S&P Global Ratings hosted a mini-series of two webinars in the place of its 19th Annual European Leveraged Finance Conference. These live and interactive webinars featured guest panelists from key institutions across the European Leveraged Finance Market, focusing on the key risks and trends.

Watch the Webinar ReplaysThe EU Capital Markets Union

Turning The Tide

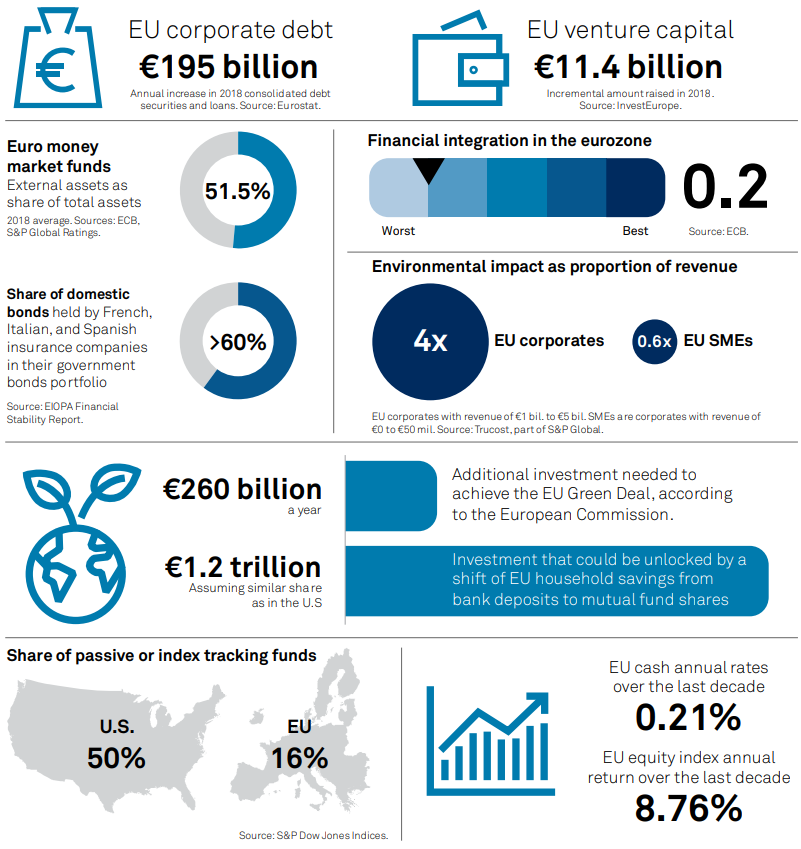

The CMU has the potential to turn the tide in Europe. At present, its substantial savings

are ineffectively allocated in a fragmented financial sector dominated by banks. As a

result, investment, innovation, and growth are subdued.

Asset managers and financial market infrastructure companies are set to be major

beneficiaries of the CMU. However, European banks can also benefit from more

developed capital markets in the EU. At the retail level, a deeper equity culture could

yield bigger returns for both savers and investors.

Growing momentum behind sustainable finance can help unlock the CMU’s potential,

while lower-for-longer interest rates risk reinforcing the reliance of the EU economy on

debt.

Watch a Summary

Listen to The Essential Podcast

Sylvain Broyer, Chief EMEA Economist at S&P Global Ratings, discusses the implications of the unprecedented 750 billion Euro recovery fund proposed by France and Germany to help EU member states weather the coronavirus-caused downturn on the latest episode of The Essential Podcast.

ESG Focus

All the green elements of the EU's €750B recovery proposal

The EU's proposal for an unprecedented spending package to fuel the bloc's recovery from the coronavirus pandemic has been tied explicitly to green principles, although the plans are still lacking in detail and environmental groups have criticized the continued support for some fossil fuels.

The European Commission's proposal would see the EU raise €750 billion in recovery funds by issuing bonds, with €500 billion doled out to member states in grants and the rest in loans. This comes on top of €540 billion in postcrisis funding already agreed in April and a newly reinforced budget for 2021-2027 to the tune of €1.1 trillion. Combined, the funding amounts to the largest European spending plan ever proposed.

