Discover more about S&P Global’s offerings

Published: May 9, 2023

Bull and bear runs in the crypto market have both coincided with periods of ultraloose monetary policy and of significant tightening. While the recent rapid increase in interest rates could have a negative impact on crypto markets, idiosyncratic factors also seem to play a large role.

Crypto assets could theoretically be a hedge against inflation. We think the track record for crypto is too short to prove this. We have seen greater adoption of cryptocurrencies in certain emerging markets with high inflation and rapid depreciation of the local currency.

The dollar has been generally inversely correlated with prices of crypto assets.

Crypto markets appear to perform strongly during periods of low market volatility and less well during high volatility.

Cryptocurrency prices seem to be less affected by macroeconomic factors than prices of more traditional financial assets. Key drivers for crypto assets include market confidence, adoption, technology and liquidity conditions (see Table)¹. By contrast, traditional financial assets are strongly influenced by macroeconomic drivers, such as interest rates and inflation. These traditional assets also differ from crypto in being subject to government regulations and in being more transparent in terms of know your-customer requirements and anti money laundering measures.

Table 1

Interconnections between the crypto ecosystem and macroeconomic factors show up in the fact that favorable market conditions increase investors’ appetite for higher risk assets, such as crypto currencies. Changes in interest rates and borrowing costs could impact crypto markets through different channels than for traditional assets. For example, financing costs influence venture capital firms’ decisions to invest in startups that want to build applications on blockchains (such as Ethereum), and consequently drive blockchain adoption. Likewise, for blockchains that lack an application layer and only have a transaction layer (such as Bitcoin), higher costs for financing mining rigs and warehouse space will lower marginal profits for miners. This difference is explained by the crypto assets’ different value proposition. Bitcoin’s value proposition is determined by transaction volumes and mining of these transactions, while Ether’s comes from transaction validation, and additionally through the utility of applications built on the Ethereum blockchain. Due to their short history and speculative nature, we acknowledge that existing trends may change. New trends might affect how macroeconomic factors impact the crypto ecosystem, especially as more retail and institutional investors expand their investment portfolios to include crypto.

The recent period of historically low interest rates fueled investors’ appetite for higher-yielding assets. The 2021 bull run in the crypto market coincided with a period of ultra-loose monetary conditions, eliciting the question of what impact, if any, low interest rates had on crypto valuations. By the same logic, as we are in a period of tighter monetary conditions, driven by higher interest rates and the reversal of Quantitative Easing (QE) – known commonly as Quantitative Tightening (QT) – it is of interest to understand the impact these dynamics will have. To better understand this relationship, we dove into the crypto ecosystem and analyzed the relationship with key macroeconomic factors using data through March 2023.

In this article we address the following questions:

1. Does monetary policy matter to crypto markets?

a. Do crypto prices correlate to changes in interest rates?

b. Do quantitative easing and tightening make a difference in cryptocurrency markets?

c. Is money supply important for the crypto ecosystem?

2. Does perception of a possible incoming recession matter for crypto markets?

3. Can crypto assets be a hedge against inflation?

4. What does a strong or weak dollar mean for crypto markets?

5. Do financial stress and market volatility spill over into the crypto ecosystem?

The past decade appears to show that crypto markets perform well when there is fast growth in a broad measure of money supply (M2), stemming from a reduction in interest rates, quantitative easing and fiscal stimulus. Conversely, monetary tightening seems to have restricted appreciation of crypto assets, or even contributed to depreciation. In this section, we analyze how these relationships hold over time and focus on interest rates, and other monetary policy measures that influence money supply, such as quantitative easing.

The US Federal Reserve’s (Fed’s) actions influence the global economy, arguably including crypto markets. Low interest rates increase appetite for assets with higher risk and higher returns. In reaction to the decline in economic activity as a result of the Great Recession (2007-2009), the Fed and other central banks lowered interest rates to zero and held them at that level for just shy of a decade. During that period, demand for higher-yielding assets, including speculative grade credit was very strong. Global high yield issuance increased from less than $50 billion in 2009 to more than $250 billion in 2014. This demand for higher-yielding assets could also have extended to crypto assets.

Conversely, when the Fed, and other major central banks increase benchmark interest rates, higher-yielding assets become less attractive. It could be argued that the same applies to crypto assets. We analyze whether this inverse relationship between interest rates and crypto prices is supported by the data.

