Discover more about S&P Global’s offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsContents

The importance of energy security

Over the last few decades, the spotlight on energy security subsided as globalized markets provided a sense of secure energy supplies. Over the past two years, many governments have faced reevaluating their approach to energy security because of skyrocketing energy prices, the cost of living challenges that followed, and the geopolitical risk associated with securing a supply of energy sources.

This reassessment acknowledges that to secure public support and prevent significant economic disruptions, with the potential political consequences that could follow, the energy transition needs to be grounded in energy security, with adequate and reasonably priced supplies.

While the Russian invasion of Ukraine in February 2022 did not initiate the current crisis of energy supply, it raised attention to the ongoing issues. The current crisis of energy supply began in the summer of 2021 when the economic recovery that came with the ending of global COVID-19 lockdowns boosted global energy consumption.

Energy prices increased as demand outstripped supply in the second half of 2021 for oil, natural gas, and coal markets. The US government announced the first release from its strategic petroleum reserve in November 2021, three months before Ukraine’s invasion. It is now clear that "preemptive underinvestment" constrained the development of sufficient new oil and gas resources.

Government rules and regulations, investor concerns over climate and sustainability, low profits due to two price drops in seven years, and uncertainty over future demand are a few causes of upstream underinvestment. The shortfall in investment was “preemptive” because of what was mistakenly assumed—that sufficient alternatives to oil and gas would soon be in place at scale.

Optimizing the speed of transition

If energy security is the first challenge of the energy transition, timing is the second. How quickly can the energy transition proceed? There is intense pressure to move a significant part of the 2050 carbon emission target of the Paris Agreement on climate change to 2030, but the scale of the change should not be underestimated.

<span/>All previous energy transitions were not a product of policy initiatives, but economic and technological advantages of new sources of energy. Each of the preceding energy transitions unfolded over a century or more, and none were the type of transition currently envisioned. This transition's goal is to completely alter the energy foundations of the current $100 trillion global economy in less than 25 years. Further research is necessary to fully understand the macroeconomic impact of a change of this size and scope.

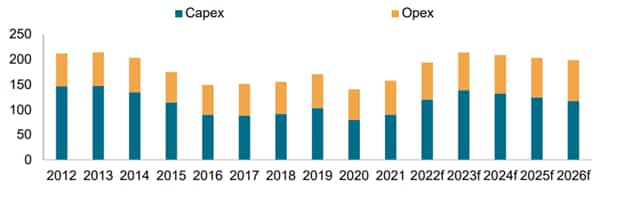

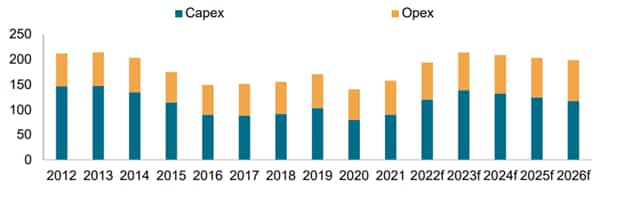

Energy security: Global upstream E&P capex

S&P Global Commodity Insights analysis on global upstream and exploration and production capex reported after experiencing a significant increase in 2022, E&P capex is predicted to rise by 12% in 2023 because of a recovery in global upstream activity and energy security concerns. Mainland China and Australia remain the key areas of investment in Asia Pacific.

Upstream prices remain likely to rise because of the ongoing war in Ukraine, rising inflation, an increase in project activity, and supply chain bottlenecks. Although upstream activity is gradually picking up, Asia Pacific will benefit from a focus on renewable energy security as more projects proceed. We are seeing more floating storage and regasification unit orders from Europe in 2023.

The utilization rate of construction vessels is anticipated to increase through 2023 because of rising oil prices and greater activity. After a sharp decrease in 2020, marine vessel utilization has increased and now stands at 60%. High oil prices and rising domestic energy needs will sustain a steady improvement of interest in upstream investment through 2023. Although day rates are anticipated to rise, the continued vessel surplus situation will keep them from rising significantly.

Asia- Pacific capital expenditure and operating expenditure index, 2012–2026 (US)

Explore our power and renewable energy content from our Climate and Sustainability Hub.