Achieving the 2050 goal would mean removing unabated fossil fuels from the EU's energy mix, and increasing demand for renewable electricity and low carbon gases, such as hydrogen.

In Europe, COVID-19 brings government renewable energy auctions into sharp focus

While there remains appetite from investors to build unsubsidized renewable energy projects in Europe, the current economic downturn and power price slump could drive more developers towards revenue stabilization mechanisms via government auction programs, industry participants said.

Read the Full ArticleEU green energy spend key to economic recovery: EC's von der Leyen

European Green Deal investments will remain a priority as part of the EU's efforts to jump-start its economy after the coronavirus pandemic lockdowns, European Commission President Ursula von der Leyen said April 16.

Read the Full Article

Economic Research

The European Crisis Backstop Is Underpinning Corporate Funding Conditions

On April 30, 2020, the European Central Bank (ECB) announced expanded measures aimed at further incentivizing banks to channel liquidity to the wider European economy. It was the latest in a series of actions since the onset of the COVID-19 pandemic aimed at containing market volatility and facilitating market liquidity. The central bank's twin-pronged approach, combining direct asset purchase programs alongside credit-easing measures aimed squarely at facilitating bank lending, has led to a surge in bond issuance and a significant increase in bank lending to corporates. However, the recovery in funding conditions has been uneven: certain primary markets, most notably high yield, are proving slow to recover, and financing costs remain elevated.

Investment-Grade Issuance Surged On Announced Support Measures From Central Banks

European Nonfinancial Issuance

Source: S&P Global Ratings.

The EU's Recovery Plan Is The Next Generation Of Fiscal Solidarity

The pandemic is accelerating the debate on fiscal solidarity in the EU, which is responding swiftly and forcefully with a three-layer €540 billion safety net and a proposed €750 billion recovery plan.

Europe might be experiencing just a small Hamilton moment, not full fiscal union. However, the European Commission's call for deep changes to the European budget sows the seeds of a closer EU.

For the first time, the EU intends to use its strong credit signature to absorb an asymmetric yet common shock on the member states and foster its environmental and social objectives.

Read the Economic Research

LCD News

European high-yield bond market sanguine in face of rising fallen-angel risk

The major rating agencies are being proactive in addressing outlooks and ratings changes to account for the impact of COVID-19 on companies and economies, meaning the list of potential fallen angels is now growing.

For now though, both the sellside and buyside within the European high-yield bond segment remain sanguine about this situation, with some investors keen to pick up any new names on offer. What's more, few players appear to be concerned that a slew of fallen angels could overwhelm the market — although some analysts do warn of indigestion arising from credit downgrades in certain sectors.

Key Takeaways

- Note that a fallen angel is a company whose credit rating has been downgraded to sub-investment grade. The majority of its ratings (typically two, from the three major agencies, Fitch, Moody’s, and S&P) have to be in this category to be designated a fallen angel, but if the company is only rated by one agency, then that is sufficient.

- May sees a number of fallen angels enter high-yield indexes, the biggest of which is Ford Motor Co., with $85.7 billion of bonds outstanding — of which roughly €13.5 billion is euro-denominated, spread between 2020 and 2025 maturities, according to Refinitiv.

- However this situation pans out, it's worth remembering that to date fallen angels have been absorbed by high-yield, while participants agree there is a potential technical on the horizon that would dramatically shift the market, whatever side of the debate they take.

Support Programs

European middle market vies for support amid coronavirus/economic challenges

There is still little certainty over the length or full impact of the coronavirus pandemic on European businesses. But as national governments battle the immediate economic challenges, massive support programs designed to preserve as much corporate liquidity as possible are being worked through.

Lenders and sponsors in the European mid-market were quick to welcome these efforts. "There has been an immediate reaction from the government in order to alleviate financial stress caused by the total lockdown of businesses, and it's hugely appreciated," one U.K.-based lender said.

Key Takeaways:

- In terms of specific support, governments across Europe have put in place payment holidays and other relief, but the programs differ from country to country.

- State-owned banks are the primary channel each country is using through which to inject cash into their most vulnerable companies.

- Some direct lenders have also suggested their loans could receive similar state guarantees as those from banks.