Discover more about S&P Global’s offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsContents

NATO-Russia tensions explained

The history of the relationship between NATO and Russia is complex and often characterized by political tension. NATO's standards for political governance and democratic control over its armed forces are distinct from Russia’s centralized political and military structures. In the past, Russia has opposed efforts by its neighbors to develop closer relations with NATO. At times, this opposition has resulted in political tensions and overt military conflict in countries such as Georgia in 2008 and Ukraine in 2014 and 2022.

After the Russian occupation of Ukraine's Crimean Peninsula in March 2014, NATO countries in central and Eastern Europe expressed concern that Russia might also seek to intervene in other countries with large Russian-speaking minorities. In October 2021, NATO withdrew the accreditation of several Russian officials to NATO's headquarters in Brussels on the suspicion that they were secretly working as Russian intelligence officers. Russia responded by suspending its mission at NATO and closing NATO's Moscow office. These developments degraded bilateral contacts between NATO and Russian military personnel. In 2022, following Russia's large-scale invasion of Ukraine, NATO began reinforcing its deterrence and defense posture.

Key tensions driving NATO-Russia conflict

Russia's reaction to the trilateral statement of intent between Sweden, Finland and the United States

In July 2016, Russian President Vladimir Putin warned that if Finland joined NATO, it would result in military action. In October 2017, the Russian ambassador to Finland cautioned that such an accession would have serious consequences for their bilateral relations. However, Finland and Sweden are often described as de facto NATO members due to their close cooperation with the alliance. Russia’s invasion of Ukraine significantly increased support for NATO membership in both Scandinavian countries, resulting in a joint NATO application in May 2022, and the consequent official invitation to join NATO in June 2022. Finland formally became a NATO member state on April 4, 2023. Sweden’s NATO accession has been delayed, but is likely in the one-year outlook. The trilateral statement of intent was seen as unlikely to provoke a significant response from Russia, and this was demonstrated by the lack of military response from Russia since the Finnish accession into NATO. Russia is likely to intend to militarize the Arctic or the Kaliningrad exclave in the Baltics. However, it is unlikely to possess immediate military capabilities for as long as kinetic fighting in Ukraine is ongoing.

Escalating crisis on the EU-Belarus border

The de facto president of Belarus, Alexander Lukashenko extended his rule in 2020 in a disputed election that the EU believes was characterized by intimidation and violent repression of peaceful protesters, opposition members, and journalists. Since October 2020, the EU has imposed restrictive measures against Belarus. The EU Council introduced a ban on the overflight of EU airspace and access to EU airports by Belarusian carriers, after the forced landing of a Ryanair flight in 2021 that overflew Belarus on the way from Greece to Lithuania.

In June 2021, Belarus started to organize flights and internal travel to facilitate the transit of migrants toward the EU, crossing the border irregularly, to Poland, Lithuania and Latvia. The EU and NATO consider the transit of migrants as a hybrid attack, intended to destabilize the situation on the EU borders and within the EU. While most of the crisis ended by late 2021 due to a sharp reduction in the number of direct air links between Belarus and the countries in the Middle East region, attempts by irregular migrants to cross into the EU continue. The potential militarization of the conflict is rising. Belarus and Russia organized large-scale military maneuvers close to the border with Poland in 2021. Belarus also provided Russia with a staging ground for the military invasion of Ukraine in February 2022. These actions precipitated further sanctions against individuals associated with the leadership in the Belarusian capital of Minsk, with even more sanctions likely if Belarus joins the Russia’s war in Ukraine directly.

Territorial and security conflicts with Ukraine

In early February of 2022, relations between Russia and NATO reached a state of crisis. Russia had deployed up to 190,000 troops along the Russian and Belarusian border with Ukraine, warning that it was prepared to use military force to achieve its goals. Following the start of the large-scale Russian invasion of Ukraine, relations between Russia and NATO have reached a nadir. In response to Russia’s actions in Ukraine, the US, EU, UK and Canada have imposed a wide range of sanctions, aimed at reducing Russia's ability to finance its war of territorial conquest.