Global power & renewable energy market: Bringing energy security and energy transition together

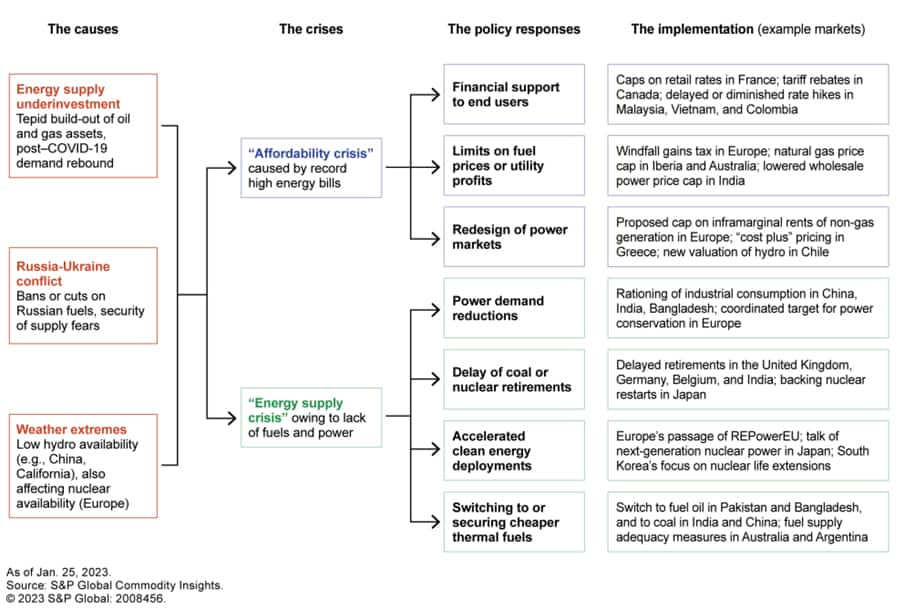

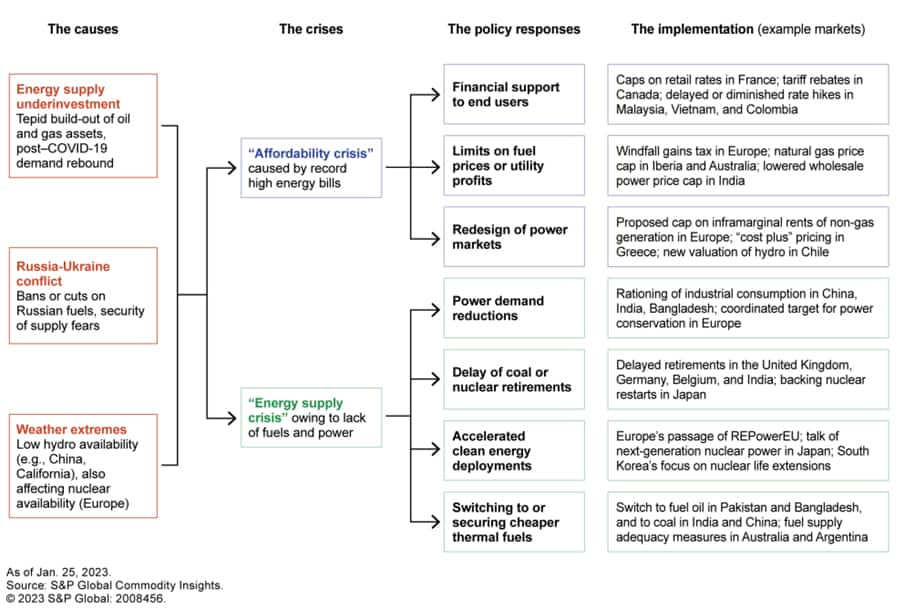

The 2021–2022 energy crisis is anticipated to continue through 2023. S&P Global Commodity Insights analysts see a tension developing between a desire for energy security among market stakeholders and the ambitions of the energy transition.

The global fuel and power shortage, brought on by underinvestment in energy infrastructure, the robust post-COVID-19 economic recovery and the Russia-Ukraine war should support prices in the power market and ambitions for an energy transition in 2023.

As attention focused on energy prices and inflation, policymakers have instituted momentous energy transition policies—and more will come—that will rapidly translate into real investments in clean energy.

