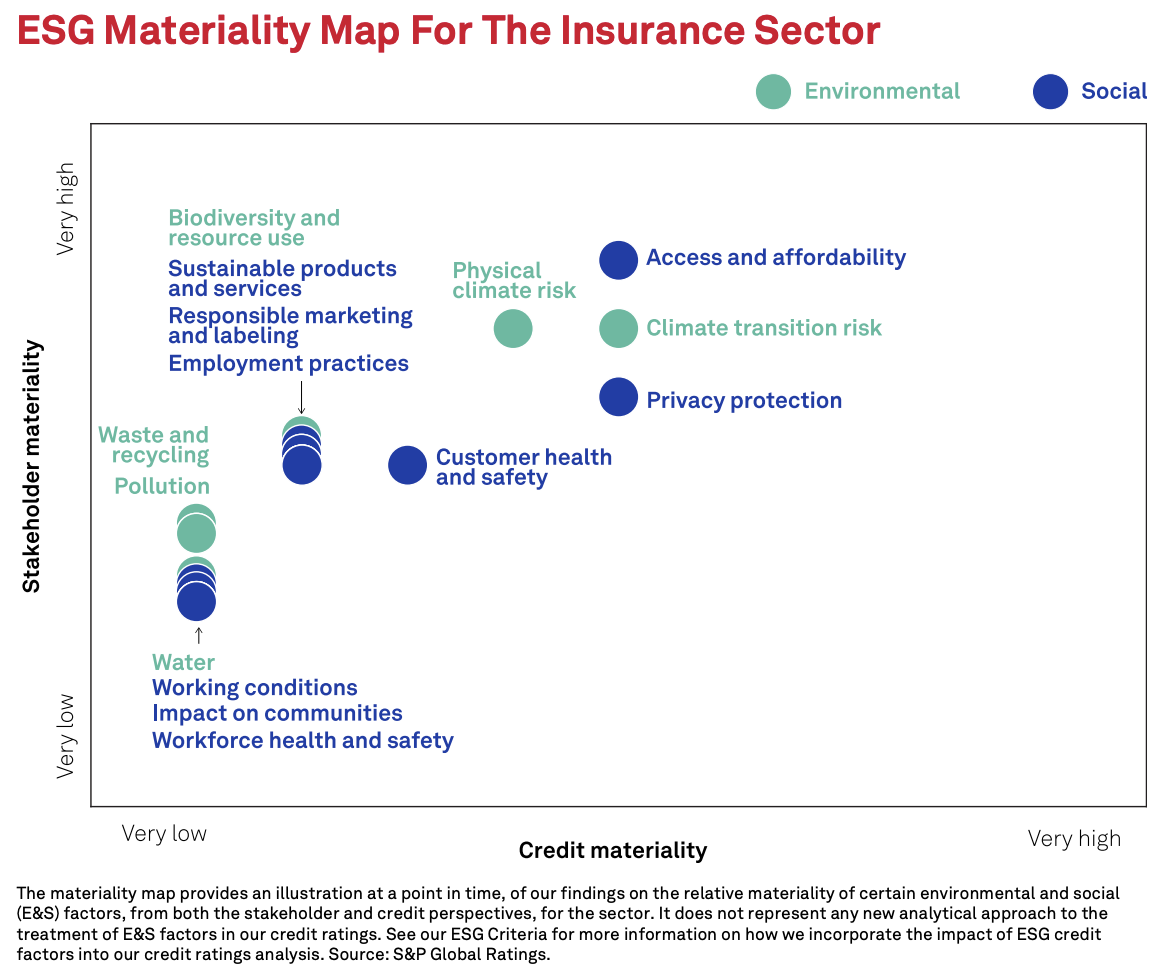

Read the Full ArticleEnvironmental and social factors are material from both the stakeholder and credit perspectives, but less so than for most industrial sectors. Access and affordability, privacy protection, and climate transition and physical climate risks are among the most material factors.