Discover more about S&P Global’s offerings

India’s mobility sector is on the cusp of a major transformation. Aspirational car buyers are trading up to SUVs and electric vehicles, while other drivers are shifting to shared services amid environmental and infrastructure challenges.

Published: August 3, 2023

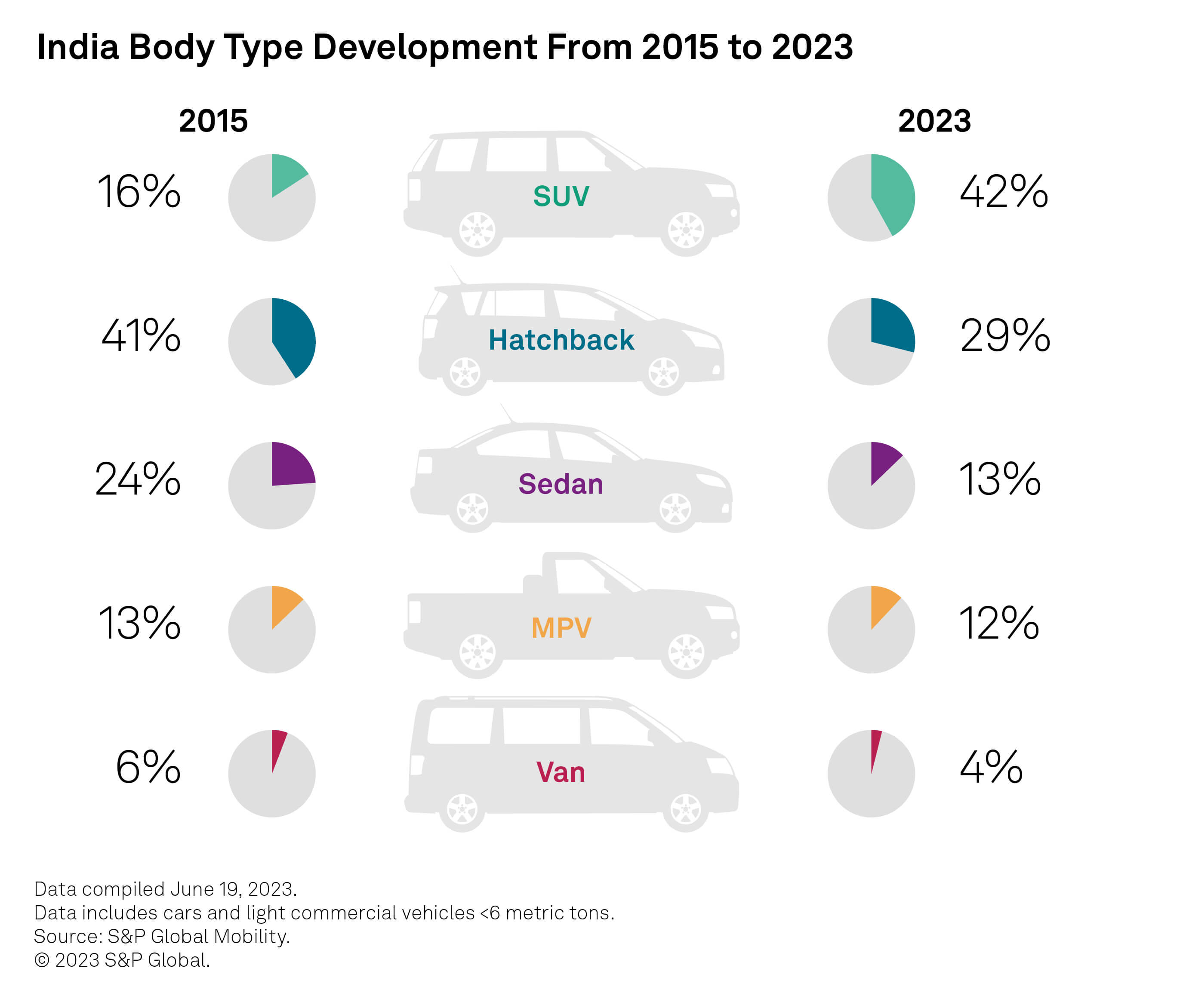

India’s light-vehicle market has grown from “small is beautiful” to favoring larger models. SUVs already account for more than 40% of sales, and their share will top 50% by 2030.

Total sales will grow to 6.1 million units in 2030, from 4.4 million in 2022, helped by India’s economic growth and investment in the national highway network.

Urban infrastructure is still a challenge, leading to congestion and pollution in large cities. This may spur demand for shared vehicle services as well as public transport.

