Discover multiple layers of ESG insight with S&P Global ESG Scores, powered by the deep heritage of the SAM Corporate Sustainability Assessment (CSA).

Discover more about S&P Global ESG ScoresWirecard's Deep Loss

Wirecard’s Chronically Low ESG Scores Reflected Governance Challenges

On June 25, 2020, the German digital payment company Wirecard AG filed for insolvency following reports that over USD 2 billion in cash assets went missing. Wirecard’s stock has gone down 90% since the initial announcement, and the company’s lenders now face deep losses.

Key Takeaways

- The case sheds light on how governance factors are incorporated and controversies are monitored in screening companies included in many ESG indices and benchmarks.

- What stands out in Wirecard’s ESG score is its poor governance performance. The company received a score of 4 (out of 100) in the governance dimension in the most recent review cycle for the CSA.

- Even though Wirecard was not in any S&P ESG Index and thus could not trigger this process, the S&P ESG Index Series does have measures in place to account for controversies affecting current constituents.

- The combination of Wirecard’s ESG score plus the S&P ESG Index Series methodology appears to be fulfilling its intended design.

ESG Index

Who’s In? Who’s Out? Walmart & Twitter Dropped from the S&P 500 ESG Index, among Other Major Changes

After markets closed on April 30, 2020, the S&P 500® ESG Index underwent its second annual rebalance since it launched in January 2019. Last year, the rebalance resulted in some changes that hit the headlines—most notably, the removal of Facebook from the sustainable version of the iconic S&P 500. With markets currently in turmoil due to the outbreak of COVID-19, interest in ESG is at an all-time high. Thus, the big question, “Who made the cut?” is perhaps more relevant now than ever before.

Aligning Investment Objectives and ESG Values

S&P DJI’s Mona Naqvi discusses how the S&P 500 ESG Index could help investors maintain their ESG values without sacrificing performance.

Watch the video

S&P Global ESG Scores

Our commitment to Essential ESG Intelligence runs deep

We provide essential ESG data insights that go beyond traditional financial statements to help you get ahead of emerging or underreported sustainability trends and make decisions with conviction. Our ESG solutions inform differentiated sustainability strategies built on comprehensive data sources and a sharp focus on material issues.

Power your investment strategy with S&P Global ESG Scores

We understand growing and evolving needs to integrate ESG data into business strategies and investment decisions. Over the last decade, we have accelerated our expertise. We are proud to introduce S&P Global ESG Scores, leveraging the SAM Corporate Sustainability Assessment (CSA), identified as one of the “highest quality” and most "useful” ESG assessments by sustainability professionals and investors. Unlock access to our deeply informed S&P Global ESG Scores to power your investment and risk management strategies, enhance your reporting, and more.

Register for the webinar

Impact on Gender Diversity

Coronavirus crisis to test banks' gender balance efforts, could halt progress

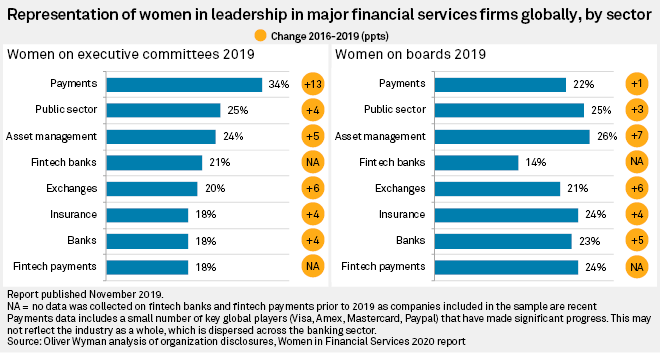

Financial institutions with gender-diverse boards and management will be better placed to navigate the coronavirus crisis, according to experts.

But they warn that, unless banks put gender balance front and center of their crisis management strategy, the pandemic could be detrimental to the progress made by the sector.

Key Takeaways

- A discussion note released by IMF researchers in 2018 found that banks with a higher share of women on their boards were more stable in 2008 when the global financial crisis hit. Banks with more female board members generally had higher capital buffers, a lower proportion of nonperforming loans and a greater resistance to stress, it found.

- The most immediate impact will be felt by women working from home during the lockdowns, as they are likely to be burdened more than men by domestic duties such as looking after children while schools are closed, Lordan said.

- The coronavirus crisis will likely become another reminder of the importance of gender diversity, as differing views are integral to managing complex situations and uncertainty, said Angela Gallo, lecturer in finance at Cass Business School. "The more different views that are brought to the table, the better," she said.

Impact on Social

The New Purpose of a Corporation; or, What We’ve Known All Along

Late last summer, nearly 200 chief executives (S&P Global’s own CEO, Doug Peterson, included) put their signatures on a new statement of the purpose of a corporation, one focused not only on shareholder value, but on value for all key stakeholders. The declaration emphasizes people—employees, customers, and communities—in which employers know they must invest to ensure long-term growth and success. This renewed focus on a company’s contributions to society as a whole is in line with the increased popularity in sustainable investing; one-quarter of all professionally managed assets now incorporate environmental, social, and governance (ESG) considerations.

Why voluntary CEO pay cuts, while largely symbolic, matter in ESG context

CEOs and management teams at dozens of companies around the world are taking voluntary pay cuts as their companies lay off workers to cope with the revenue hit from the coronavirus pandemic. Experts say cutting executive pay, while largely a symbolic gesture, could help companies manage reputational damage and enhance their ability to attract and retain workers in the long term.

Read the Full Article

Forcing Function

Work-from-home boom amid COVID-19 forcing enterprise security changes

With an unprecedented number of employees working from home, the coronavirus pandemic is forcing companies to think differently about network security, potentially ushering in a new wave of innovation in the space.

While most companies had already begun the process of digitizing their workflows and communications, the new normal of a widely distributed remote workforce is creating problems for companies big and small.

Key Takeaways

- Of the 75% of companies that implemented expanded or universal work-from-home policies during the pandemic quarantine periods, 38% intend to keep those policies in place after coronavirus subsides.

- With companies needing a long-term solution to address the expected increase in remote employees, the future of network security may not be to shore up existing VPN capacity, but rather to shift the focus of security to different points of connection between the endpoint worker and the organization, dissolving the need for VPNs altogether.

Corporation's Labor Issues

Protests at Amazon, Instacart may lead to more coronavirus-related labor unrest

Amazon.com Inc. and other e-commerce retailers could face increasing labor unrest and worker backlash at their warehouses and grocery stores in the coming weeks if essential workers continue wielding their collective power to advocate for better working conditions in the wake of the coronavirus outbreak, experts said.

Worker frustration took center stage when some Amazon employees at the company's Staten Island fulfillment center in New York City walked off their jobs, calling on the retailer to close the facility for a deep-clean and pay during a closure after an associate tested positive for coronavirus. Meanwhile, shoppers who work for online grocery delivery service Instacart began walking off the job nationwide to protest for more protections such as hazard pay and safety gear for essential workers on the front lines of the outbreak.

Key Takeaways

- The protests highlight growing health and safety concerns among food delivery workers, online fulfillment employees and independent contractors whom society has often considered unskilled and replaceable, experts say.

- If labor protests continue, organized worker backlash could slow Amazon's efforts to hire thousands of workers at a time when the company and other retailers are experiencing a surge in online demand for groceries and other merchandise, experts say.

- Amazon, Kroger and Walmart have all extended extra worker benefits in the wake of the virus, though unions and other labor advocates have said such measures are not adequate.