Environmental, social, and governance factors are driving change in business and investment decisions. This recurring newsletter captures news and insights on ESG issues that are, or will likely be, relevant to sustainability-minded businesses and investors.

SUBSCRIBE TO THE NEWSLETTERGlass Ceiling

Female Insurance Leaders Work Against Odds to Open Doors for Other Women

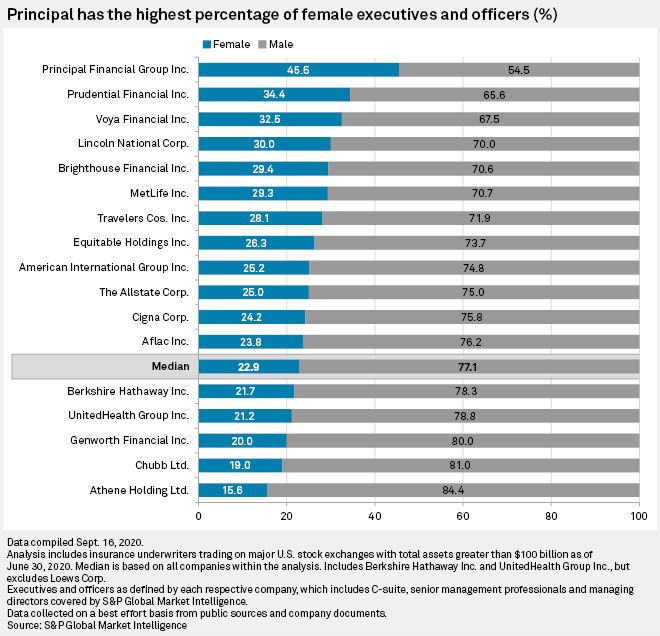

Approximately 23% of executives and officers at the large insurers that trade on the NYSE or Nasdaq are women, according to data S&P Global Market Intelligence compiled from publicly available sources. “That's just a sad, sad percentage,” said National MI’s top executive Claudia Merkle, one of the industry’s few female CEOs.

Key Takeaways

- There are just seven female CEOs in the U.S. insurance industry, where female representation among leadership has remained extremely low over the past decade.

- As investors and regulators pay increasing attention to environmental, social and governance issues such as diversity, some industry leaders are looking for ways to bring more women up the insurance ranks.

- Big names like BlackRock Inc. and State Street Global Advisors Inc. have urged their portfolio companies to promote women and minorities within their ranks and increase gender diversity on their boards.

- NMI Holdings Inc. CEO. Claudia Merkle believes one of the reasons for the low percentage of women among executives is because organizations are not taking "deliberate" steps to get them into those roles.

- Principal Financial Group Inc., Prudential Financial Inc. and Voya Financial Inc. have the highest percentage of female representation among executives and officers.

- Despite the heightened focus on gender, "There are still times when I'm the only woman in the room," Horace Mann Educators Corp. CEO Marita Zuraitis said. "That's wrong."

- Some regulators, too, are putting increasing emphasis on diversity.

Demand for Representation

Black Representation in Insurance Grows Slowly as Industry Seeks to Diversify

With growing calls for diversity and a dearth of new talent, the U.S. insurance industry has made some progress in adding more people of color to its ranks over the last decade.

Insurance regulators have also taken up the cause. After George Floyd’s death while in police custody earlier this year brought racism into the national spotlight, the National Association of Insurance Commissioners launched a Special Committee on Race and Insurance to examine levels of diversity in the industry.

Key Takeaways

- Lack of diversity in insurance leadership continues today, members of the industry say.

- Systemic racism became part of the conversation for corporate America, but data remains sparse.