Two decades ago, a popular slogan in India’s vehicle market was “small is beautiful.” The outside world’s view was encapsulated by decidedly developing-world mini cars. This relegated India to the status of an economy-car market.

Today, more than 40% of Indian light-vehicle sales are SUVs, reflecting consumer preferences for larger and more spacious rides. An increase in national highway construction has accelerated this trend.

Indian light-vehicle sales, comprising cars and light commercial vehicles, will grow to 6.1 million units in 2030 from 4.4 million units in 2022, according to an S&P Global Mobility forecast. SUVs will surpass 50% of demand. The nation has already passed Japan to become the third-largest vehicle market globally. It is also the largest two- and three- wheeled automobile producer and the second-largest bus maker.

Continued industry growth will be challenged by infrastructure hurdles, particularly within cities. This will make personal mobility far more important than individual car ownership.

Continued industry growth will be challenged by infrastructure hurdles, particularly within cities. This will make personal mobility far more important than individual car ownership.

Existing congestion in big Indian cities shows how urban infrastructure may limit the auto industry’s growth. Today, there are more than 100 registered vehicles per kilometer of road in many big Indian cities. This often leads to gridlock and protracted journey times even for shorter trips.

Traffic jams also cause pollution, which is another deterrent against further private vehicle ownership. Forty of the world’s 100 most-polluted cities are in India, with Delhi ranked as the worst, according to air-quality monitoring company IQAir. A scrappage scheme may help to eliminate old fuel-guzzling, high-emission vehicles.

Pollution and congestion could spur demand for public transportation in India. The nation has about 2 million buses on the road. Still, this is only about 1.2 per 1,000 people, which is notably less than in developed markets. This does provide massive headroom for growth. Presently, many states have started switching to e-buses and adopting a public-private partnership model, where the government pays bus operators per kilometer of service. E-buses will rise to 9% of the total bus fleet by 2026 and to 30% by 2030, according to S&P Global Mobility.

Sales of commercial vehicles will also likely increase as economic growth stokes goods shipments and infrastructure development. India’s GDP will expand 6.7% per year from fiscal 2024 to fiscal 2031, reaching $6.7 trillion, according to an S&P Global forecast.

The pandemic and subsequent lockdowns also spurred the use of vehicles for hyperlocal deliveries, with goods being brought to consumers instead of the other way around. The associated rise of e-commerce and startups will likely fuel sales growth for two-wheelers and light commercial vehicles in coming decades.

The automotive industry is a key contributor to the Indian growth story as it generates almost 7% of GDP and provides a livelihood to more than 40 million households spread evenly across the nation. The industry is also adapting to growing urbanization, rising aspirations, higher incomes and stricter regulations.

The industry is adapting to growing urbanization, rising aspirations, higher incomes and stricter regulations.

The average price of a car has more than doubled in India over the past decade to 1,150,000 Indian rupees (about $14,000) from 450,000 Indian rupees. This is an opportunity for global carmakers, as it reflects Indian drivers’ willingness to pay up for feature-loaded and robust vehicles that offer safety and security. Still, cars will continue to be overshadowed by two-wheelers in terms of units. The two-wheeler market will reach 27 million units in 2030, more than four times the size of the light-vehicle market, according to S&P Global Mobility. Half of these two-wheelers are likely to be battery-electric.

We predict that shared mobility, such as ride-hailing services and car-sharing platforms, will gain further traction in India. Car subscription services — where consumers pay a monthly fee for access to a vehicle — are also gaining popularity. These developments reflect a focus on cost-effective and convenient transportation, along with changing consumer preferences. Indian millennials and Gen Z consumers are less interested than Gen X and baby boomers in owning a car. The shift toward shared mobility will help to increase vehicle utilization, which is extremely low. On average, cars are in use less than 5% of the time in India.