We use the risk-neutral yield on the 2-year US Treasury bond to gauge short-term market expectations on the evolution of US interest rates – it reflects what markets are pricing in for the Fed funds rates two years from today, according to the ACM model developed by the Fed. To study the crypto markets, we use the S&P Cryptocurrency Broad Digital Market Index (S&P BDMI). We focus our analysis on data from February 2017 (when the index started) to March 2023. In some cases, we look at longer time periods and will use Bitcoin prices.

The S&P Cryptocurrency Broad Digital Market Index (S&P BDMI) reflects a broad investable universe of digital assets listed on open digital exchanges. Assets have to meet minimum liquidity and market capitalization criteria. Lukka is the pricing provider. The index is weighted by the equivalent of market capitalization for cryptocurrencies (coin supply multiplied by coin price). Bitcoin represents 40% of S&P BDMI, so the index is highly correlated with Bitcoin prices.

In Chart 1, we plot S&P BDMI and the 2-year Risk-Neutral Treasury Yield. Since 2017, the two indices exhibit a historical correlation of –0.33.

Chart 1

On a daily rolling three-month basis (chart 2) interest rates and the crypto index have exhibited an inverse relationship 63% of the time since May 2017. This increases to 75% from May 2020, following the start of the COVID-19 pandemic. The inverse relationship is generally in line with how we would expect traditional assets to behave.

Chart 2

Some argue that crypto assets could be in demand in a high interest rates/high inflation environment because they could serve as a store of value. We think the track record for crypto is too short to prove this. We study the relationship between crypto assets and inflation in section three of this report.

When interest rates hit the zero bound after the Great Recession, and economic growth remained sluggish, central banks sought additional tools to stimulate activity. One was Quantitative Easing, in which central banks purchase mostly government-issued fixed income securities, typically of relatively long maturities. This let central banks further ease financial conditions and reduce long-term financing costs by lowering term premia in government bonds.

In the US, three QE rounds took place in 2009-2014, leading up to the Taper Tantrum of May 2014 when bond yields surged after Fed officials announced plans to reduce the pace of Treasury bond purchases. Then in 2018, the Fed started reducing its balance sheet by lowering the amount reinvested from maturing securities through Quantitative Tightening. A new emergency QE program was introduced in 2020 during the COVID-19 pandemic, before the resumption of QT in 2022. The Fed’s balance sheet peaked at nearly $9 trillion in early 2022 and has since gradually fallen to roughly $8.7 trillion.