Market | Policy or program (announcement date) | Brief description |

|---|---|---|

United States | Inflation Reduction Act (August 2022)

| $391 billion in funding for the energy sector and combating climate change |

Infrastructure Investment and Jobs Act (November 2021) | $73 billion in funding to support investment in energy infrastructure | |

European Union | REPowerEU (May 2022) | 45% share of renewables in energy by 2030; 13% improvement in energy efficiency by 2030* |

Fit for 55 (July 2021) | Reducing greenhouse gas emissions by 55% by 2030 | |

China | “1+N” Policy Package (October 2021) | Reaching peak carbon emissions by 2030 and carbon neutrality by 2060 |

14th Five-Year Plan for 2021–25 (March 2021) | Energy sector modernization across economic, social, and environmental criteria |

Transformative energy policy that will drive clean energy investment in major power markets in 2023

In 2023, there is likely to be a stronger convergence between energy security and the energy transition. According to S&P Global Commodity Insights, the world will add up to 380 GW of clean energy this year, which will account for 75% of all new capacity in 2023. China will account for more than 40% of these additions, followed by Europe with 20% and the US with 12%. As a result, 2023 will set a record for clean energy additions.

Neither the path to global energy security nor the energy transition will necessarily be a smooth process for investors or governments. This will be especially true in emerging economies with domestic fuel resources. The end of COVID-19 lockdowns in 2023 appears likely to increase coal-based emissions in China.

In other places, the energy crisis changed the fuel mix due to short-term “patches” (e.g., delayed thermal retirements in Germany, Pakistan switching to cheaper albeit dirtier thermal fuels) or newfound opportunities (e.g., China and India procuring cheap gas from Russia).

Power market dynamics may soon be adjusted again. These shifts, whether in supply/demand fundamentals or in policy, will bring new risks and opportunities for the energy sector in 2023.

The energy sector policy responses to the global energy crisis

Are you ready to accelerate your Energy business growth? Discover timely insights from our European Long-Term Power Forecast.

<span/>Energy security: Top five trends in 2023 for India’s power and renewable energy market

India will look to manage energy prices in 2023, despite a 2022 inflation rate of more than 6% and the declining value of the rupee.

In 2023, India aims to implement energy transition strategies and address issues related to energy security. These include building local supply chains, securing domestic fuel resources, deepening power sector reforms to address structural issues, and continuing to adopt new and clean technologies by creating demand and infrastructure.

Further interest rate increases are possible in 2023, and the government's efforts to encourage investment through the production-linked incentive program and additional foreign direct investment liberalization could be undermined by the economy's uneven recovery.

After COVID-19-related interruptions and the intense heat waves that swept the country during a prolonged summer, electricity consumption in India increased 8.7% in 2022.

On the supply side, coal generation increased 8.7%, resulting in higher emissions. In 2022, energy security and affordability remained top priorities for the Indian government, leading to efforts to increase domestic coal production, mandates for coal imports and an emphasis on expanding local manufacturing.

Key trends for the India power and renewables market:

- India has ambitious goals related to a clean energy transition. However, coal maintains a significant role in the current energy mix.

- Securing fuel is a top priority to respond to short-term challenges, while implementing reforms is on the long-term transition agenda.

- Power market sentiments remain fragile, as regulatory uncertainty derails the pace of reforms.

- Climate action strategies require technological and financial support.

- Renewable energy supply chain issues continue to impact project costs and renewable growth.

India’s clean energy transition is advancing but coal use will continue to boost energy security

Electricity demand growth is expected to continue, driven by commercial activity, key state elections, and expected La Niña climatic conditions.

The recent increase in energy demand was driven primarily by the recovery in commercial and industrial activity, as well as an intense heat wave that swept the country, resulting in a prolonged summer season. S&P Global Commodity Insights expects India’s electricity demand to remain healthy in 2023 and grow between 6.5% and 7.5%.

The demand projections are higher than the 20th Electric Power Survey forecast by the Central Electricity Authority of 5.8%. Continued recovery in commercial activity is expected to drive demand, though global recessionary pressure is expected to keep electricity demand suppressed from the industrial sector.