Meanwhile, Russia has responded to western sanctions by seeking closer bilateral relations with China. Prior to the invasion of Ukraine, Russia and China signed significant deals for the supply of oil and gas, which include Rosneft Oil Co. and China National Petroleum Corp.'s agreement for supplies of 100 million metric tons, or 200,821 barrels per day, and for 10 Bcm per year of gas, according to S&P Global Platts.

Russia and Ukraine War: More Than One Year On

The Russia-Ukraine war has been ongoing for more than 15 months. According to analysts, the Russian strategy appears to be focused on undermining the Ukrainian population's support for resisting the invasion by bombing civilian targets and infrastructure. Since early October 2022, Russia has intensified missile and unmanned aerial vehicle strikes on cities across Ukraine, targeting critical national infrastructure in dozens of swarm missile attacks. Although Ukraine claims to have intercepted up to 90% of these attacks with its air defenses, the strikes have caused significant damage, reducing power generation capacity by up to 50% and causing large-scale blackouts. Despite these attacks, a February 2023 Kyiv International Institute of Sociology poll revealed that 87% of respondents in Ukraine still support continued resistance to Russia and were against territorial concessions to Russia.

Evaluate global trade, commodity values and companies involved in trade activity.

Geopolitical risk in NATO-Russia conflict

Consequences of escalation

Governments and business in NATO countries and Ukraine have accused Russian state-linked groups of cyber-attacks on digital infrastructure. These cyber conflicts, characterized by attack and counter-attack have increased geopolitical risks, and had an impact on credit conditions and energy markets. Russia has also accused NATO and Ukraine of engaging in retaliatory cyber-attacks. Russia’s largest internet service provider, Rostelecom, recorded 21.5 million critical web attacks in 2022 against 600 Russian businesses, including those in the government, finance, retail, and telecom sectors. Moscow was the most attacked region in the country in 2022.

Impact on international relations and stability

The conflict between NATO and Russia affects companies that operate across both regions. In Russia, discrimination against foreign businesses has accelerated since Russia's invasion of Ukraine in February 2022 and the subsequent economic sanctions imposed by NATO members. Many businesses chose to divest Russian operations or close offices operating in Russia following the invasion, making it more challenging for businesses from NATO countries to operate in Russia. Russia’s response of introducing capital controls and regulatory restrictions to prevent more than 1,000 Western companies’ divestment of Russian assets is likely to increase compliance risks further. Western companies may face obstacles in Russian court cases. This risk of biased judgments is likely to increase as Moscow looks to respond to Western sanctions. This can make it more challenging for foreign companies to withdraw from the Russian market and extract market value for their assets.

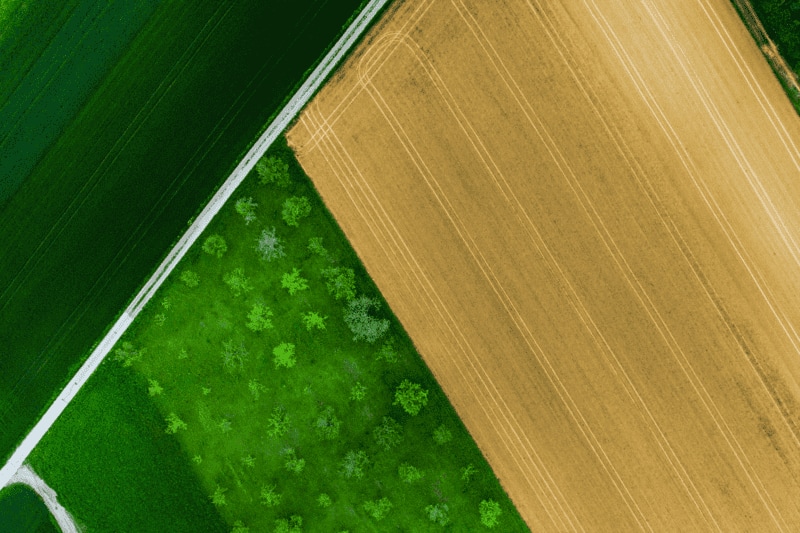

Comprehensive data and analysis across the global agricultural commodities and processed food markets.

