EMEA Outlook

European Oil Majors Outpace US Companies on Climate Goals

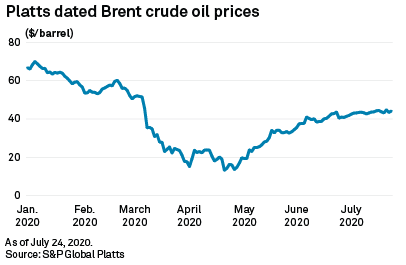

The strong and growing pressure on oil and gas companies to dramatically reconfigure their core businesses to accept a lower-carbon agenda could soon lead to irreversible changes in the energy commodity markets.

Investors and policymakers worldwide are rapidly increasing their focus on environmental, social and governance, or ESG, factors. Oil and gas companies risk losing billions of dollars in investor capital if they do not adapt.

Key Takeaways

- European integrated oil majors have led the charge, acknowledging the inevitability of the transition, as well as the scale of the challenge, as they face the possibility that petroleum demand could peak in the next decade.

- U.S.-based oil and gas companies began to pay closer attention to environmental concerns in 2018 and 2019, when many began to issue yearly sustainability reports. But in most cases, their efforts were more acknowledgement of the issue than a plan for action.

- Aside from the majors, there are no North American producers, refiners or midstream firms with net zero emissions goals yet, but it is also much harder for companies in these fossil fuel-heavy sectors to truly achieve a net-zero status.

Transition in the U.S.

In Taking plunge, U.S. Utilities Ahead of Global Oil, Mining

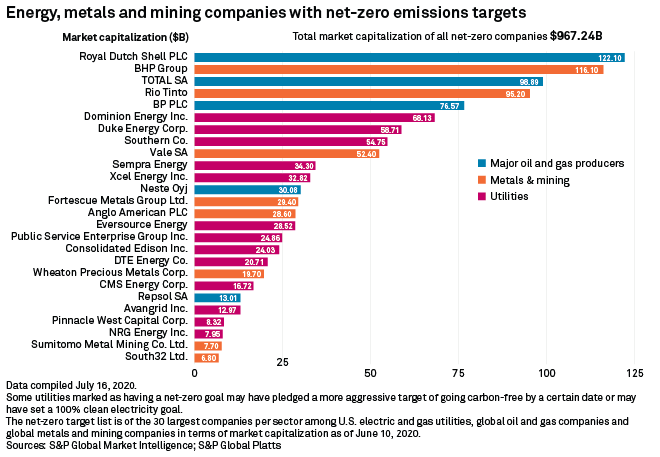

Energy and mining companies are grappling with how to respond to growing pressure from investors, local and national governments, and the public to develop decarbonization strategies.

While some of the biggest corporations in each sector have responded by setting ambitious net-zero emissions targets, not all have made the leap and decarbonization strategies vary greatly. Moreover, each sector, and even each company, faces its own set of challenges in navigating the clean energy transition.

Key Takeaways

- Scientists have asserted that to limit global warming to 1.5 degrees Celsius relative to pre-industrial levels, the world will need to achieve net-zero greenhouse gas emissions by around 2050.

- Domestic electric and multi-utilities that own both electric generation and natural gas distribution pipelines have made the most net-zero carbon emissions pledges, followed by mining and then oil and gas companies operating on a global scale.

- Decarbonization actions by states, pressure from investors, and customer preferences have prompted many major companies to adopt decarbonization goals that they will continue to pursue.

To facilitate long term, sustainable growth, it is imperative to analyze the environmental, social and governance (ESG) performance of companies and examine how activity in the markets influences the world in which we live.

Learn more about our ESG CapabilitiesNatural Gas

Cracks Appearing in Natural Gas' Role as Bridge Fuel

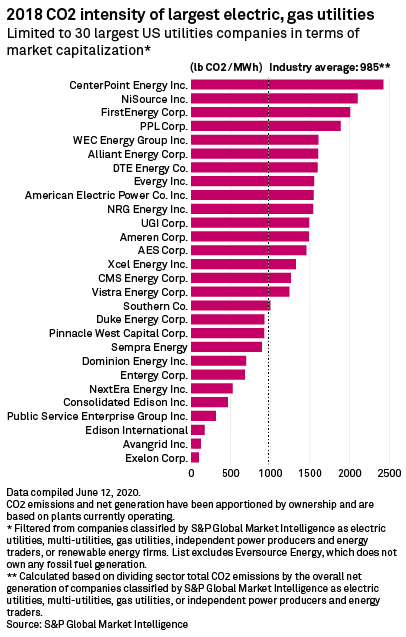

Cracks are starting to show in utility support for using natural gas as a bridge fuel to a low-carbon future.