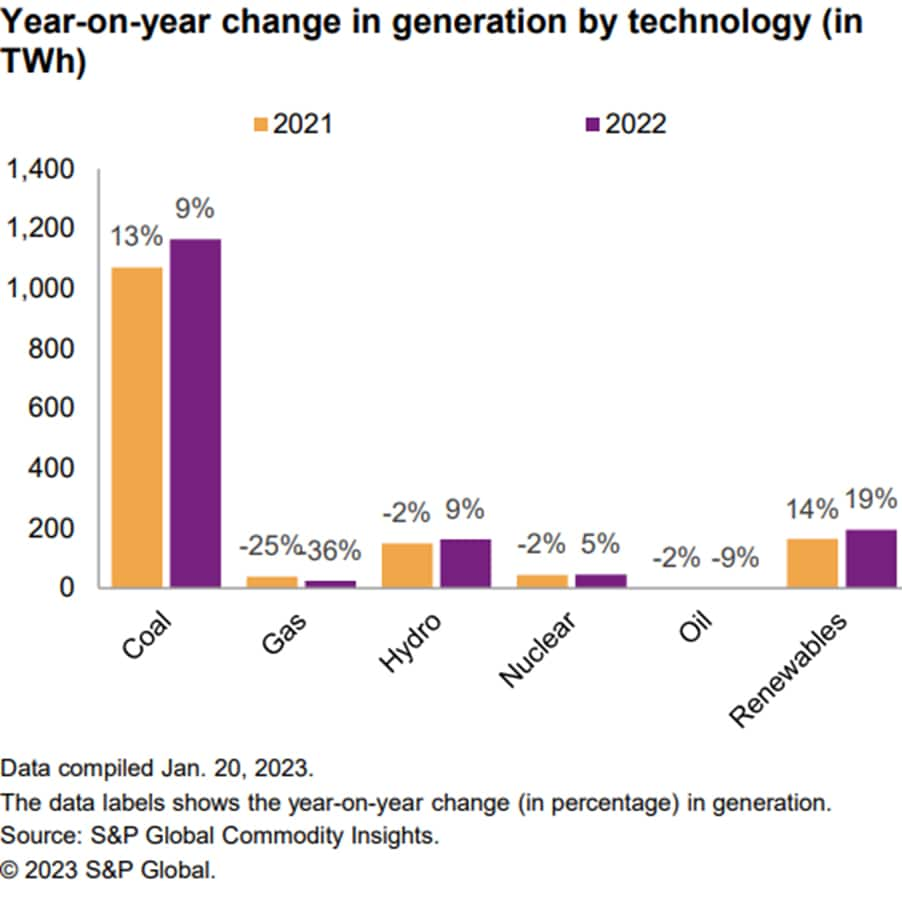

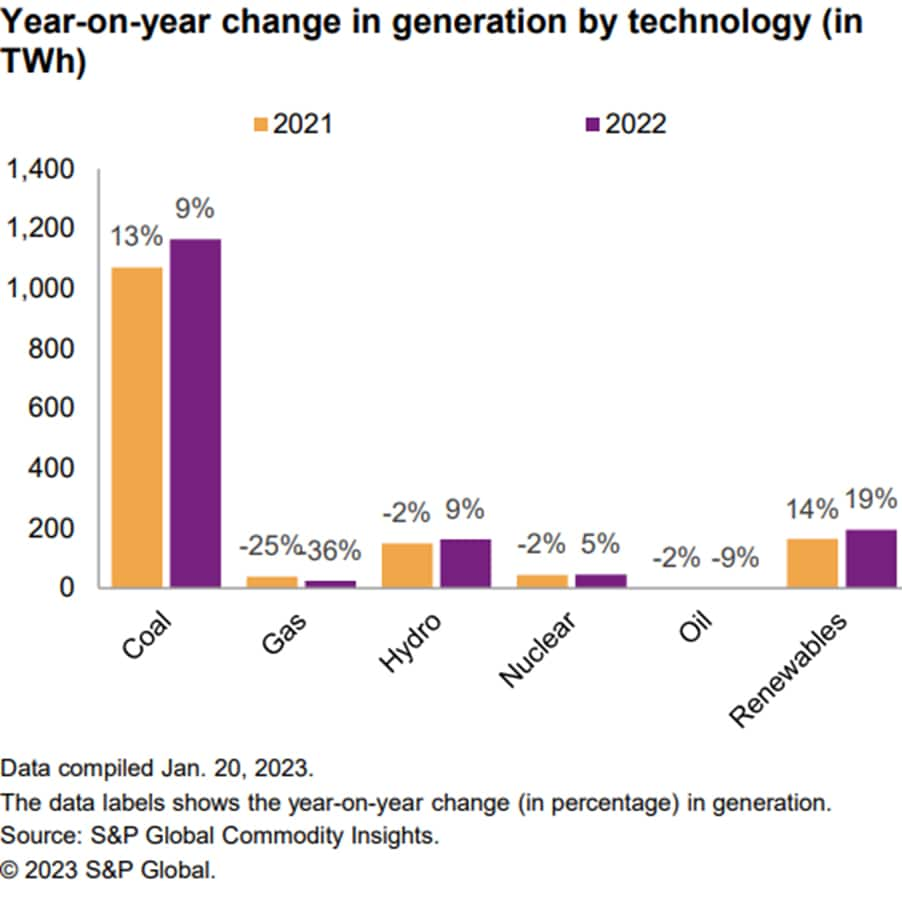

In terms of generation, coal continues to dominate, registering year-over-year growth of 8.7% in 2022, contributing to the power sector’s carbon emissions growth.

India's renewable energy sector rose by more than 15% despite missing the 175 GW target by about 30%, demonstrating the policy focus on expanding clean energy resources. According to S&P Global Commodity Insights India is expected to add about 18 GW of renewables, driven by a significant pipeline build through tenders in 2023. About 2 GW of corporate projects are expected to come online in India in 2023, in addition to utility projects.

Demand for renewable energy in the corporate segment is driven by the widespread adoption of sustainability and carbon neutrality targets by corporations, increasing affordability, and green open-access policies at the federal and state levels.

<span/>The data labels shows the year-over-year change in generation by technology (in TWh).