Economic and business implications

Due to Western sanctions, Russia's economy is expected to face a prolonged recession. After falling 2.1% in 2022, Russia’s GDP should ease to a contraction of 0.6% in 2023 before growing 1.5% in 2024. The ongoing sanctions have forced adaptation to the economic conditions through structural changes, which may result in more lasting productivity losses. These changes will create supply-side shortages, leading to price increases. Inflation is predicted to ease in the coming years. The policy rate is expected to ease to 7.25% by the end of 2023. Russia has responded to Western sanctions by introducing capital controls and regulatory restrictions to prevent Western companies from divesting Russian assets and to support the ruble. This response may increase compliance risks further. The Western sanctions have been expanded to an unprecedented level, targeting multiple sectors of the economy, and more sanctions are likely as the war in Ukraine drags on. The oil, financial, and technology sectors will be most affected.

Insights, expertise and data analytics on the world's commodity prices and the key factors that drive them.

Evolving risk in NATO-Russia conflict

The situation between Russia and Ukraine is volatile, with ongoing kinetic fighting, and there are concerns about an escalation involving NATO countries or Belarus. However, the international community has been taking proactive measures to prevent escalation. China and India have offered diplomatic support for a ceasefire, but questions remain about who has the credibility to broker a lasting conflict resolution. The ongoing conflict between Russia and NATO highlights the need for a coordinated response from the international community to contain and resolve this crisis. Long-term continuation of the Russia and Ukraine war could destabilize markets and permanently alter supply chains. Russia’s main point of significance appears to be acceptance of the current territorial control, while Ukraine insists on territorial integrity and a full withdrawal of Russian forces.

Understand the Europe-Africa trade and investment relationship in the three- to five-year outlook.

<span/>Related NATO-Russia conflict research and analysis

Looking for NATO-Russia conflict related solutions?

Global trade analytics suite (GTAS)

Discover the power of S&P Global's Global Trade Analytics Suite (GTAS) - the intuitive, powerful, and decision-ready analytics platform. Try GTAS today.

Category and commodity price forecast data

Access insights, expertise and data analytics on the world's commodity prices and the key factors that drive them.

Crop commodities market insights and forecasting

Stay ahead of the curve with our crop commodity forecasting and insights to navigate the dynamic market.

Advanced country analysis & forecasting

Uncover valuable data on emerging markets - Access hard-to-find data and in-depth analysis on emerging markets to support your business plans and unlock new growth opportunities.

Foresight Location Analytics

Protect your assets with precision. Get Foresight Location Analytics for accurate risk mapping and quantification. Request a demo now!

NATO-Russia conflict FAQs

{}

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fnato-russia-relations-impacts-geopolitical-risk%2f%3futm_campaign%3dPC025216%26utm_medium%3dreferral%26utm_source%3dspgcorp","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fnato-russia-relations-impacts-geopolitical-risk%2f%3futm_campaign%3dPC025216%26utm_medium%3dreferral%26utm_source%3dspgcorp&text=NATO-Russia+relations%3a+Impacts+on+Geopolitical+Risk+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fnato-russia-relations-impacts-geopolitical-risk%2f%3futm_campaign%3dPC025216%26utm_medium%3dreferral%26utm_source%3dspgcorp","enabled":true},{"name":"email","url":"?subject=NATO-Russia relations: Impacts on Geopolitical Risk | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fnato-russia-relations-impacts-geopolitical-risk%2f%3futm_campaign%3dPC025216%26utm_medium%3dreferral%26utm_source%3dspgcorp","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=NATO-Russia+relations%3a+Impacts+on+Geopolitical+Risk+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fnato-russia-relations-impacts-geopolitical-risk%2f%3futm_campaign%3dPC025216%26utm_medium%3dreferral%26utm_source%3dspgcorp","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}