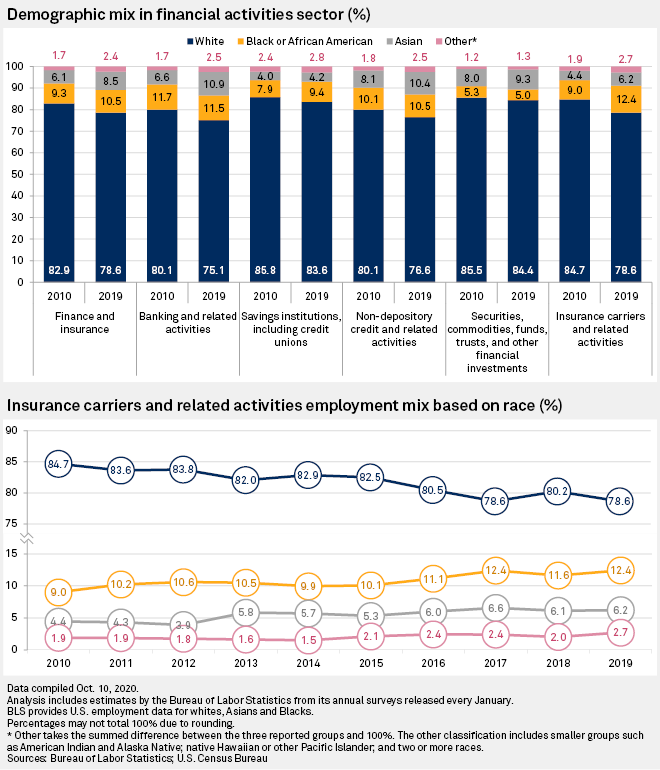

- The percentage of nonwhite employees in the insurance workforce stood at 21.4% in 2019, an increase from 19.8% the prior year according to data S&P Global Market Intelligence compiled from the U.S. Bureau of Labor Statistics.

- The percentage of nonwhite insurance workers was just 15.3% in 2010.

- The percentage of Black or African American employees in the insurance workforce was 12.4% in 2019, up from 9.0% in 2010.

- Meanwhile, Asians represented 6.2% of the workforce in 2019, an increase from 4.4% in 2010.

- TThose in the "other" category, which includes but is not limited to American Indian, Alaska Native, Native Hawaiian or other Pacific Islanders, represented 2.7% of the workforce.

- People of Hispanic or Latino ethnicity are not specifically broken out in the data set as they could have selected any race.

- Lack of diversity in insurance leadership continues today, members of the industry say.

Diversity Plans

To Boost Female Leadership, Insurers Need to Shuffle Succession Plans, CEO Says

As CEO of NMI Holdings Inc., Claudia Merkle is one of only seven female CEOs in the U.S. insurance industry. In a recent interview with S&P Global Market Intelligence, she discussed diversity in the industry and the importance of having a plan to improve representation of underrepresented groups.

In the interview, National MI's CEO said that companies need to be deliberate to boost female leadership in the insurance industry, National MI's CEO said. "Every CEO in the insurance industry should be getting out their succession plans," the executive said. The CEO also believes women need to be proactive and "raise their hand" to advance their careers.

It is Still Harder for a Woman to Succeed in Insurance Than a Man, CEO Says

The CEO of Horace Mann said gender diversity in insurance is improving, but she still finds herself the only woman in the room at some industry events.

Horace is no stranger to the difficulties that female leaders face in the U.S. insurance industry, where there are only a handful of women running companies. S&P Global Market Intelligence sat down with Zuraitis virtually to discuss her experiences climbing the ranks of an industry still dominated by men and the steps she takes to promote diversity in her organization.

Read the Full Interview

Changing the System

'Everything is on the Table' NAIC President says of Committee on Race, Insurance

The National Association of Insurance Commissioners' Special Committee on Race and Insurance had its first structured meeting on Sept. 17, as it introduced its formal charges and split into five separate workstreams.

South Carolina Insurance Director and NAIC President Ray Farmer said in an interview that "everything is on the table" in terms of concrete actions that the committee might take to address issues of diversity and potential discrimination in the insurance industry, but declined to comment on specifics.

The special committee is charged with conducting research and analyzing diversity and inclusion across the industry, with particular emphasis on potential practices or barriers that may disadvantage people of color and historically underrepresented groups.

Insurance Regulators Weigh Ban on Underwriting Factors They Say Harm Minorities

Over 40 years ago, Greg Squires watched members of the insurance industry grow defensive during a meeting that the National Association of Insurance Commissioners convened to address redlining — refusing coverage or otherwise engaging in discriminatory practices based on the income, racial or ethnic composition of a geographical area.

Fast forward several decades and regulators are putting a renewed focus on how race plays into insurance practices. The death of George Floyd while in police custody brought racism to the forefront of the national dialogue.

Read the Full Article

Leaders

Amid Scrutiny on Industry Underwriting, Progressive CEO Says Rates are Justified

As one of the few women leading a U.S. insurance company, Progressive Corp. CEO Tricia Griffith has experienced unconscious bias throughout her career.

In a recent interview with S&P Global Market Intelligence, Griffith talked about what the industry needs to do to increase diversity at a time when regulators are taking a hard look at the way insurance practices and products impact communities of color.

"I started in 1988 as a claims rep trainee, so literally walking into body shops, crawling under cars, meeting with attorneys. As a young woman, a 22-year-old at that time, we were required to wear suits and hose and high heels. Walking into a body shop with that outfit on and then going onto a dolly underneath a car, it was very intimidating and also not as welcoming because they assumed I didn't know what I was talking about,” she said. “But that sort of thing motivates me, and it motivated me to get other young women involved in claims because that's really the product that we are selling."