Some signs that the narrative is shifting include a recently canceled major gas pipeline project and a raft of utilities setting net-zero emissions targets amid changing customer preferences, new state mandates, and investor concerns that the recent glut of gas generation and pipeline investments could result in stranded assets.

Key Takeaways

- As of mid-July, 13 of the 30 largest U.S. publicly traded electric and gas utilities had set goals to achieve either zero or net-zero greenhouse gas emissions by 2050 or earlier or have set a 100% clean electricity goal.

- Of the 30 largest U.S. electric and gas utilities, Avangrid in 2018 had the second-lowest carbon emissions intensity levels — surpassed only by Exelon — and will need to either buy carbon offsets or retire the only natural gas plant in its portfolio to achieve its net-zero target.

- Most electric utilities are counting on major advances in related technologies — such as carbon capture and sequestration, advanced nuclear reactors, green hydrogen, longer-lasting battery storage and carbon offset credits — to achieve their decarbonization goals.

Mining Impacts

Miners Are Starting to Decarbonize as Investor Pressure Mounts

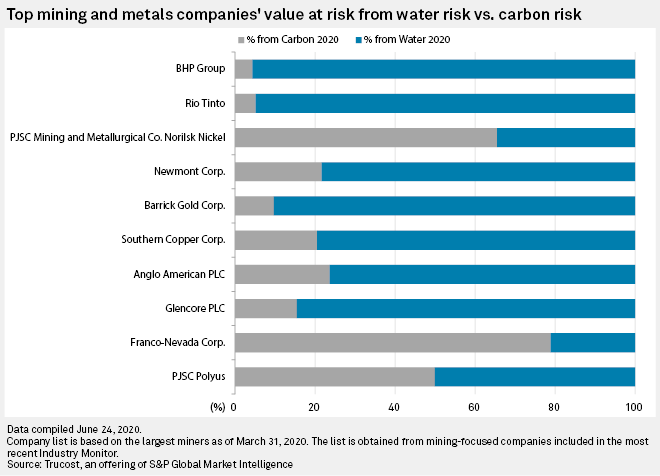

Mining companies worldwide are working to slash greenhouse gas emissions, but many of the largest have yet to align their goals with international targets to reach net-zero emissions by 2050.

Mined materials are the starting point in the supply chain for much of the global economy. Decarbonizing the sector is critical to meeting global emissions targets, particularly as a growing energy transition increases the demand for critical raw materials. While governments in places such as Europe are solidifying net-zero goals in laws and regulations, shareholders everywhere are pushing companies to take more significant action on climate change.

Key Takeaways

- Miners are likely to increasingly be held to account not only for their own emissions but also for those that occur from the use of their commodities that turn up downstream in many sectors of the economy.

- Half of the global industrial greenhouse gas emissions in 2015 were traced to just 50 companies in heavy fossil fuel industries, including 20 mining companies, according to a report from the Carbon Disclosure Project.

- Several mining companies have not specified net-zero goals but are otherwise addressing climate change risks. For example, Canadian gold miner Agnico Eagle Mines Ltd. has not set a net-zero emissions goal, but all of its sites are implementing initiatives to reduce greenhouse gas emissions in 2020, spokesperson Natalie Frackleton said.

Subscribe to ESG InFocus, a monthly newsletter from S&P Global Market Intelligence that captures news, insights, trends, commentary into ESG developments driving change across business decisions. Additionally, stay informed on upcoming ESG related webinars, conferences and networking events.