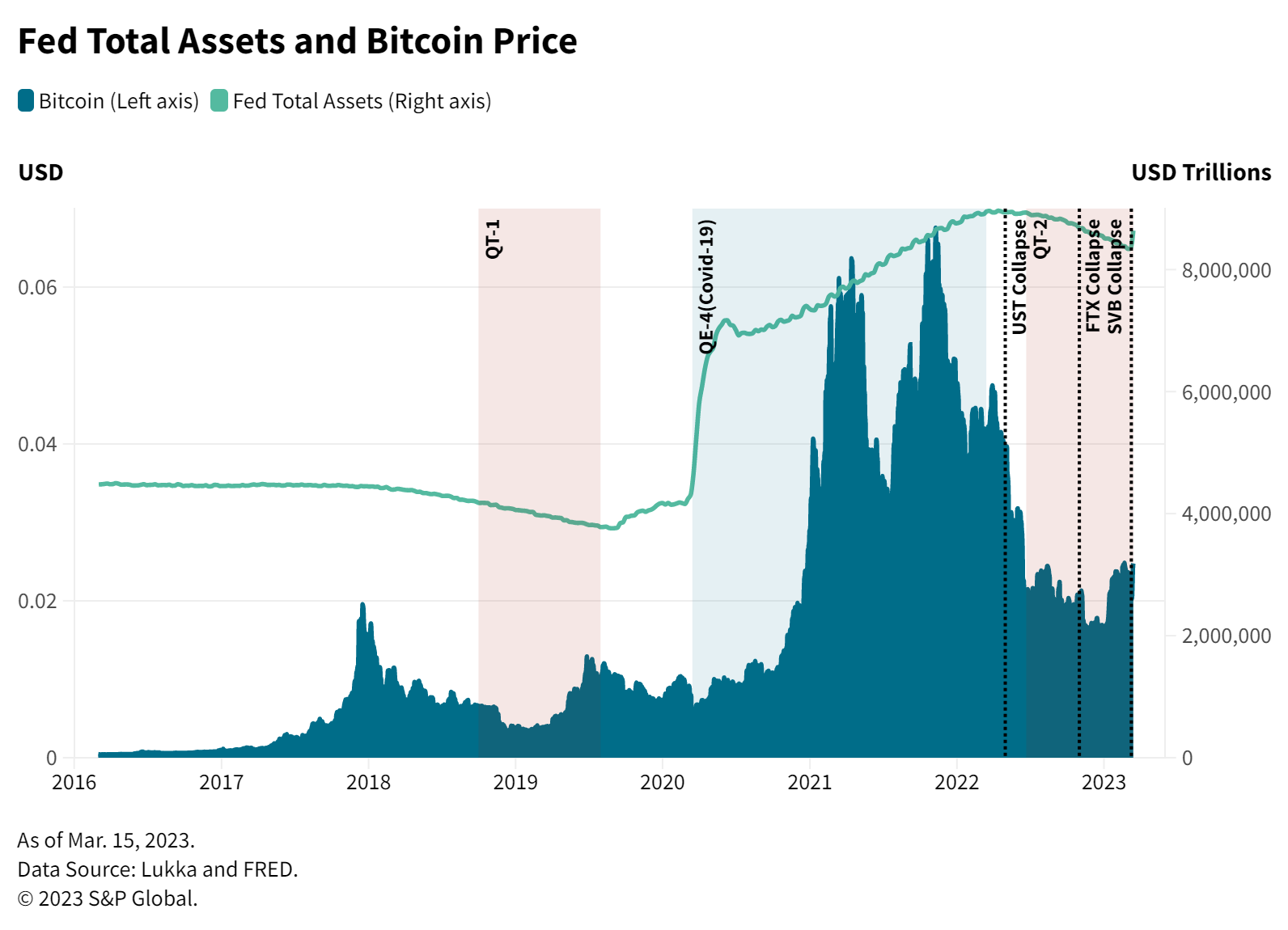

QE fueled appetite for higher-risk assets (in search of higher yield). Arguably, increased global liquidity/money supply, in an environment of favorable market conditions, should also have a positive impact on the crypto market, all else held equal. Unprecedented levels of monetary easing by central banks across the world since 2008/09 have increased money supply to record levels. Chart 3 below shows the total assets on the Fed’s balance sheet and the price of Bitcoin since 2016. The markers highlight the fourth round of QE, which began in 2020, and the two periods of QT.

Chart 3

After a Bitcoin rally in 2017, a significant price slump in 2018 coincided with the Fed’s balance sheet reduction program. There was another bull run in 2020, in which Bitcoin appreciated 1,000%. It coincided with a QE program that started during COVID-19 in 2020 and with increased institutional interest in cryptocurrency markets.

Bitcoin reached a peak in November 2021 before entering a ‘crypto winter’ in which it lost more than two-thirds of its value over six months as market appetite for risky assets decreased. This downturn took place during a tightening monetary policy that started in June 2022. It was also coupled with crypto-specific events that followed the decreasing price trend, such as the collapse of stablecoin TerraUSD (UST) in May 2022 and of the cryptocurrency exchange FTX in November 2022.