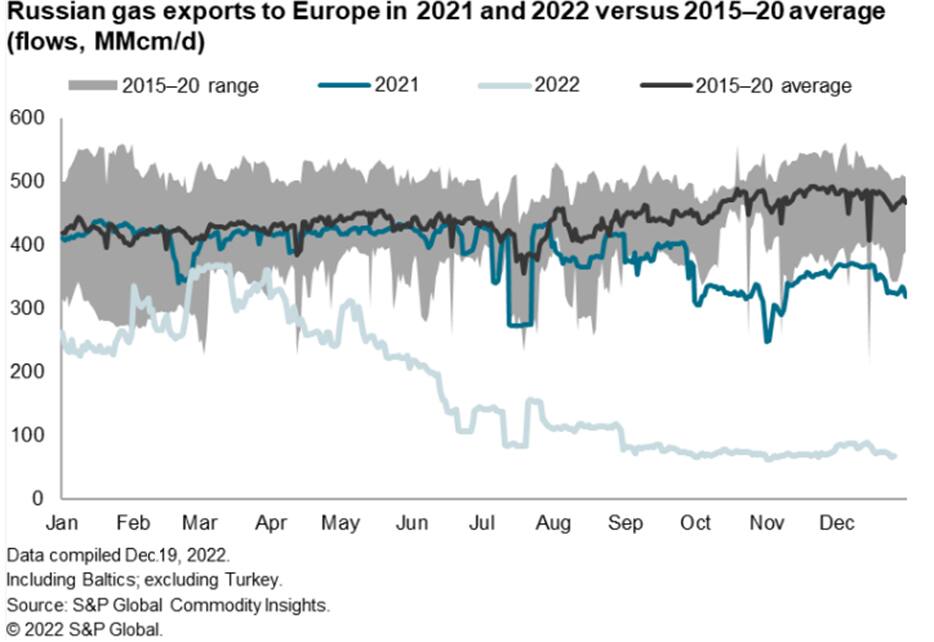

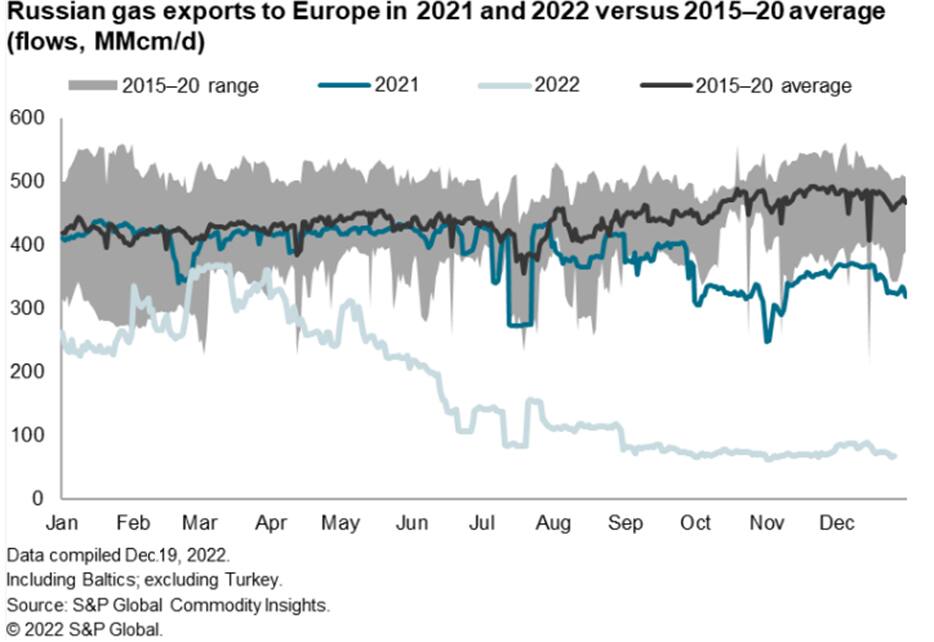

European energy security: Russian gas flows to europe

The European energy security is in crisis due to the reductions of Russian gas supply to Europe since the launch of Russia’s invasion of Ukraine. Despite the devastation of the war, Russian gas continues to flow through Nord Stream 1 pipeline and Poland via the Yamal-Europe pipeline. Russian gas transit through Ukraine continues, despite running at reduced volumes. The volumes that Russian energy company Gazprom continues to export via Ukraine to Austria and Italy are important, not only from a contractual and relationship perspective but also from a financial point of view

Russia's reliance on Ukrainian transit decreased with the construction of the TurkStream pipeline to Turkey and the ability to export gas to Hungary and Serbia via the new route. However, Gazprom today relies on transit via Turkey and Bulgaria to reach these two markets. The relationship between Russia and Turkey is still solid, although Russia-Bulgaria relations deteriorated in 2022.

Moscow has increased taxes on the oil and gas sector, with Gazprom paying out as much as $22 billion in 2022, according to S&P Global Commodity Insights. As a result, the oil and gas sector in Russia must generate additional earnings from alternative markets. It will be difficult, if not impossible, for Gazprom to accomplish this without considerable delays, as these choices depend on the successful completion of numerous projects with high capital expenditures, as well as technologies and partners that are no longer accessible because of international sanctions.

Russian gas exports to Europe in 2021 and 2022 versus 2015–20 average (flows, MMcm/d)

See how EnergyView - Gas, Power, Renewables can help your workflow. Better understand gas, power, renewables markets

Looking for global energy products and solutions?

CERAWEEK conversations - Insight with impact

Subscribe to CERAWeek conversations notifications.

The energy daily

Gain a competitive intelligence edge with breaking US energy news and policy analysis.

Industry fundamentals in the age of energy transition program

This is an exciting time to be in the energy and chemical industry as organizations aim at meeting their net-zero commitments. To seize the opportunity, get personal access to our full library of energy and chemicals eLearning courses, available on demand for 365 days

Forecasting how today's energy mix evolves into the energy mix of tomorrow.

Our workflow tools help you to understand the financial and physical implications of energy markets in transition, supporting you on your journey toward a low-carbon economy

Energy transition service

Your one-stop view into the financial and physical implications of energy markets in transition

{}

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-energy-security%2f","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-energy-security%2f&text=Global+Energy+Security+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-energy-security%2f","enabled":true},{"name":"email","url":"?subject=Global Energy Security | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-energy-security%2f","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Energy+Security+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-energy-security%2f","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}