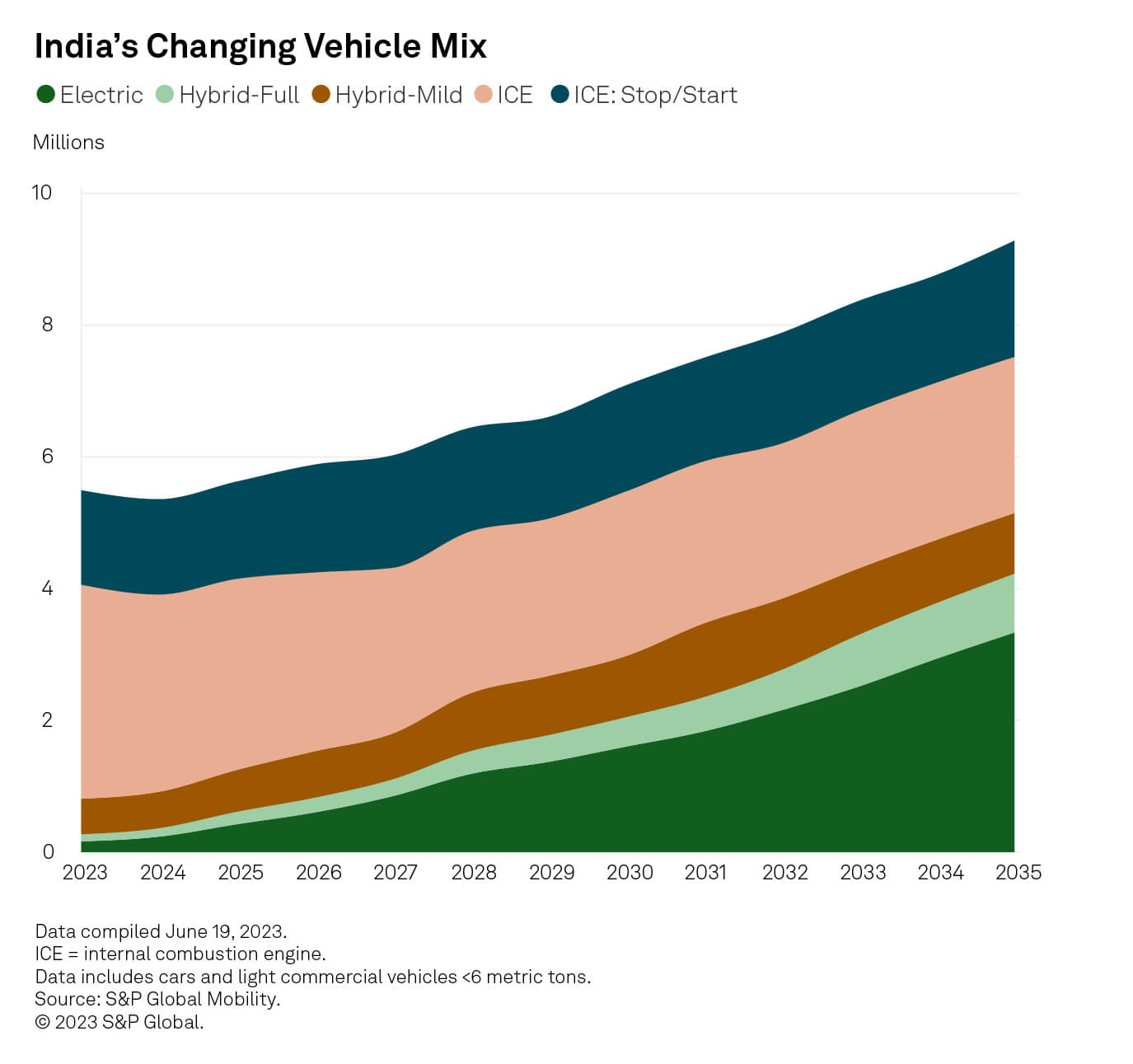

In the medium term, India will likely adopt a range of power technologies for vehicles due to each state having its own unique set of challenges. Different states will need different solutions, possibly including smart cities, reskilling, digitization and tweaking the models offered by carmakers in various parts of the country. A wide variety of technologies will also likely serve the diverse needs of customers all over India, such as internal combustion engines (ICEs), compressed natural gas, electricity, hydrogen, flex fuels and biofuels.

The auto industry is already taking advantage of greater electrification in India. Original equipment manufacturers, parts suppliers, fuel-filling companies, the government, testing agencies and others are working toward a common goal of supplying greener transportation. Stakeholders across the sector are stretching themselves and adopting innovative technologies at an ever-quicker pace. The government is proactively working to reduce pollution and cut energy imports by promoting greener mobility and technologies.

Over the longer term, green hydrogen may emerge as India’s main alternative fuel for mobility. A few Indian players are already engaging in the government’s $2.1 billion Production-Linked Incentive scheme for hydrogen. This may eventually help the technology scale and deliver on India’s decarbonization objectives. The country has pledged to reach net-zero emissions by 2070. Some conglomerates aim to achieve that goal in India by 2037.