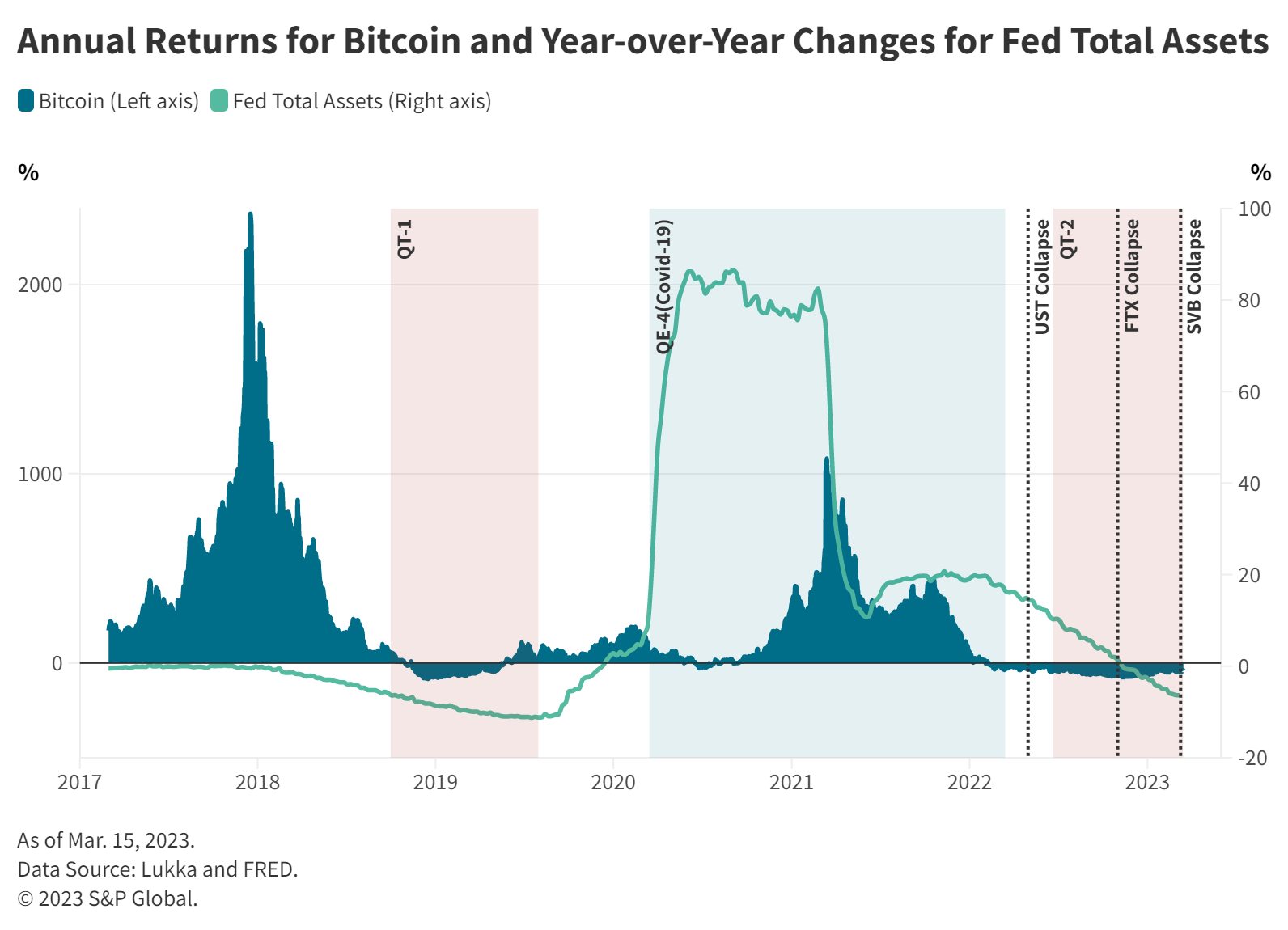

Chart 4 shows year-over-year changes for Bitcoin and the Fed’s balance sheet since 2017. Some periods of balance sheet reduction and tightening measures, captured by negative changes, are associated with bearish periods for Bitcoin. The 2020 expansionary period is followed by a glaring crypto rally.

Chart 4

Bitcoin’s rally in 2020 coincided with a QE program that started during COVID-19 and with increased institutional interest in cryptocurrency markets.

One can also look at QE and QT through the lens of the bond markets and study the relationship between bond premia and crypto prices. Term premia fell into negative territory during the 2020-2021 rally as another round of QE was implemented. This spurred investors’ interest in higher-yielding assets and high-return speculative investments like crypto. Chart 5 plots S&P BDMI and the 10-year Zero Coupon Treasury Term Premia.

Bond yields and premia are not always consistently impacted by QE and QT. For example, during the QT period in 2018-2019, the 10-year Zero Coupon Treasury Term Premia was initially positive and then turned negative. It has oscillated between negative and positive during QT since June 2022.

Chart 5

To assess the impact of global liquidity on crypto markets, we start by looking at M2 (a measure of money supply). M2 has surged since the Great Recession as central banks lowered interest rates and implemented QE. Chart 6 shows the relationship between M2 and S&P BDMI. M2 is the US Federal Reserve’s estimate of total money supply including all of the cash people have on hand plus money deposited in checking accounts, savings accounts, and other short-term saving vehicles. Since the 1980’s, M2 has exhibited exponential growth, particularly due to expansionary monetary policies during recessionary periods. In July 2022, M2 declined as the US reversed loose monetary policies.