Subscribe to ESG InFocusTransform to Net Zero

Maersk has Market Share Growth Potential from Transform to Net Zero

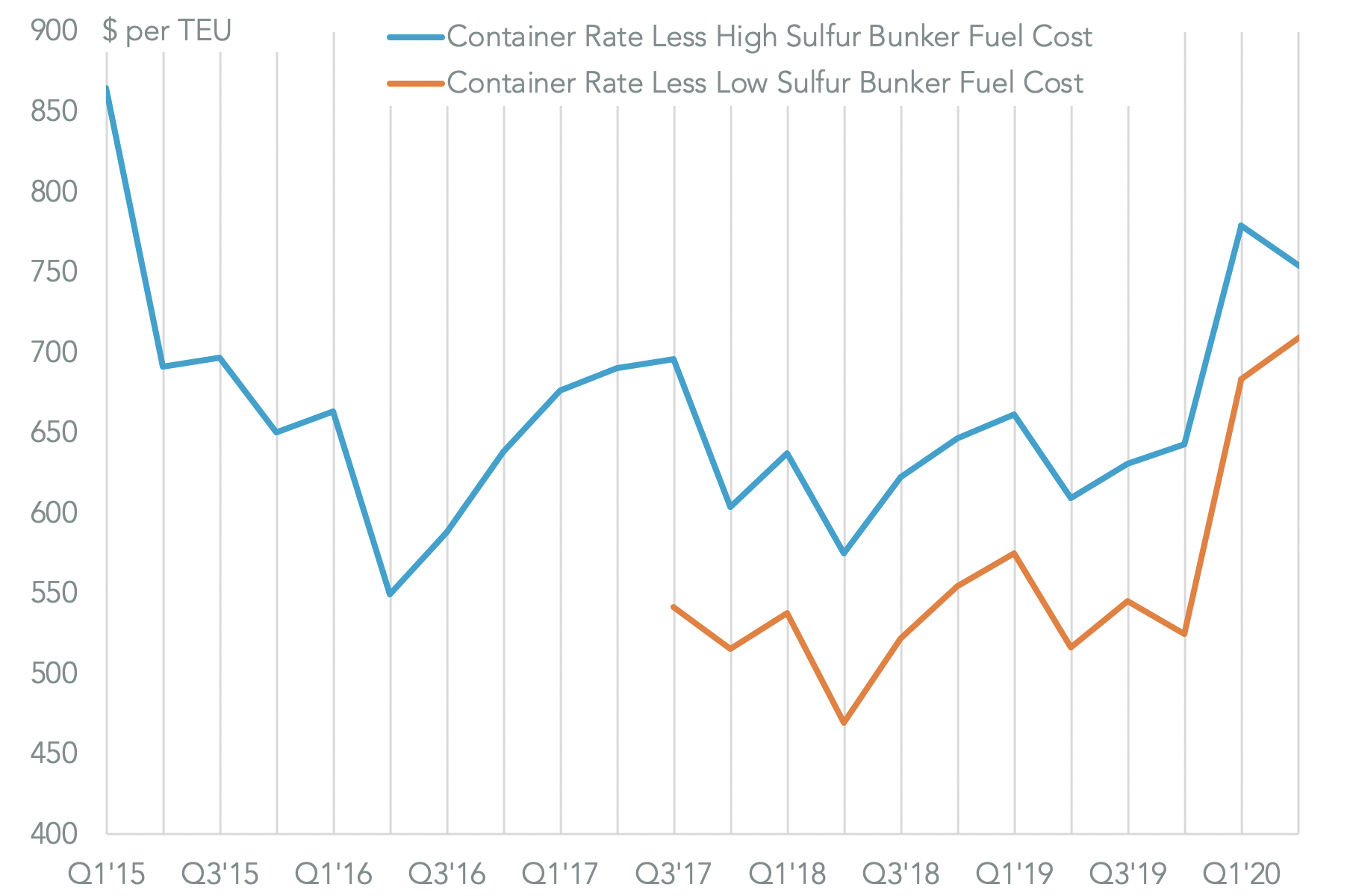

Container-line Maersk is one of nine founding firms in the new “Transform to Net Zero” environmental initiative to cut greenhouse gas emissions to a net zero by 2050. The group is drawn from a variety of industries and includes manufacturers as well as services firms.

A shift to reduced GHG emissions by the shipping industry has been inevitable for some time, as discussed in Panjiva’s research of Jan. 20. In the near-term the European Parliament has also voted to include shipping in the Emissions Trading Scheme.

IEA Official Says Reaching 2050 Net-Zero Emissions to Require Technology Development Acceleration

If governments and companies want to move more quickly toward net-zero emissions, progress on early stage technologies needs to be accelerated, the head of the energy technology policy division at the International Energy Agency said during a July 22 webcast.

In a recent report, Timur Gul said, the IEA presented a "faster innovation case" on how net-zero emissions could be achieved globally in 2050, "by assuming that technologies currently only in the laboratory or at the stage of small prototypes today are quickly made available for commercial investment."