Bright Spot

Amazon's HQ2 a Beacon in Bleak US Office Market

Amazon.com Inc. is moving forward with its $2.5 billion second headquarters in Arlington, Va., even as much of corporate America pauses to reassess new hires and weigh potentially smaller real estate footprints in the age of the coronavirus.

Construction on the 4 million-square-foot project's first phase, known as Met Park, began in January, and Amazon has made nearly 1,000 hires for the 25,000 planned jobs at the new headquarters, a company spokesperson told S&P Global Market Intelligence. Met Park, which will comprise 2.1 million square feet of office space, will be complete in 2023.

WeWork on track for positive cash flow in 2021; remote working adoption to rise

New York City's retail economy began to reopen from its coronavirus-induced hibernation at the end of the second quarter, but the damage has been done, and it may take time for market fundamentals to bounce back.

The number of direct, ground-floor retail availabilities on the city's 16 retail corridors, meanwhile, reached a new peak of 235 spaces.

Read The Full Article

Office Insights

Suburban Office Campuses Gaining Appeal in Social Distancing Age

The age of social distancing may also come to be known as the beginning of a suburban revival in the U.S. office market.

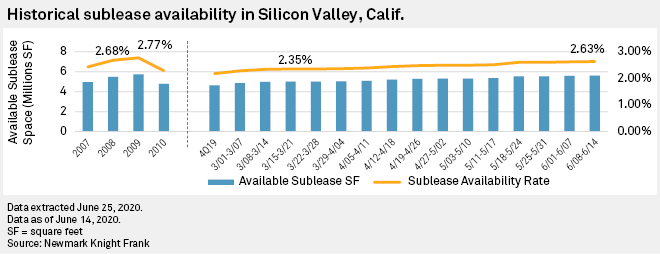

California's Bay Area, the epicenter of high tech in the U.S. and home to some of the nation's priciest office real estate, suburban Silicon Valley may bounce back before San Francisco, its urban sister to the north.

Quantamental Research Brief

No More Walks in the (Office) Park: Tying Foot Traffic Data to REITs

Foot traffic data provides investors and corporate managers with key insights on the level of activity at properties and the demographic profile of visitors to these locations.

Corporate managers can use this information to pinpoint properties at greater risk of tenant defaults, while investors can use foot traffic data to identify REITs managing properties where activity remains robust.

More importantly, once the nationwide lockdown eases, foot traffic can serve as a leading indicator of a return of economic activity across industries.

Read the Full Article

Social Distancing

Office Landlords Brace for New Normal in Workspace Demand

When white-collar employees finally return to the work spaces they left behind in March, the buildings they enter may have altogether different layouts and new safety features that suggest a possible paradigm shift in the corporate office market.

Office landlords and their lenders brace for more unknowns

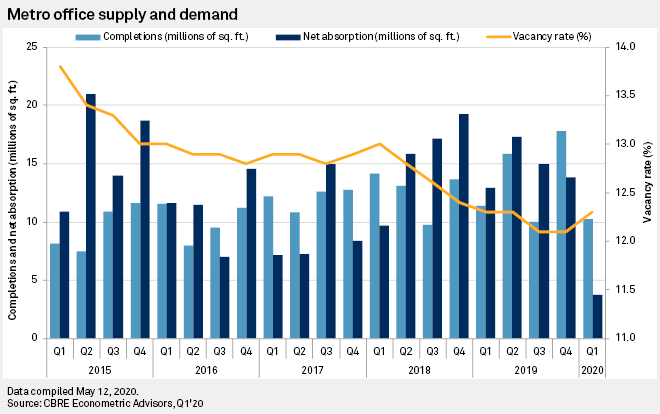

The coronavirus pandemic and the many business closures that have attended it may accelerate ongoing structural changes in the office real estate market, with unknown consequences for landlords and their lenders.

More workers may request to telecommute, while those that return to offices may require more space as a health precaution.

Read the Full Article

REIT Performance

COVID-19 Accelerates Structural Shifts In Global Office Real Estate And REITs

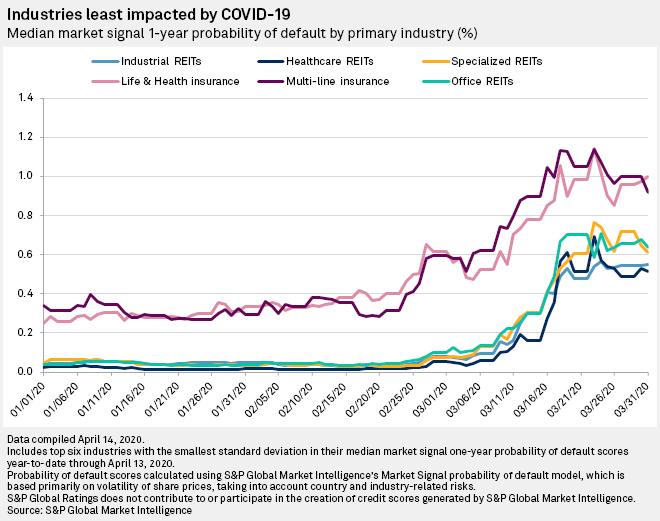

The global recession, sparked by record job losses in the wake of the coronavirus pandemic, will hurt demand for office real estate, with occupancy and rental rates to come under pressure. Rent collection for office properties has remained high but S&P Global Ratings expects landlords to share some of the pain as tenants' capacity to pay rent is impaired. Office real estate investment trusts (REITs) entered this recession in relatively good shape, with low vacancy rates and steady rent growth, and long-term leases and staggered lease maturity schedules should help mitigate the impact of the recession.

Negative Ratings Bias Rises as North American REITs Confront Effects of COVID-19

REITs are facing mounting pressure as social-distancing and stay-at-home orders intended to contain the spread of COVID-19 are disrupting tenants.

EU Landlords

How are Lockdown Measures and Remote Working Affecting European Office Landlords?

Lockdown measures to contain the spread of COVID-19 are eating into eurozone GDP and many European companies' capacity to pay rent.

S&P Global Ratings believes office landlords might share some of their corporate tenants' pain, despite the protection from their long-term leases.

Vacancy Up, Ratings Down? European Office CMBS Transactions After COVID-19

The pandemic may have an enduring effect on working practices in some areas of economic activity.

The demands of employees and the viability of remote work, given improvements in technology, means that the traditional office is likely to evolve.

The cost cutting and staff reductions that may result from prolonged disruption will exert pressure on office occupancy rates.

Read the Full Article