Correlation between money supply and the crypto index is 0.75 over the historical period starting in 2017. This positive relationship notably broke down during 2018, as S&P BDMI fell, while M2 kept growing until July 2022. S&P BDMI’s decIine followed a crypto boom in 2017, when the market was flooded with initial coin offerings and new ventures, many of which ultimately failed. Both measures moved in the same direction in the second half of 2022. M2 contracted while the crypto market was hit by a series of events that fueled volatility and price declines, including the collapse of stablecoin UST in May and the downfall of cryptocurrency exchange FTX in November.

Chart 6

Chart 7 shows rolling three-month percent changes for M2 and S&P BDMI. Since 2017, changes for M2 have been generally positive, with a pronounced peak at the beginning of the pandemic, while the crypto index has exhibited several periods of negative returns. In the second half of 2022, both indices exhibited negative returns.

In general, crypto markets have performed well in periods of expansionary monetary policies, although we are not able to establish a causal relationship. Some of the large swings in crypto currencies have taken place following factors that are not directly related to monetary policy, such as the FTX collapse.

Chart 7

Growing recessionary risk could weigh on crypto assets if economic concerns dent appetite for higher-risk assets. At the same time, a recession perceived to be driven by poor government policies could arguably boost demand for crypto because the assets’ decentralized and borderless nature creates a potential shelter.

To understand whether recession risks weigh on crypto assets, we can use a widely followed gauge of economic expectations – the slope of the US Treasury yield curve. In particular, the difference between the yields on the 10-year Treasury Constant Maturity and the 3-month Treasury Constant Maturity, which has historically been a better signal of an incoming recession than other tenors. The yield on the 10-year Treasury is usually higher than that on the 3-month T-bill, giving the curve a positive slope. When this relationship inverts, it suggests that interest rates will fall in the future due to an economic slowdown. In the past, recessions have generally occurred whenever there was a sustained yield curve inversion. A notable exception is the current inversion that started in October 2022.

The yield curve has inverted three times since the 2008 recession. The first took place from March 2019 to October 2019, as above-target inflation prompted the Fed to increase interest rates, increasing expectations that the economy would fall into a recession. However, resiliency in the labor market prevented a recession during that period. The second inversion, at the beginning of the pandemic in February 2020, did not last long because of strong monetary and fiscal policies designed to mitigate the economic shock of COVID-19 restrictions. The yield curve inverted again in October 2022, as noted in the previous paragraph, and it remains in that state as of May 2023.

Chart 8 shows S&P BDMI and the difference between the 10-year and 3-month yields. When this difference is negative, the yield curve is inverted. The data is too short to find a consistent association between yield curve inversions and price declines for crypto.

Chart 8

Chart 9 below shows a more detailed view since late October 2022. Notably, S&P BDMI has more than recovered since losing 25% of its value in November 2022, even with the yield curve remaining negative. Some of the crypto volatility was linked to the implosion of digital-asset exchange FTX and its domino effect in the crypto lending space, as well as general uneasiness about crypto risks and governance.

Chart 9

If a recession is caused by inflation, or poor government policies, investors may look at crypto assets as a safe haven because they are decentralized, not tied to any country or government, and at least partially driven by factors such as technology and market sentiment. In countries where national currencies are unstable, the crypto market offers an alternative for preserving purchasing power. A handful of countries have adopted crypto as legal tender.

Fiat currencies in emerging markets can exhibit large and recurring depreciations, or be characterized by limits on convertibility to hard currency. By contrast, crypto assets have the potential to weather economic shocks and remain a unit of account and medium of exchange. This perception may have helped to fuel adoption of cryptocurrencies in developing nations. Crypto gained popularity as a means of remittance payments and for sending money across borders. It is now seen by many as an enticing investment opportunity as well, which has encouraged the launch of several asset management products that include crypto assets.

In countries with unstable currencies, crypto assets potentially offer an alternative for preserving purchasing power.

During their limited life, crypto assets have had bull and bear periods that are not directly tied to macroeconomic inflationary shocks. This helps to explain why adding crypto to a traditional portfolio increases returns, at the cost of also raising volatility. We also observe that retail investors in emerging markets with weak currencies and hyperinflation have turned to crypto assets to protect their wealth.

Inflation is generally associated with an overheated economy after expansionary monetary and fiscal policies have increased aggregate demand. In some cases, it is also the result of negative supply shocks. Fiscal policies that increase disposable incomes above sustainable levels raise consumption, leading to demand-driven inflation. They also boost investment, including in assets that generate higher returns, such as crypto.