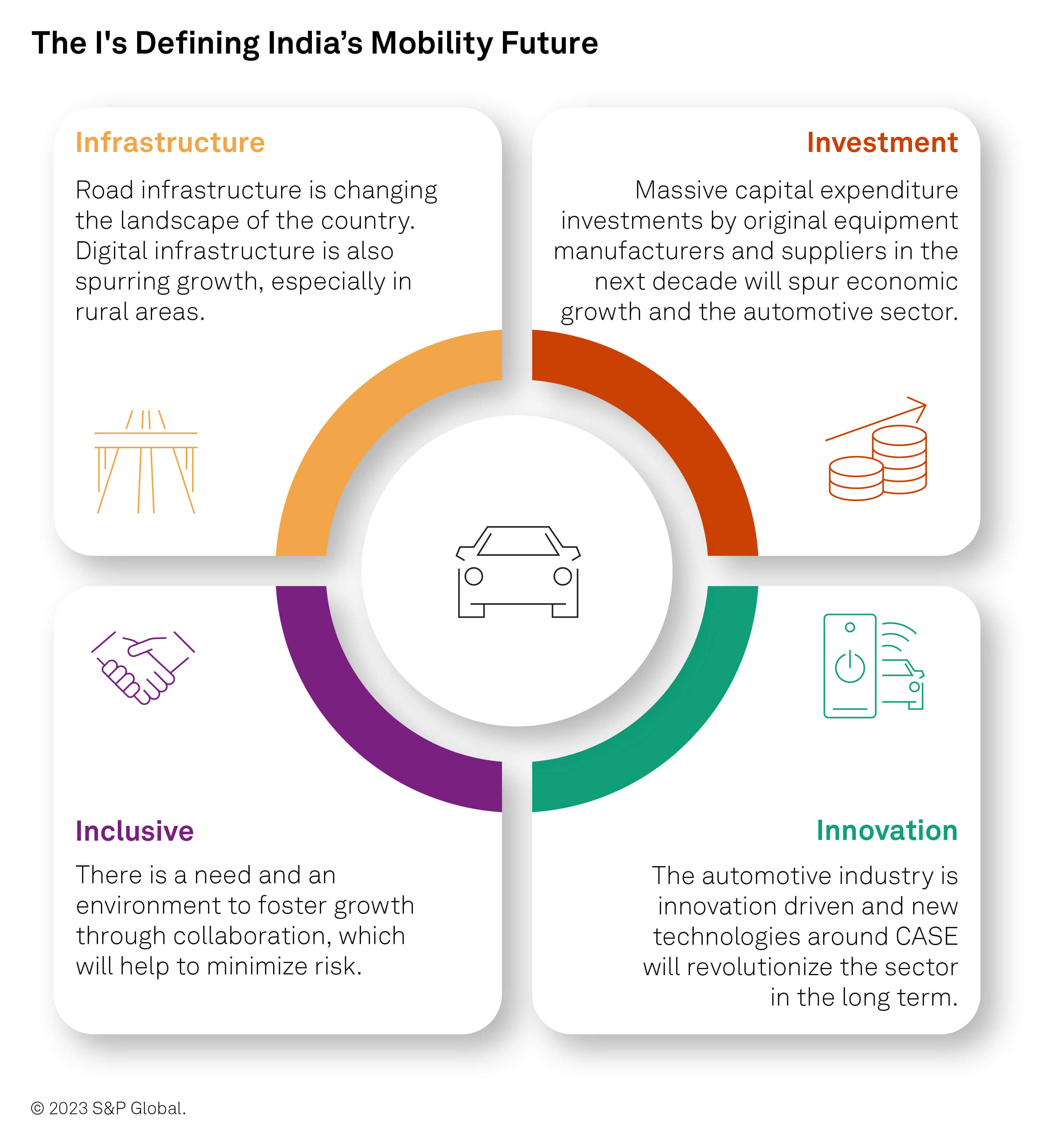

India’s mobility sector is poised for growth, building on four I’s: infrastructure, innovation, investment and inclusiveness.

India’s mobility sector is poised for growth, building on four I’s: infrastructure, innovation, investment and inclusiveness.

Infrastructure: There is massive development in road infrastructure, which is changing the landscape of the country. Digital infrastructure is also spurring growth, especially in rural areas.

Innovation and technology: Globally, the auto industry is seeing a “race for CASE,” meaning connected, autonomous, shared and electric. In India, connected, shared and electric are likely to predominate. Autonomous vehicles may be limited to nonpublic areas, such as college campuses or large corporate facilities.