A frequently asked question is whether crypto assets can be a good hedge for inflation. Bitcoin and other crypto assets should be less correlated to instabilities in a financial system due to their decentralized nature. High fungibility also makes crypto a potentially strong candidate to store value in unfavorable economic conditions. Still, this is a complex topic, and the data may be too short to confidently address it.

We analyzed the relationship between inflation and the crypto ecosystem over the past six years – a period featuring a transition from low inflation pre-pandemic to markedly high rates. We also used the relationship between inflation and gold (a traditional inflation hedge) since 1982 as a comparison. If crypto follows the path of “digital gold”, returns should be positively related to changes in US inflation expectations.

For average US inflation expectations, we use 2-year and 10-year breakeven inflation rates, derived from the relevant Treasury Constant Maturity Securities and Treasury Inflation-Indexed Constant Maturity Securities. The rates measure inflation expectations in the short and longer term. We use US inflation expectation as crypto tends to be priced in dollars and the market for financial instruments linked to inflation is liquid and well established. In countries with unstable currencies, crypto assets potentially offer an alternative for preserving purchasing power.

Chart 10 below shows S&P BDMI and breakeven inflation expectations. The 2-year breakeven inflation rate dipped into negative territory during the pandemic when the yield on Treasury Inflation-Protection Securities (TIPS) exceeded the yield on Treasuries.

Chart 10

The historical correlation between the daily returns of S&P BDMI and the inflation expectation indices is low, around 0.10.

Looking at rolling three-month returns for S&P BDMI and 10-year breakeven inflation expectations in chart 11 shows no conclusive pattern. There is a notable number of periods where returns on crypto and inflation indices exhibit opposite signs, meaning an increase in inflation expectations is not associated with an increase in cryptocurrency prices. However, there are also periods where the two measures are both positive or both negative.

Chart 11

Overall, the data to date does not support a conclusive answer on crypto assets’ hedging capabilities with respect to inflation. By contrast, Chart 12 below shows that gold prices and the 10-year Breakeven Inflation Expectation index have tracked each other quite well since 2003. Additionally, there is evidence of Granger causality between the 10-year Breakeven Inflation Expectation index and the S&P GSCI Gold index at a 95% confidence level. The same test fails for Bitcoin. (Granger causality is a statistical test to verify whether one variable is useful in forecasting another.)

Chart 12

In developing economies, there are cases in which crypto assets have been used as an alternative to holding the domestic currency amid very high levels of inflation, rapid currency depreciation, or stringent capital controls. This could underpin reports that emerging markets rank among the top countries for cryptocurrency trading (according to Chainanalysis data for instance) . Still, in some countries, cryptocurrencies may also be used to bypass financial sanctions, which complicates the study of crypto as a counter-inflationary asset.

It’s also worth noting that supply matters in crypto markets, even if this isn’t directly analogous to inflation. New coins are minted with proof-of-work mining or proof-ofstake validation. Supply of Bitcoin increases because miners get newly minted coins in return for their work. These rewards continually decrease and they will eventually end in about 2140. Ether, on the other hand, has recently had brief periods of burning more than minting. This will likely continue going forward.

We measure dollar strength, using the Nominal Broad US Dollar Index, which tracks the currency against a weighted basket of currencies used by US trade partners. Investors should favor other currencies when the dollar is expected to weaken (an index decline) and demonstrate the opposite amid dollar strength (a rising index). Arguably, the same logic should apply to crypto assets, which would lead to a negative relationship between crypto prices and the US Dollar Index.

Chart 13

Chart 13 shows the Nominal Broad US Dollar Index and S&P BDMI. The historical correlation between their daily returns is –0.16. That compares with a –0.40 correlation between the US Dollar Index and S&P GSCI Gold. In chart 14, a rolling three-month correlation analysis shows an inverse relationship (negative correlation) between the US Dollar Index and both S&P BDMI and S&P GSCI Gold 75% of the time.

Idiosyncratic events may derail the expected relationship between crypto and the US Dollar Index over short time periods. Furthermore, because correlation does not substitute for causation, it is not obvious that a change in the US Dollar Index can provide insight into future movements in the crypto markets. In fact, there is no Granger causality between the US Dollar Index and Bitcoin prices.

Chart 14

Increased financial stress and market volatility are generally associated with declining crypto prices. We use the Financial Stress Index (FSI) to measure stress in global financial markets. The index incorporates five categories of indicators: credit, equity valuation, funding, safe assets and volatility. The index is positive when stress levels are above average, and negative when stress levels are below average. Chart 15 plots the FSI index and S&P BDMI.

FSI turned positive in early March 2020, around the day when WHO declared COVID-19 to be a global pandemic. The shock was felt in crypto markets, with Bitcoin losing more than 40% of its value that day. Many other cryptos also plunged, along with stocks. Bitcoin then subsequently started a bull run, along with other assets, which continued until late 2021. FSI turned negative in June 2020. The FSI turned positive towards the middle of 2022, as the aftermath of the Russia-Ukraine conflict increased prices of several commodities, putting upward pressure on inflation, and consequently raising interest rate hike expectations.

Chart 15

FSI turned positive most recently in mid-March 2023, though to a lesser extent than in 2022 or 2020. The failure of a few US banks added significant pressure to the banking system. These upheavals caused two major stablecoins (USDC and DAI) to depeg by 13%. Circle, the issuer of USDC, confirmed that $3.3 billion of cash reserves backing USDC were held at one of the failed banks. Both stablecoins recovered to their peg levels after the government confirmed that it would support the banks’ creditors. These events highlight contagion risks from traditional finance to decentralized financial systems. Interestingly, Bitcoin rallied after the event, leading to speculation as to whether this was a response to the banking crisis, to the government intervention or to something else.

We also looked at another widely used metric for market volatility – The Chicago Board Options Exchange’s (CBOE) Volatility Index (VIX). Also known as the market fear index, the VIX measures expectations of near-term volatility conveyed by S&P 500 index option prices.

Higher levels for the VIX indicate expectations for increased volatility. That adds pressure and fear to financial markets, drives liquidity premiums upward and reduces investors’ confidence. In such a market, it is expected that cryptocurrencies will exhibit more volatility.

In addition to VIX, we looked at the CBOE Crude Oil ETF Volatility Index (OVX), which measures the short-term volatility of crude oil as priced by the United States Oil Fund. We chose to analyze this index because considerable energy requirements mean that there may be a relationship between energy prices and Bitcoin miners. Chart 16 shows the VIX and OVX indices and S&P BDMI. The volatility indices both show sudden spikes in Spring 2020 during the COVID-19 period.

Chart 16

Crypto prices have an inverse relationship with the VIX and OVX indices – prices fall when the fear indices go up. S&P BDMI’s historical return correlation is –0.20 with VIX and –0.11 with OVX. Rolling three-month correlation is negative 90% of the time, reaching –0.60 in the past year. Interestingly, considering that both indices pertain to different asset classes, we found a Granger causality relationship between VIX and S&P BDMI.

The interconnectedness between traditional and decentralized finance is of particular importance because a healthy banking system is the backbone of a healthy economy. For example, in the US, the collapse of a few banks in March 2023 caused liquidity pressure in the banking industry. This in turn depegged some stablecoins, which are supposed to provide a stable bridge between the fiat and crypto ecosystems. There is no indication of how the wider crypto ecosystem would have reacted if the crisis hadn’t been contained. At the same time, crypto-friendly banks are exposed to crypto instability and have no control over market trends. That means the banking industry may be directly affected by uncertainties stemming from the crypto ecosystem.

Chart 17

As more institutional investors turn to crypto, contagion risk between traditional and crypto assets may rise.

Conclusion

Crypto assets are not exempt from the effect of macroeconomic changes, even if performance is also powered by other drivers such as technology and market sentiment. The market’s relationship with macroeconomic indicators may become stronger – and more in line with that of traditional financial assets – as more institutional investors turn to crypto. If that happens, contagion risk between traditional and crypto assets may rise, potentially flowing in both directions. With regulators demonstrating a heightened scrutiny of cryptocurrency risks, the interconnections between the rapidly evolving crypto ecosystem, the global economy and financial markets continue to develop.

– Stablecoin Depegging Highlights DeFi’s Exposure To TradFi Risks, March 15, 2023

– The Fed’s Plan For US Banks Should Reduce Contagion Risk, March 13, 2023

– DeFi Securitizations: A Credit Risk Perspective, Feb. 7, 2023

– A Deep Dive Into Crypto Valuation, Nov. 10, 2022

– Regulating Crypto: The Bid To Frame, Tame, Or Game The Ecosystem, July 14, 2022

– Stablecoins: Common Promises, Diverging Outcomes, June 15, 2022