A key innovation goal for Indian carmakers is developing battery-electric vehicle technologies that are affordable for the local market. Core and peripheral EV infrastructure will also have to be built. Still, once the technology becomes cost effective, Indian drivers will see EVs as a viable alternative to conventional ICE technology.

Investment: Car manufacturers and suppliers are set to spend more than $15 billion on capital expenditure in India through 2030. This is to meet consumer demand and develop new technologies.

Inclusive growth: Mobility depends on an ecosystem. Carmakers, parts suppliers, fuel-filling companies, energy providers and the government must all collaborate on common platforms to provide affordable and efficient mobility solutions.

India’s mobility sector is on the cusp of a major transformation. Consumer aspirations are spurring a shift in vehicle sales toward SUVs, while environmental concerns are helping to fuel demand for alternative propulsion systems.

Consumer aspirations are spurring a shift in vehicle sales toward SUVs, while environmental concerns are helping to fuel demand for alternative propulsion systems.

Elsewhere, shared mobility will play an important role for effective utilization of vehicles, and better public transportation may ease congestion and pollution.

Still, the mobility of 1.4 billion people needs to be transformed around the four I’s to realize a greener future. This change must be made gradually, and it will require infrastructure developments and technological advancements to make future mobility accessible to all.

What is your vision for sustainable mobility in India?

We know mobility is key for economic growth and livelihood security, particularly in our urban areas, where work and home are distant. My vision is a mobility system that is affordable and accessible for all, yet modern, convenient and clean. Let me explain why I say this. Currently, as per official data, the bulk of people in our cities do not drive personal vehicles; less than 15%-20% on average commute by personal car. Yet personal cars take up the bulk of our road space, and, like other cities in the world, we are struggling to build more highways and fight the battle of the bulge. A city like Delhi has over 25% of its land area under road infrastructure, 90% of which caters to the 15%-20% of the commuting population that travels in personal vehicles. The bulk of people in cities still walk, cycle or take the bus, or now the metro — this is where the huge opportunity is. We need to envision and reengineer our cities so that people can use public transport that is massively augmented and available to all. Most importantly, for public transport to work, we need last-mile connectivity. People cannot take a bus or metro if they cannot walk or cross the road — our cities need to be redesigned not for the ease of moving vehicles but moving people.

What is the link between mobility and sustainability in India?

We face a challenge of toxic air pollution, which is endangering our health. The key contributors to pollution are vehicles in our cities and the use of unclean fuel for energy. This is in spite of the huge efforts made by the government to introduce clean fuel and vehicle emission standards. The fact is we have a large fleet of older vehicles, and as we introduce newer, cleaner variants of fuels, the sheer number of older vehicles on the road negates the impact of cleaner fuels. Congestion on roads adds to pollution as well.

We also know that transport-related emissions are a key contributor to greenhouse gas emissions. So, as India moves to transforming its mobility systems, it will improve air quality in our cities as well as decarbonize our transport sector. It is a clear opportunity for co-benefit. This is particularly important as we can see that with only 15%-20% of people driving, the airshed is polluted. We literally do not have the space for the remaining 80% of people to drive personal vehicles, which will then contribute to emissions. Like the issue of climate justice in our world, this needs policies deliberately designed to cater to the growing needs of people, and, in this case, it means building mobility systems of the future that are suitable for all.

Does electric mobility play a role in this transformation in India?

Indeed it does, but not in the way the rest of the world is approaching electric mobility. The focus on e-mobility for private transport is not a game changer in a fast-warming world. This is particularly because there are constraints on minerals and the management of batteries and other issues when it comes to e-vehicles. The Indian government has recognized this, and its programs have incentivized e-buses and paratransit vehicles like three-wheelers. This means that we are investing in e-vehicles for the transport for the majority — over 15,000 e-buses will soon be on roads in key cities in the country. The Ministry of Housing and Urban Affairs is providing guidance to cities to invest in public transport. This now needs to be augmented and interconnected to intra- and intercity mass transport systems, including fast-track railways and metro-rail systems. This electrification of transport systems will help to clean local air. This is a huge opportunity for our cities.

Contributor:

Gaurav Sharma

Senior Analyst (Automotive Sales Forecast),

S&P Global Mobility

gaurav.sharma2@spglobal.com

Electrification technology in reshaped supply chains for ubiquitous EVs | S&P Global (spglobal.com)

A revolutionary road | S&P Global (spglobal.com)

Autos and Sustainability: From Compliance to Leadership | S&P Global (spglobal.com)

What consumers want, and what the network can deliver | S&P Global (spglobal.com)

Next Article:

'Make In India' Manufacturing Push Hinges on Logistics Investments

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.